A business line of credit is a flexible way to have access to capital. Unlike a term loan, you only pay interest on your line of credit when you draw from it. Two of our partners, BlueVine and Fundbox, offer competitive lines of credit. In this article, we will compare the two companies, side-by-side, and provide you with details to help you decide which one is best for your business.

Business Line of Credit Through BlueVine

BlueVine offers lines of credit from $5,000 up to $250,000 to help your business meet its financial need without taking out a term loan. BlueVine offers other banking services, such as invoice factoring and business checking accounts.

Qualifications: In order to qualify for a line of credit with a 6-month repayment term with BlueVine, you will need a FICO score of 600, must be in operation for at least 6 months, and have $10,000 in monthly revenue.

To qualify for a 12-month repayment term, you need a FICO score of 620, be in operation for two years, and have $450,000 in annual revenue.

Interest: Rates start as low as 4.8% of draw amount.

Repayment: BlueVine automatically withdraws from your bank account on a weekly or monthly basis over 6 or 12 months, with no prepayment penalty.

Timeline: Businesses can receive an initial decision in as little as 5 minutes and can receive funding in as little as 24 hours.

Best For: BlueVine can be best for businesses that need fast access to cash and longer repayment terms.

Business Line of Credit Through Fundbox

Fundbox offers business lines of credit up to $150,000 with 12 or 24 week (3-6 months) terms.

Qualifications: In order to qualify for a line of credit with Fundbox, you need a FICO score of 600, be in operation for six months, have $100,000 in annual revenue, and have a business checking account to link to.

Interest: Rates start as low as 4.66% of draw amount.

Repayment: Equal payments are made over 12 or 24 weeks with no prepayment penalty.

Timeline: Funding can be approved in as little as 24 hours, with next-day transfers following approval.

Best For: Fundbox is another option for businesses who need fast cash, but it's best for businesses who can re-pay their line of credit quickly, within the 12 or 24 week window.

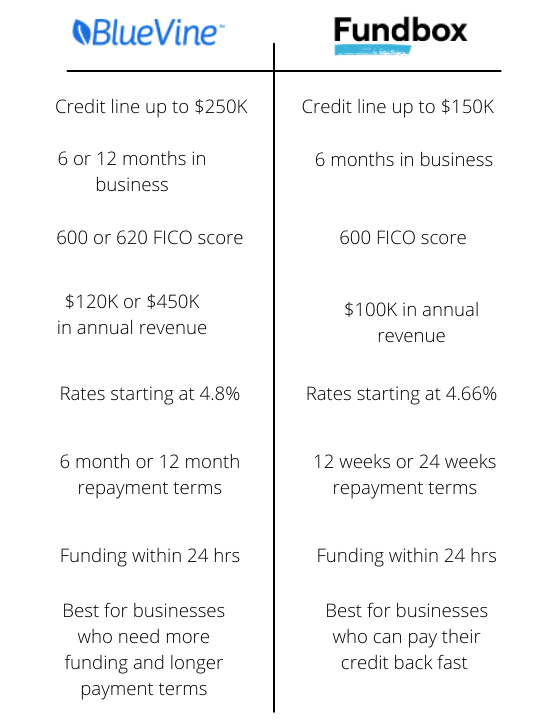

Line of Credit Side-by-Side Comparison

BlueVine and Fundbox have similar options for small businesses, but there some differences. The most notable difference is the repayment terms. BlueVine allows 6 or 12 month payment terms, whereas Fundbox has terms of 12 or 24 weeks (3 or 6 months).

Asses Your Line of Credit Options Carefully

It's important to ensure you know the term details before signing a contract, so you are not caught off guard. After reading about BlueVine and Fundbox lines of credit, you may already know which one is better for your business. If not, here are some more pointers:

BlueVine may be better for your business if:

- You need more than $150,000

- You have a FICO of 620 or more

- You need up to 12 months to re-pay the credit balance

- You have been in business for over one year

Fundbox may be better for your business if:

- You need $150K or less

- You want a lower interest rate

- You can repay the credit in 3 or 6 months

- You have been in business for at least 6 months

Get Funding Help for Your Business

Do you need help getting your credit in order or getting funding for your business? We can help determine your best option. We can help with SBA loans, grants, or other business financing options. Get ongoing personalized help from our team. Join Skip Premium today and get 1-1 support for your business.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.