On Thursday, the Small Business Administration (SBA) Office of Inspector General (OIG) released a report on the SBA's disbursement of Emergency EIDL grants to sole proprietors and independent contractors. This 20-page report by the OIG determined that $4.5 billion was distributed in error and should be remedied. Here are details of the report and how this could affect you.

📌 Pro-tip: Do you have questions about EIDL 2.0, including reconsideration, new collateral requirements, or how to get approved? Get ongoing personalized funding help from our team. There are over 2,000 on our waiting list, but you can skip the wait list completely with this invite link, exclusive to our readers.

Background to the Emergency EIDL Grants

The Coronavirus Preparedness and Response Supplemental Appropriations Act, which was signed on March 6, 2020, officially marked Covid-19 as a disaster. The SBA was authorized to provide Economic Injury and Disaster Loans (EIDL) to eligible businesses.

On March 27, 2020, the CARES Act added the Emergency EIDL grants and funded them with $20 billion so businesses could receive grants while they waited for a loan decision. Businesses were awarded $1,000 per employee, up to $10,000. Businesses without employees (sole proprietors and independent contractors) were eligible for $1,000. By July 11, 2020, the SBA had exhausted the Emergency EIDL grants and provided 5.8 million grants.

$4.5 Billion in Emergency EIDL Grants Awarded In Error

The OIG report indicates that the SBA erroneously awarded $3.5 billion dollars in Emergency EIDL grants to sole proprietors and $1 billion to independent contractors. The CARES Act prohibited the SBA from requiring applicants' tax records for verification, so the SBA relied on self-attestation for the Emergency Grants.

While the SBA could not request tax documents, there were other ways they could have verified the applicants' information. The OIG report states the SBA relied solely on self-attestation and did not have a review process in place. The OIG states, "SBA has a responsibility to prevent improper payments through internal controls, particularly through validation of illogical information."

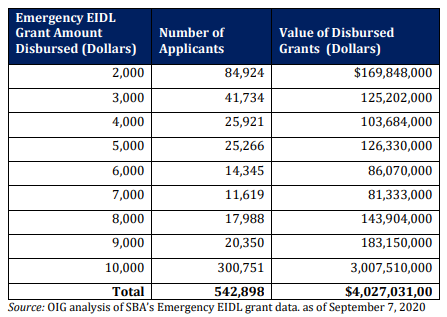

This is the illogical information that OIG is referencing. Over 542,000 sole proprietors claimed that they had 2 or more employees (15 claimed to have 1 million employees), but did not provide an EIN. The OIG correctly highlights that "sole proprietors and independent contractors with employees should have an EIN and submitted the numbers on their COVID EIDL applications." In total, over $4 billion was awarded in error.

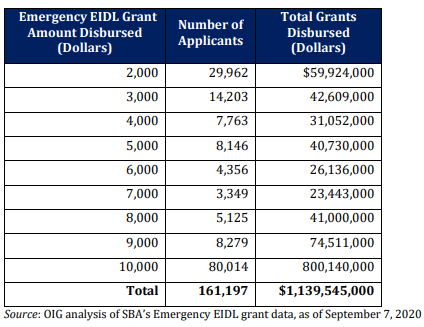

Similarly, over 161,000 independent contractors claimed at least 2 employees on the Emergency EIDL grant application. 143 independent contractors attested that they had at least 100,000 employees. 29 stated they had over 1 million employees. In total, over $1.1 billion was awarded in error.

OIG Recommends The SBA Rectify the Error- Possibly Awarding More Emergency Grants

In their conclusion, the OIG states that the SBA can still take action, even though the Emergency EIDL grant program has long concluded. Over 6 million applicants for the Emergency EIDL grant program were denied once the funds ran out in July of 2020. The OIG makes the following suggestions that "could potentially result in the recovery of Emergency EIDL grant funds...":

- SBA can request an EIN from the applicants that claimed to have employees.

- SBA could require proof of employees from the applicants.

- SBA could request a "return of funds" from the applicants that should not have received the grant money.

- SBA could also refer the applicants to the OIG for investigation and potential prosecution.

It is important to note that these are recommendations for the SBA. The OIG suggests that the SBA should "remedy" the problem, which could recover the grant funds awarded in error. Whether or not the SBA pursues the OIG's recommendations or makes additional grants available to the 6 million that did not receive a grant, only time will tell.

Meanwhile, SBA is Sending Emails to Businesses Eligible for an EIDL Increase

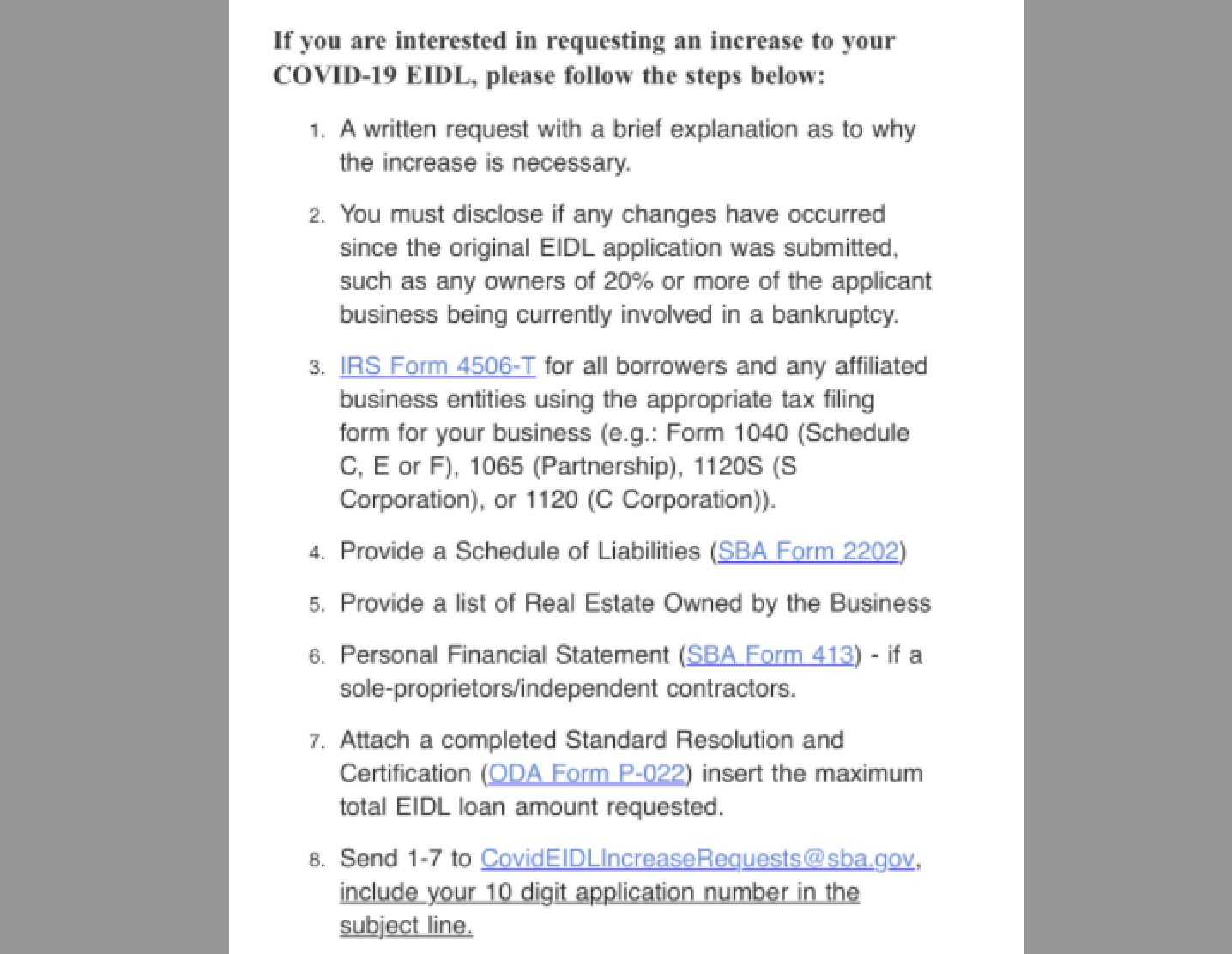

Several businesses have received an email invitation from the SBA to apply for an EIDL increase. The email (see below) lists eight steps that businesses can take to manually apply for an EIDL increase over $500K. Businesses interested in applying manually need to submit the five new documents to the SBA by email. However, it is likely more efficient to apply on your SBA portal instead.

EIDL Increases Over $500K Start To Be Approved

For those that have already submitted their extra documents and applied for an EIDL loan increase over $500K, the SBA started sending approval letters today. Denial letters have already been going out for these EIDL loan amounts, having started last weekend. For those that are denied — but believe they're eligible for EIDL loan increases over $500K — you can apply for EIDL reconsideration.

Get Personalized Help With EIDL

Do you have other questions about EIDL 2.0, including reconsideration, new collateral requirements, or how to get approved? Get ongoing personalized funding help from our team. There are over 2,000 on our waiting list, but you can skip the wait list completely with this invite link, exclusive to our readers.