The Paycheck Protection Program Flexibility Act was passed today, in order to help the tens of thousands of small businesses that took PPP loans. Here are the 4 big changes in the PPP Flexibility Act that you need to know about. These include a spending period, an easing of rehire requirements, and more. Let's get started.

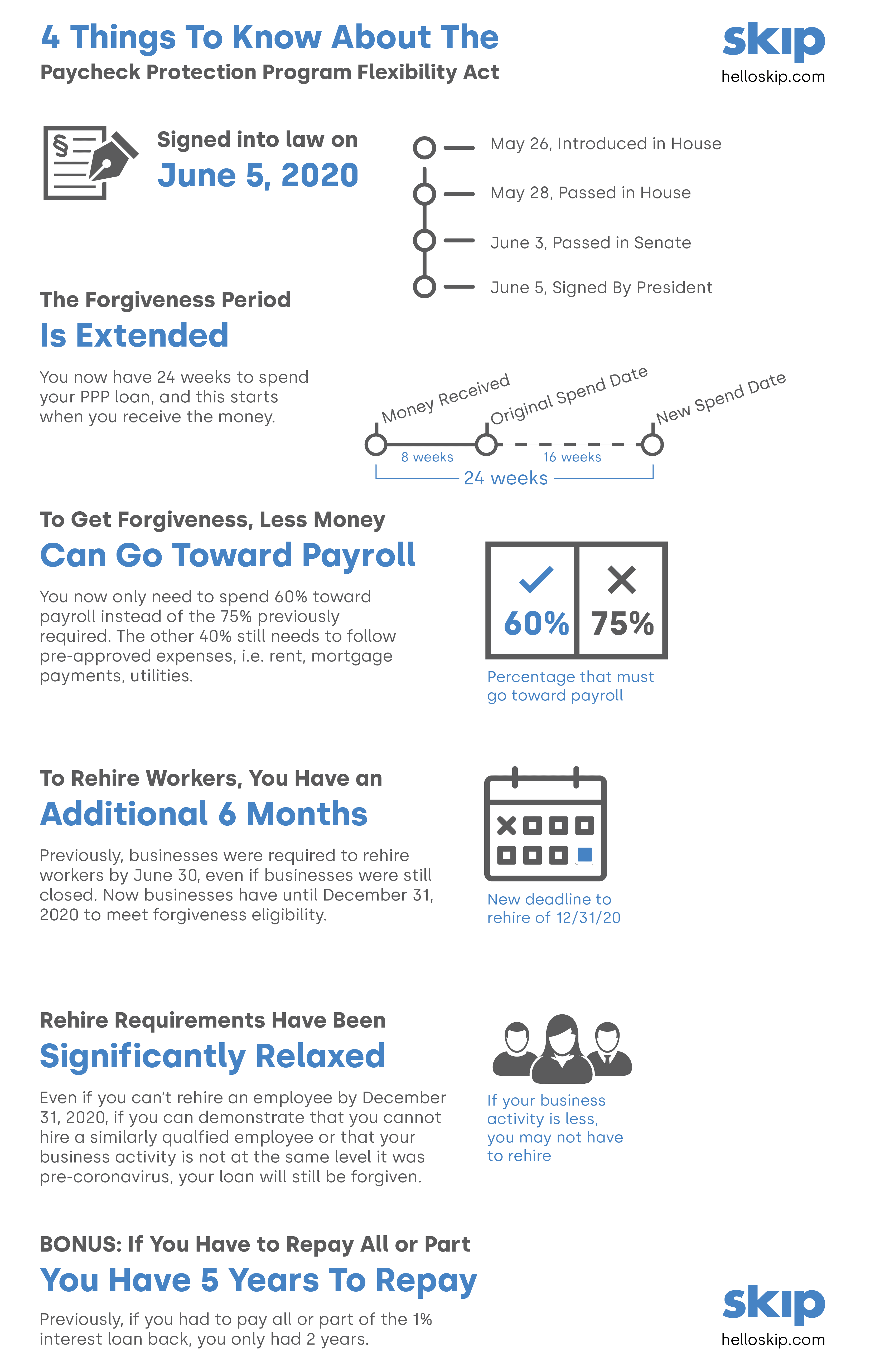

The Paycheck Protection Program Flexibility Act Passed Quickly, In Just Under 2 Weeks

Thousands of small businesses that took PPP funding in early April had expressed apprehension and concern about getting these loans forgiven. Many of these businesses were still closed and wondering how they were going to meet the original requirements. In May, as infections continued to rise and stay-at-home orders continued in the US, it became clear that the original rules didn't make sense. That's when Congress started discussing new PPP loan requirements to make it easier on businesses.

This Bill (H.R. 7010) was first introduced on May 26th in the House of Representatives. After approval in the House and Senate, it was signed into law by President Trump on June 5, 2020.

The PPP Forgiveness Period Is Extended

You now have 24 weeks to spend your PPP loan, up from the original 8 weeks, in order to have your loan forgiven. This time period starts when you receive the PPP money from your lender or bank. You still have the option of spending it all in 8 weeks if you like, but now you have the "flexibility" to take longer.

The PPP Payroll Allocation Requirements Have Decreased

You now only need to spend 60% of your PPP loan toward payroll instead of the original 75% required.

To be clear, you can spend 100% on payroll if you wish. This new act means, however, that if you have rent, mortgage, payments, utilities (these are the qualified other expenses) you can put up to 40% of the PPP loan toward these items, and still qualify for forgiveness.

The 60% is also not a "cliff" which means that if you spend less than 60% of your loan on payroll, you can still have the amount that you did spend forgiven, as well as non-payroll expenses up to 66 2/3% of your payroll expenses. Here's a bit more info on how to calculate that, but the important thing to know is that forgiveness will be proportional, rather than your loan not being forgiven at all if you don't spend 60% on payroll.

To Rehire Workers, You Have An Additional 6 Months Under the PPPFA

Previously, businesses were required to rehire workers by June 30, 2020, even if they were still closed due to stay at home orders, curfews and other hurdles. This was a major sticking point among business owners. How could they bring people back if they weren't even open for business? Now businesses have until December 31, 2020 to rehire workers.

Rehire Requirements for PPP Loan Forgiveness Have Been Significantly Relaxed

Even if you cannot rehire an employee by December 31, 2020, you may still be in the clear. If you can demonstrate that you cannot find a similarly qualified employee or that your business activity is not at the same level it was pre-coronavirus, you loan will still be eligible for forgiveness.

Bonus: Even If You Have to Repay All or Part of your PPP Loan, You Now Have 5 Years To Do So

Previously, if you had to repay all or part of your loan, you had 2 years, at a 1% interest rate. Now you have 5 years to repay at the same interest rate, as long as your loan was approved on June 5th or later.

Here is our infographic on the PPP Flexibility Act. Feel free to share and spread the word to other small businesses!