The SBA Economic Injury Disaster Program (EIDL) is available for all businesses, including sole proprietors and independent contractors. Many questions still arise about the eligibility of these business owners and many believe they don't qualify. If you are or know a sole proprietor or independent contractor that is interested in the EIDL program, this article is for you. We explain what the EIDL program is, who is eligible, how to use the funds, and more.

What is the EIDL Program?

If you are unfamiliar with Economic Injury Disaster Loan (EIDL) program, here is a quick breakdown. The government created the EIDL program at the beginning of the pandemic to provide relief to small businesses in the form of grants and low-interest loans.

All small businesses, from sole proprietors to Corporations, can apply if they meet the basic requirements of the program, such as a 570 credit score and fewer than 500 employees. The loan offers a 30-year term at 3.75% for qualifying businesses and will close on December 31, 2021.

Are Sole Props or Contractors Eligible For the EIDL Program?

Yes, sole proprietors and independent contractors can apply to the EIDL program as long as they have verifiable business income for 2019 or January of 2020. Any business formed or conducted after January 31, 2020, does not qualify. If you have filed for bankruptcy, you are ineligible unless you have an approved plan of reorganization.

You must be able to prove that you made an income as a sole prop or contractor, through tax returns or other documents. If you don't have an official "salary" but draw your income from net profits, the SBA can still determine your income by your bank statements and any other financial documentation.

How Do You Apply For the EIDL Program As A Sole Prop or Contractor?

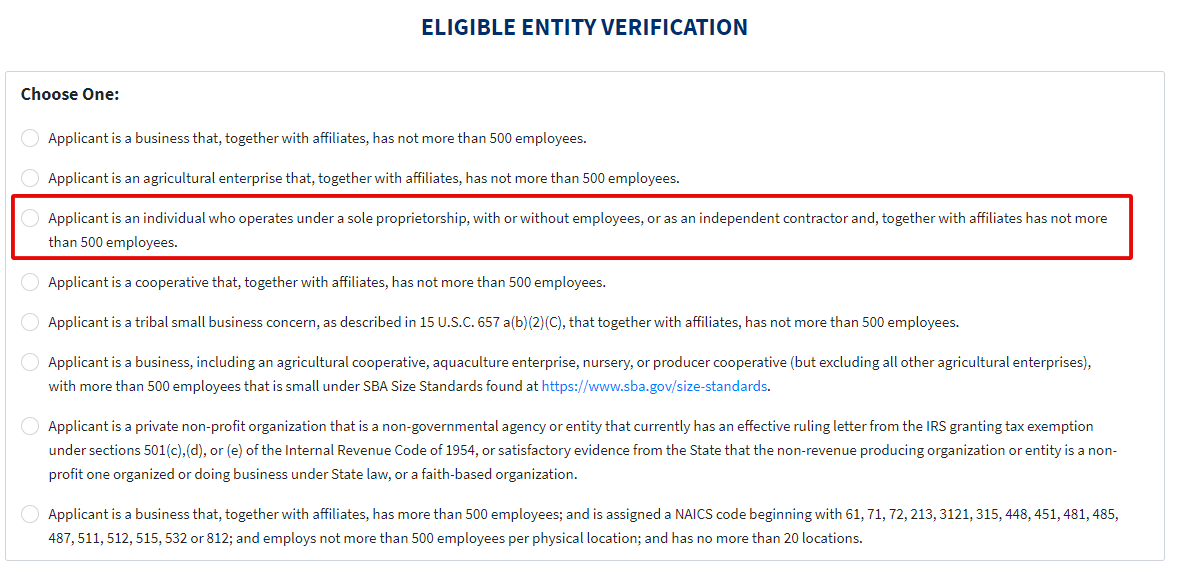

To apply for the EIDL, head to the SBA's EIDL application page. There are four main pages you will need to fill out and is the same for all businesses. When you begin the application, you will select the third option, which identifies you as a sole prop or contractor.

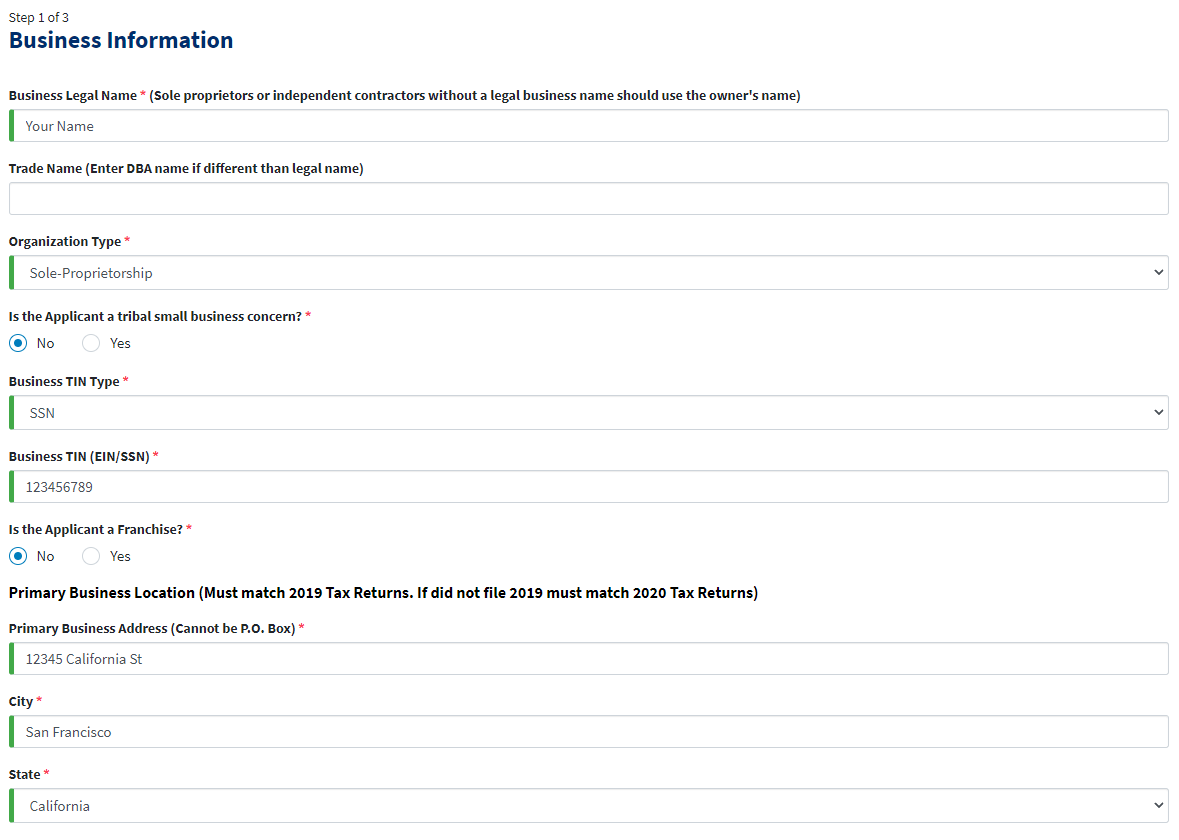

The second page of the application is the business information. As a sole proprietor or independent contractor, you will use your personal information to fill out this page. For example, the "business legal name" will be your name. There is a separate line for a DBA if you have a trade name.

Next, select your organization type (sole prop or independent contractor), your business TIN type (which is your SSN), and then type in your SSN. Your business location can be your home address, but this must match the tax return you submit (either 2019 or 2020). The number of employees will be 1 (for yourself) unless you have other employees. Once you finish this page, the second page will be very similar, as it is the business owner's information.

What Can EIDL Funds Be Used For?

There are several eligible expenses that EIDL funds can be used. For sole proprietors and independent contractors, examples include payroll (your salary), rent or mortgage, your utilities, and other ordinary business expenses. The SBA does not define what "ordinary business expenses" means because it depends on the type of business you have.

If an expense is pertinent to your business operation, then it should be covered. If you have questions about your specific business and eligible expenses, ask your loan officer or contact your local SBA office. Remember, there are ineligible expenses for the EIDL program to keep in mind. These include starting a new business and expanding your current business.

How Do You Calculate Your Potential Loan Amount?

The SBA begins its calculations using your 2019 gross revenue and cost of goods sold. Take your 2019 revenue, subtract your cost of goods sold (COGS), and multiply that number by two. That will give you the total amount you may qualify for. According to Investopedia, COGS is "the cost of acquiring or manufacturing the products that a company sells during a period." Depending on what you do, your COGS may be zero. You can also use our EIDL calculator on your Skip dashboard, or sign up for free to use it.

There are other factors to consider. If you were not in business for the entirety of 2019 or started in January 2020, the SBA will annualize your income based on the monthly revenue you had for 2019 or 2020. If you did not have any income in 2019 or 2020, you will not qualify for an EIDL loan. Lastly, you may not be approved for your entire eligible amount, based on business debt, personal debt, and other facto

Do You Want Personalized EIDL Help?

If you want to get personalized assistance with your EIDL application– with reconsideration, collateral requirements, or simply getting approved, book a time to speak with a member of our team. There is currently a waitlist of nearly 4,500 people, but you you can skip the wait list completely with this invite link. In addition to one-on-one assistance, you'll be able to use the cash flow analysis calculator to see what your actual EIDL approval amount might be.