Earlier this week, the Office Of Inspector General (OIG) issued a memorandum to the SBA highlighting the level of fraud that was found in Covid EIDL distributions.

According to the OIG report, nearly $3.7 billion in Covid EIDL funds was awarded to "potentially ineligible recipients." The OIG offered three recommendations to the SBA to rectify the situation. Here's what you need to know.

$3.7 Billion in EIDL Funds Awarded to Potentially Ineligible Recipients

Tuesday, the OIG alerted the Small Business Administration (SBA) to the numerous improper Covid EIDL payments that it potentially made. The OIG collaborated with the U.S. Department of the Treasury's Do Not Pay Business Center to conduct the analysis.

The Do Not Pay (DNP) system pulls data from numerous different sources (such as the Credit Alert System, Death Master File, list of excluded individuals and entities, Office of Foreign Assets Control, and others) so various agencies can verify the eligibility of a recipient before any money is awarded.

Typically this system is used to verify recipients of federal grants, loans, or contracts to prevent fraud, waste, or abuse of federal dollars.

The OIG's review of the Treasury Department's analysis– which processed Covid EIDL loans and EIDL emergency grants from March to November 2020–determined that over $3.1 billion in Covid-EIDL funds and over $550 million in emergency EIDL grants were awarded "to potentially ineligible recipients."

Why the $3.7 Billion Was Potentially Awarded In Error

The OIG report posits that the SBA did not implement proper controls at the beginning of the Covid-EIDL program. The Payment Integrity Information Act of 2019 (PIIA) requires agencies to establish a verification procedure before awarding any federal dollars.

It also requires the use of the DNP system as part of that verification to ensure federal dollars are going to eligible businesses. The SBA did not utilize the DNP as a control during the review period (March to November 2020).

The SBA was prohibited from requiring applicants' tax records for verification, under the terms outlined in the CARES Act, so the SBA initially relied on self-attestation.

How the Recipients Were Identified by the DNP

Recipients that were deemed potentially ineligible were discovered using DNP data. The Treasury Department's DNP center compared their data to Covid-EIDL applicants' information. The data included Taxpayer Identification Numbers (TINs)–which can be a Social Security Number or Employer Identification Number–and applicants' names.

The DNP system has three levels of match confidence that the individual or entity can be classified as: possible, probable, and conclusive. A conclusive match means that the TIN and name is an exact match to at least one record in the DNP system, indicating a potential ineligibly to receive federal funds.

The report only included conclusive findings. Possible and potential findings were excluded because they are based on one criterion only (either TIN or name). This means that the recipients flagged as potentially ineligible are an exact match to at least one record in the DNP system.

The OIG states that while the DNP system is not always 100% accurate, "there is a strong likelihood that awarding to an applicant that matched to a DNP data source could result in an improper payment."

EIDL Ineligible Recipient Data

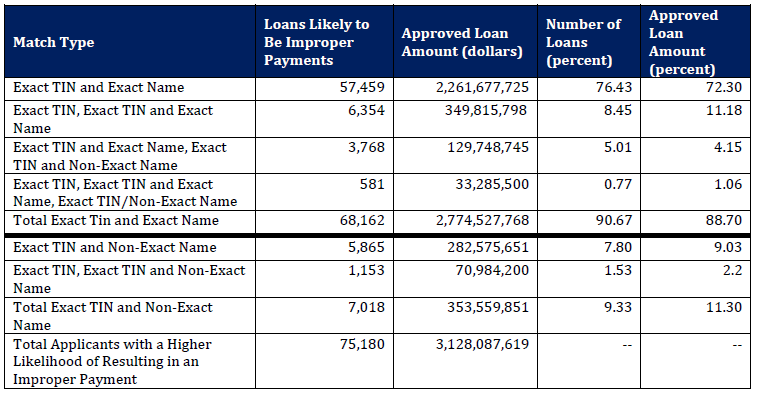

According to the DNP's analysis, 75,180 applications–totaling $3.1 billion–were flagged as conclusive and represent a high likelihood of improper payment, which could have been awarded to eligible applicants.

Of the 75,180 applications, 26,736 (or 35%) were identified in previous OIG reports. Here is a chart illustrating how the EIDL loan recipients were found.

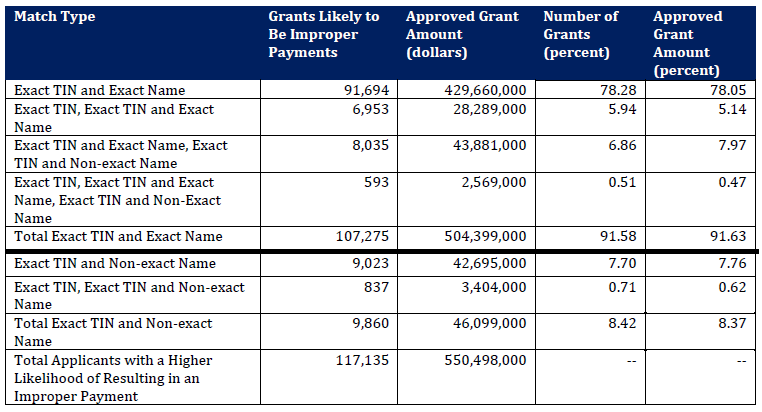

Additionally, the DNP's analysis concluded that 2%–$550 million–of the $19.7 billion in emergency EIDL grants were awarded to recipients flagged as conclusive.

Of the 117,135 applications marked as having a high likelihood of improper disbursement, 44, 920 (38%) were identified on previous OIG reports. Here is a chart showing the identified EIDL emergency grant recipients.

OIG Recommendations for the SBA

In light of this data, the OIG made three recommendations that it believes the Associate Administrator for the Office of Capital Access should implement. The SBA agreed with and implemented recommendations one and two but disagreed with the third.

Here are the three recommendations from the OIG:

- Before disbursing Covid EIDL funds, form a prepayment procedure where the batch match or continuous monitoring functions of the DNP system are utilized, to identify potentially ineligible applicants.

- Use the DNP system to analyze the applications that were not previously reported by the OIG, determine if the applicants are ineligible, flag the applications if they are ineligible, and recover the disbursed funds from the recipients.

- For all EIDL grants and loans flagged as potentially ineligible, include the amounts in the SBA's 2021 improper payments estimation process.

Get Personalized EIDL Help

Do you need help getting funding for your business? We can help you with SBA loans, grants, or other business financing options. Get ongoing personalized help from our team. Join Skip Premium today and get 1-1 support for your business.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.