If your business tax form indicates a negative income, the SBA will deny your EIDL application. Did you know that some expenses can be added back into your business profit?

This can make the difference between you getting approved for your EIDL loan, and not. Here, we describe what add-backs are, which expenses are eligible, and how to potentially get approved for your EIDL loan.

What Is An Add-Back?

Cash Flow add-backs are expenses that are added back into the profit of a business for the sole purpose of improving the company's financial situation. Add-backs are completed to make adjustments to the business's net profit calculation. Correctly understanding and applying them can help in managing your business earnings.

For an item to be considered an add-back, it must have been an expense or item subtracted from your business profits in some way. You are not able to add something back into company profits if it wasn't deducted to begin with.

Which Expenses Are Eligible Add-Backs?

Can any expense be considered an add-back? No, in order for an expense to be an eligible add-back, it has to be a one-time expense or change. Re-occurring charges cannot be counted as add-backs. Here are several common add-backs that you could potentially utilize.

- Adjustments to owner's compensation. It's not uncommon for business owners of small but profitable companies to bring in a salary that is higher than the market average. The difference between what you make as a business owner and what the market average is can be an add-back.

For example, if your salary is $300K but the market average for your position is $200K, that $100K difference can be an add-back. - Compensation for family members. If you had a family member temporarily working for your business (such as for a summer job or temporary project) but is not going to be an ongoing employee, the income paid to that family member is an eligible add-back.

- Lawsuit settlements or severance payments. Your business will not get sued regularly (or at least should not be), but if you find yourself on the victorious side of a lawsuit, the settlement you receive is an eligible add-back. If you cut a long-time employee severance pay, that is also an add-back assuming that you don't regularly do that.

- Personal expenses. While mixing personal finances and business finances is generally not advised (especially if you have an LLC or C-Corporation), it's not uncommon. If you use your business finances for personal travel expenses (including meals and entertainment), personal vehicle expenses (such as monthly car payment, gas, etc.), and other expenses that are not ongoing, those expenses can be added back.

- Other rare or non-occurring business expenses. If you hire an employee and they don't work out, their wages can be a one-time add-back. If you launched a new product or initiative and it failed, the cost of that failed campaign can be a one-time add-back.

If you joined a peer group for the first time, those membership fees can be an add-back. Other miscellaneous one-time expenses can also be add-backs.

How Does the SBA Assess My EIDL Application?

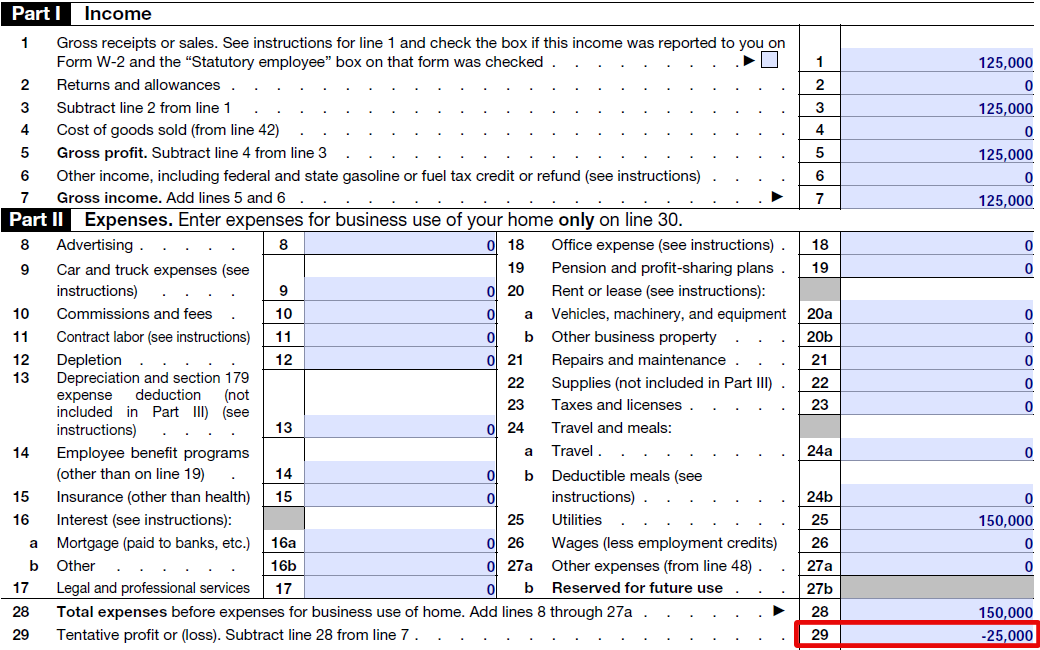

The SBA looks at the whole picture, but they especially want to know your total profit when making their decision on your EIDL application. If you file a Schedule C, they base their decision, in part, on line 29 (line 22 for IRS form 1065, line 30 for IRS form 1120, and line 21 for form 1120-s). If the number on that line is negative, that's the likely reason your application was denied.

Here is a basic example of a Schedule C for a sole proprietor. If your line 29 is negative, no matter what line 1 or line 7 indicate, the SBA is not going to look favorably at your EIDL application.

The same goes for line 22 on form 1065, line 30 on form 1120, and line 21 on form 1120-s. If you have a negative number, determine if you have eligible add-back expenses. If you do, this can improve your EIDL application.

How Can You Get Your EIDL Loan Approved Via Add-Backs?

If the SBA has denied your EIDL application due to insufficient cash flow, the first step is to determine if any of your expenses are eligible add-backs and calculate the total. If your total add-backs (using the categories above) bring your income into the positive, you may now qualify.

Using the Schedule C example above, that sole proprietor needs to find at least $26K in add-backs (line 29 is -$25K) for the SBA to reconsider the application.

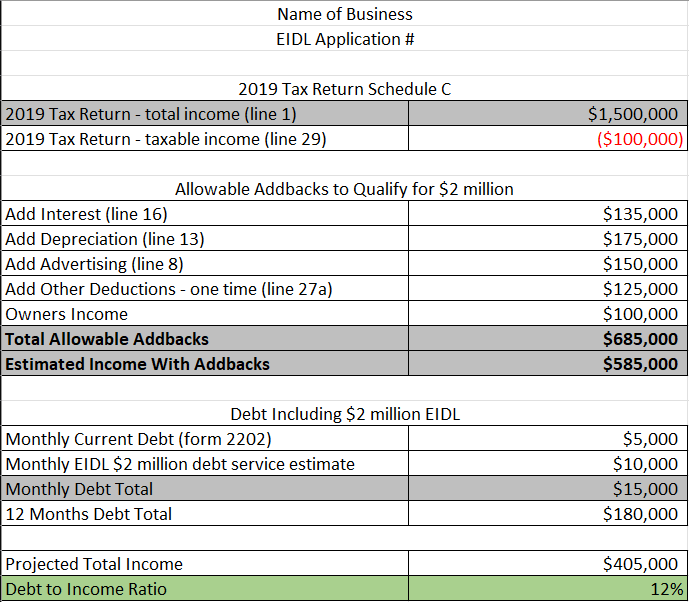

After you have calculated your add-backs, record them on a spreadsheet so it clearly demonstrates where your numbers are coming from. Be sure to include your business name and EIDL application number.

Attach this in your reconsideration application so the SBA can make a more accurate assessment. Here is an example of an add-back calculation for a sole proprietor.

Need Personalized EIDL Help?

Do you need help getting funding for your business? We can help you with SBA loans, grants, or other business financing options. Get ongoing personalized help from our team. Join Skip Premium today and get 1-1 support for your business.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.