The Covid EIDL program through the Small Business Administration (SBA) is set to close Friday, December 31, 2021. Over $312 billion has been doled out to businesses since the genesis of the program but funds are still available.

There has been some confusion around the timeline, so this article will explain what will and will not happen on December 31st.

EIDL Loan and Targeted Advances Will Be Accepted Until December 31st

The deadline to apply for the EIDL program's $10K Targeted Advance or low-interest rate loans is December 31, 2021. The EIDL program offers business loans at 3.75% (2.75% for non-profits) up to $2M with a 30-year term. If you are looking for business capital, an EIDL loan is hard to beat.

To qualify for a Targeted Advance, you must have fewer than 300 employees and your business must be in a low-income area. Additionally, you must demonstrate a 30% reduction in revenue compared to the previous year. The reduction in revenue can be over any eight-week period of time starting March 2, 2020.

SBA Will Process Reconsiderations, Appeals, and Increases After December 31st

The deadline to apply for the EIDL program for the first time is December 31st, but the SBA will continue to process applications after the deadline. In other words, reconsiderations, appeals, and loan increases will still occur in 2022 and beyond–as long as your initial application is filed by the 31st.

If your EIDL application is denied, you have six months from the date of denial to request a reconsideration. If you receive a denial on March 1, 2022–for example–you have until September 1, 2022, to request a reconsideration. December 31st is the deadline for NEW EIDL submissions.

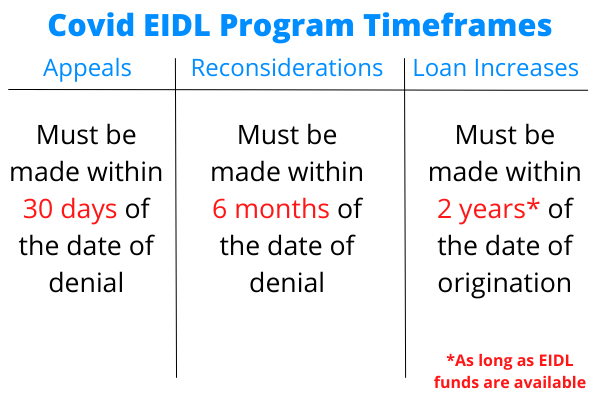

Furthermore, businesses have two years from the origination date to request an increase. Appeals are more time-sensitive; they must be made within 30 days of the date of decline. Below is a chart illustrating the different EIDL loan timeframes.

Remember, the longer you wait, the more likely the SBA is to run out of funds. If you know you want to request an increase, do it right away.

SBA Is Still Accepting Supplemental Advance Applications, but May Not Get to Them in Time

The SBA confirmed yesterday in a news update that it will continue to accept Supplemental Advance applications until December 31st as well. There is one main caveat to the Supplemental Advance. The SBA "cannot continue to process Supplemental Targeted Advance applications after December 31."

Because of the hard deadline for Supplemental grants, the SBA advised all eligible applicants to submit their applications to the SBA by December 10th. The SBA wants to process all eligible applicants but must stop on December 31st.

If you qualify for the Supplemental grant (located in a low-income area, have 10 or fewer employees, and show a 50% reduction in revenue) and were invited by the SBA to apply, you can still do so until the 31st–you just may not get the grant.

Get Personalized EIDL Help

If you want to get personalized assistance with your EIDL application– with reconsideration, collateral requirements, or getting approved–book a time to speak with a member of our team. You get ongoing, personalized, 1-1 funding help when you join Skip Premium today.