If you're a small business owner, sole proprietor, or independent contractor, there's good news. The SBA plans to announce changes to the Economic Injury and Disaster Loan (EIDL) program this coming week.

These changes are said to include raising the EIDL limit to $2 million (up from the current $500K limit). In addition, the eligible uses of EIDL loans will also change.

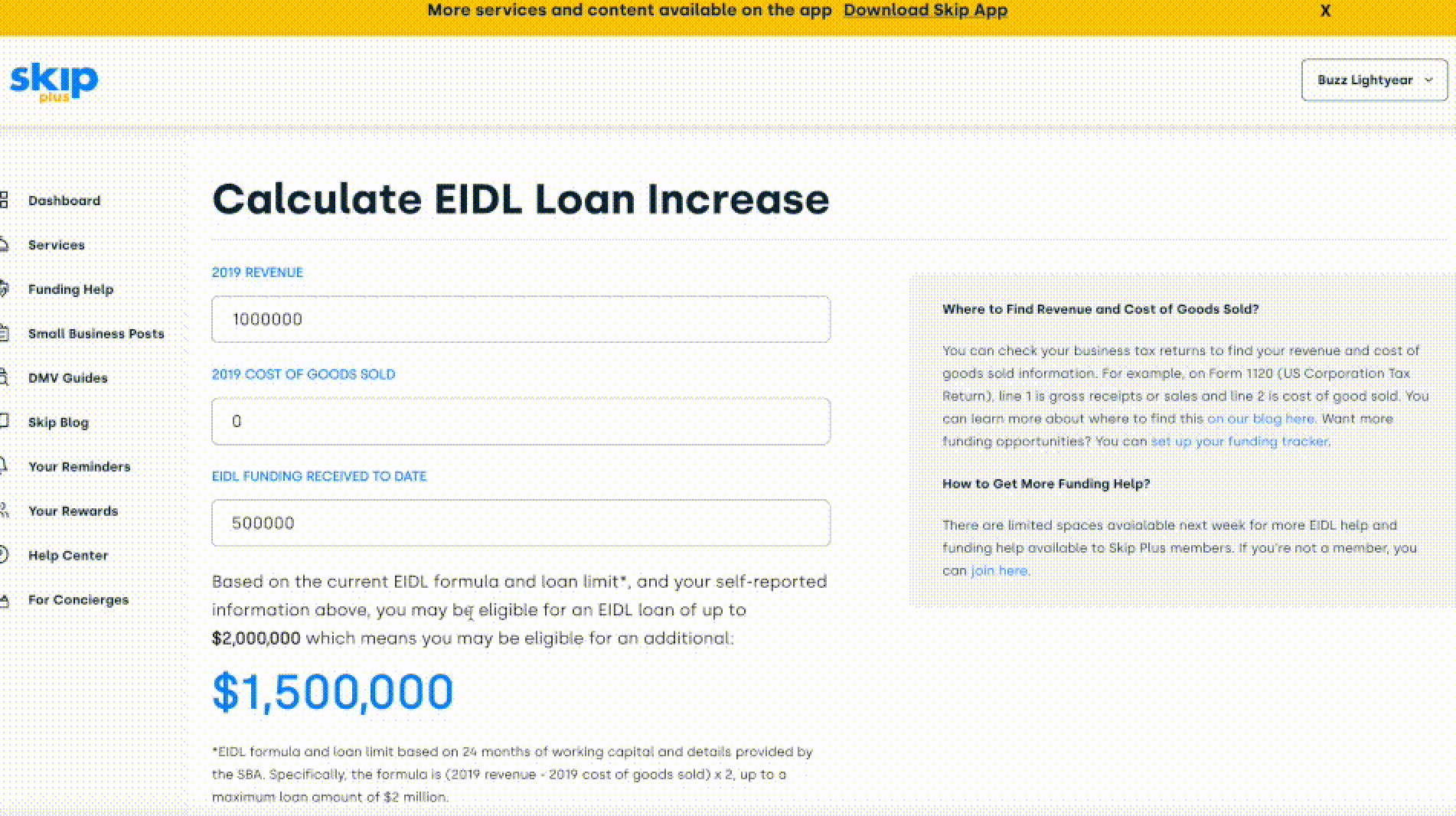

Here's a quick recap of the changes, what to expect when the SBA makes the official announcement, and how to calculate your potential EIDL loan increase with our EIDL loan increase calculator.

A Summary of EIDL 2.0 and the New EIDL Loan Limits

The SBA held a series of closed webinars last week with industry groups to talk about the upcoming EIDL loan limit changes. In addition to the new $2 million EIDL loan limit, it's reported that EIDL loans will also be permitted to pay off business debt, such as business credit card debt. It will also be allowed to pay off other government funding debt.

According to a source, the SBA will require property as collateral for loan increases above $500K. It is unclear what other requirements or alternative requirements may be required from business owners. It is expected the details of collateral will be announced on Monday August 16th — with the official EIDL 2.0 announcement.

How to Calculate SBA EIDL Loan Increase Amount

To give a quick way to calculate how much you may potentially be eligible for, a new EIDL loan increase calculator is now on the Skip website — alternatively you can go to EIDL2.com to see the calculator. You will need to add and confirm your email to see the calculator, and you'll have the opportunity to track other funding options.

How To Get More Funding Help For Your Business

Set up your funding tracker on the Skip dashboard or app to get access to more in-depth funding information — and find out first about new funding opportunities.

If you're not following Skip on YouTube, we highly recommend hitting subscribe. Our team publishes daily on app, website, YouTube, and other social media.

Business Funding

Do you need help getting funding for your business? We can help you with SBA loans, grants, or other business financing options. Get ongoing personalized help from our team. Join Skip Premium today and get 1-1 support for your business.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.