Now that EIDL 2.0 is live, many business owners are wrestling with the new forms necessary to request an increase. The five forms are the Schedule of Liabilities, Personal Financial Statement, ODA P-022, 2019 Business Tax Return, and List of Owned Real Estate. In this post, we explain the five new forms that businesses must complete to raise their EIDL loan above $500K.

📌 Pro-tip: Have questions about EIDL 2.0, including reconsideration, new collateral requirements, or getting approved? Get ongoing personalized funding help from our team. There are over 2,000 on the waiting list to get help. You can skip the wait list completely with this invite link, exclusive to our readers.

Schedule of Liabilities

The SBA form 2202 Schedule of Liabilities is the first document you will need to upload into your EIDL portal. It's critical to fill this out correctly and completely. The SBA allows you to use your own form, if you have one, but they provide one for you.

Whether you use the template provided by the SBA or your own, ensure that you list all of the liabilities for your business. If this is not accurate (or any of the documents) it could hold up your approval. Consider speaking with your accountant to ensure you account for all payables (mortgages, loans, other account payables).

2019 Business Tax Return

Since you have made it this far in your EIDL application process, you likely already have your 2019 business tax return handy. Not everyone will need to submit it again. If the SBA does not need another copy of your 2019 taxes, you will see the word "Received" in green on your portal.

Some are waiting on the SBA to receive their tax transcripts from the IRS. If you are in that situation and the SBA is asking for your 2019 business taxes, go ahead and upload it again.

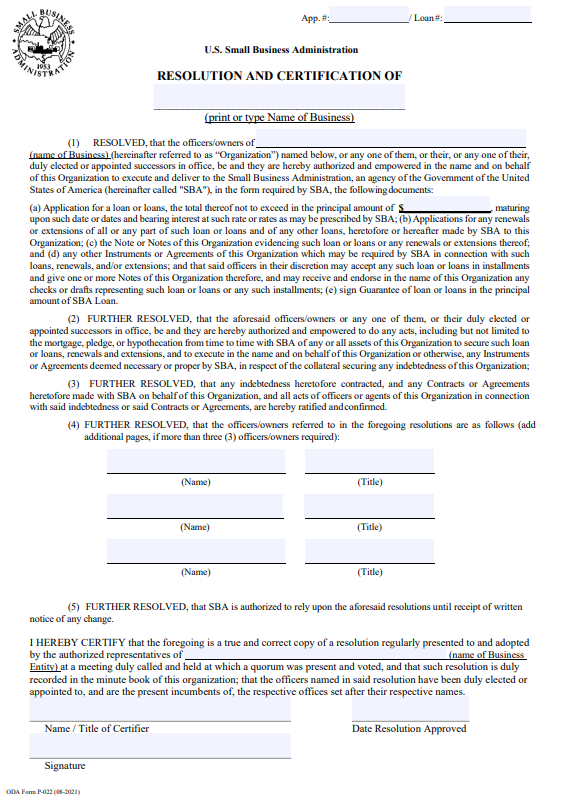

ODA P-022

Everyone requesting more than $500K for the EIDL loan must fill this out. The ODA Form P-022 is a short one-page document that owners or authorized signers of the business need to sign. The document is an attestation by the business owners that they have the authority to take out the requested EIDL loan.

It may seem difficult at first, but there are only a few lines that you fill out. You need to fill in the application and loan numbers, business name, the total amount you are requesting, the names and titles of the owners/officers, have it certified by someone (such as a Secretary or Bookkeeper), and keep a record that this decision took place (such as meeting minutes).

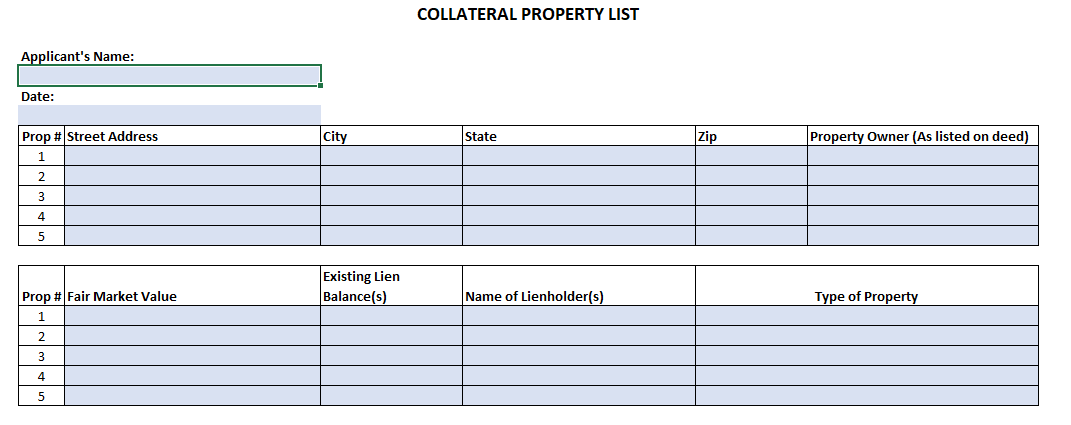

List of Owned Real Estate

The List of Owned Real Estate is a spreadsheet where you must list out any property of the business. You will need to list the market value, the owner, the lienholder, and other applicable information. You will need to do your due diligence to get the fair market value of your property.

You may not be required to fill this out, but will still need to provide adequate collateral. Remember that the SBA requires a personal guarantee for any loan over $200K. If you do not have any business property or collateral, the SBA may require you to list your personal home.

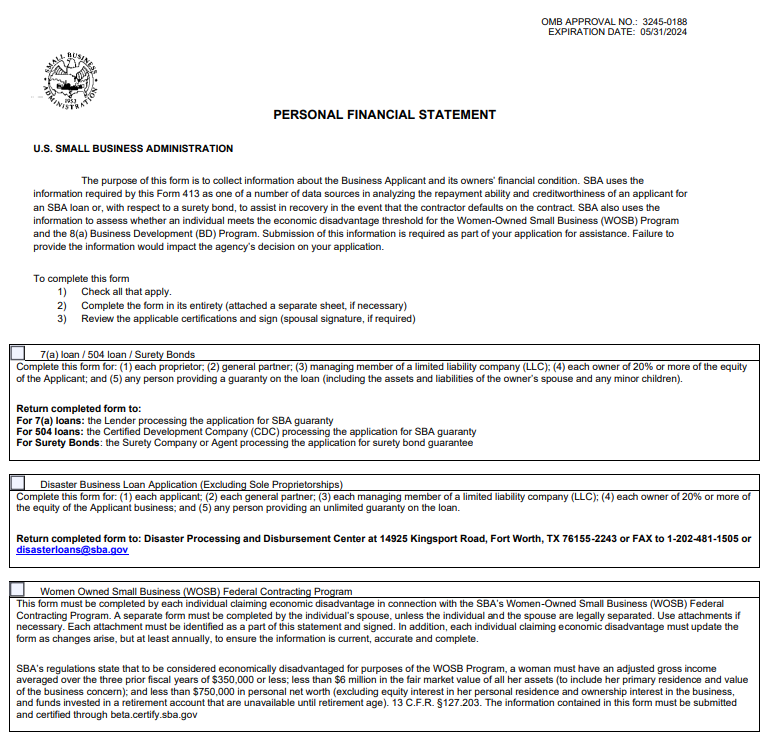

Personal Financial Statement

The fifth and last document that you will need to submit is the SBA Form 413- Personal Financial Statement. This is a six-page document that will likely take the most time to complete. Take your time and read each section slowly. Every person with 20% or more ownership in the business must fill this out.

When you fill out the Personal Financial Statement, you will need to provide detailed information on your personal assets, liabilities, income, and personal real estate. If a spouse owns any of the personal assets in conjunction with the applicant, the spouse will need to sign the document as well.

How to Get Individual EIDL Assistance

Have questions about EIDL 2.0, including reconsideration, these forms, new collateral requirements, or getting approved? Get ongoing personalized funding help from our team. There are over 2,000 on the waiting list to get help. You can skip the wait list completely with this invite link, exclusive to our readers.