One of the most important decisions you make when starting a business is choosing which business structure to form. Limited liability companies (LLCs) and limited liability partnerships (LLPs) are similar entities — both offer some level of liability protection — but it's critical to understand the differences.

In this article, we highlight the four main differences between LLCs and LLPs so you can decide which one is better for your business.

What is an LLC?

A Limited liability company (LLC) is a very popular business structure in the U.S. It’s a hybrid legal entity that combines the simplicity of a sole proprietorship (or partnership) with the liability protection of a corporation. One of the most compelling reasons to form an LLC is to protect the owners, known as members, from personal liability of business debt.

What is an LLP?

Limited liability partnerships (LLPs) are like general partnerships with liability protection. A general partnership is an unofficial agreement between two or more parties that conduct business together. Like sole proprietorships, general partnerships do not require any business filings. An LLP, like an LLC, is considered a separate legal business entity and does require you to file paperwork with your state.

What’s the Difference Between an LLC and LLP?

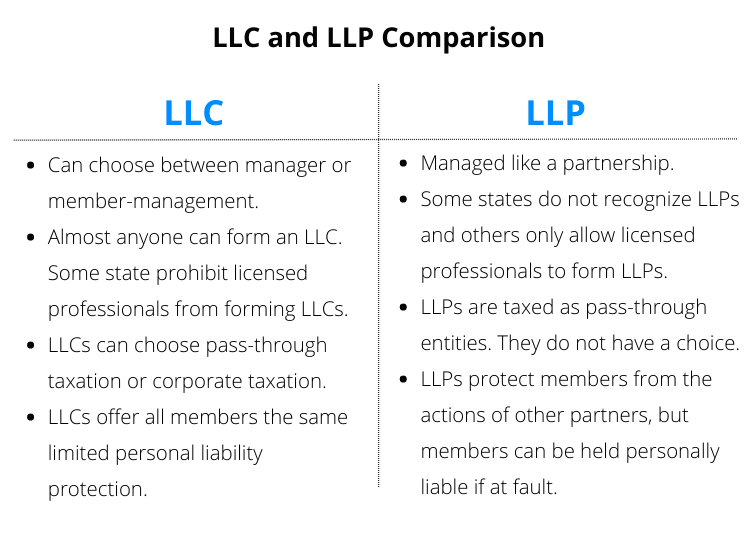

LLCs and LLPs are very similar to one another, especially in the liability protection that they afford their owners. There are some key differences between how LLCs and LLPs are managed and structured, who can form them, how they are taxed, and their level of liability protection.

Management Structure

LLCs can choose between two different management styles: member-managed and manager-managed. Member management means that the owners of an LLC (called members) are responsible for the management of the company. In a manager-management structure, the owners of the LLC hire an outside agency, appoint a member, or appoint a non-member to oversee the business.

The operating agreement of the LLC is the document that details how the business is run, the responsibility of each member, how profits are distributed, and more. Additionally, LLCs can be created by one person — called a single-member LLC.

An LLP is structured similarly to a partnership in that the business partners all carry equal responsibility for overseeing the business. LLPs must have a managing member that assumes responsibility for the actions of the LLP, whereas an LLC can appoint someone else to fulfill that role.

The partnership agreement is the document that details the management structure, distributed responsibilities, and profit-sharing. Unlike an LLC, LLPs must have at least two members.

Formation Eligibility

Any individual or group of individuals seeking to start a small business can form an LLC. You can form one anywhere — all that’s required is the proper filing within your state. That’s not always the case with an LLP.

Some states do not recognize LLPs as business entities. Other states restrict LLP formation to licensed professionals, like lawyers, accountants, engineers, and so forth. In some states, licensed professionals cannot form an LLC. It all depends on your state's regulations.

LLC and LLP Taxation

When you form an LLC, you have the option of selecting how the entity is taxed. LLCs do not have their own IRS tax classification, so they have the option to elect the tax status of a sole proprietorship, partnership, or C corporation (and even S corporation).

The IRS automatically assigns LLCs the same pass-through tax status as a sole proprietorship. This means that the LLC holds no income tax liability; the income and tax are passed through to the owners and are recorded on personal tax returns. If you elect to be taxed as a corporation, the company may pay corporate taxes — and you will pay taxes on your income.

In contrast, LLPs must file as a partnership; they do not have the choice like LLCs do. Partnerships, like sole proprietorships, are pass-through entities, so the income of the LLP is passed through to the owners and is recorded on personal tax returns.

Liability Protection

Arguably one of the most important benefits of forming a limited liability company (LLC) is the personal liability protection that it offers you as the business owner. An LLC shields all of the members from being held personally liable for business debts. The only exception to this occurs when business owners engage in nefarious acts or business mismanagement.

LLPs also offer liability protection, but it can be quite different. In some states, LLPs offer the same protection that LLCs do. In other states, the liability protection only extends to the acts of the other members, but you can still be held liable.

In other words, an LLP shields you from any mismanagement or wrongdoings committed by the other partner(s), but it does not shield you from your own wrongdoings. Some states also require at least one partner to have unlimited liability or who is fully liable, while the other member(s) enjoy the limited liability.

Is an LLC or LLP Better for You?

When it comes to deciding on the right structure for your business, there are several factors to consider. The first is whether or not your state allows LLP formation, if it’s restricted to licensed individuals, or if your state prohibits LLC formation for licensed professionals. Your state’s regulations may make the choice for you.

If you have the choice between starting an LLC or LLP, the other factors to consider are liability protection and tax status. For many, the higher level of liability protection and the plethora of tax options make LLCs the more popular choice.

Get Help With Your LLC

Do you need help starting your LLC or getting funding for your business? We can help you with LLC formation, SBA loans, grants, or other business financing options. Get ongoing personalized help from our team. Join Skip Premium today and get 1-1 support for your business.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.