Like many businesses, yours may need financing to get started — or to grow. There are several routes for obtaining working capital: sell equity in the company (stocks), borrow capital, debt financing, or a hybrid model.

In this article, we’ll focus on what debt financing is, how a small business might use debt as a strategy to grow, and different lending options available to small businesses. We’ll lay out the pros and cons of debt financing to assist you in making an informed decision.

In This Article:

- Debt Financing vs. Equity Financing — What's the Difference?

- How Does Debt Financing Work?

- What is Debt to Equity Ratio?

- How Much Debt Can You Afford?

- Debt Financing Pros & Cons

- What Else Should You Consider?

Debt Financing vs. Equity Financing — What's the Difference?

When a business raises capital by leveraging its debt instruments, e.g., government or corporate bonds, bills, or bank loans, it’s known as debt financing. In short, it means taking on debt to pay for your business needs. Most often, these transactions occur with an institutional investor – like with a bank or other financial institution.

Debt financing is generally easier to come by for established businesses. These businesses may be more reliant upon debt financing to obtain the capital necessary to operate and facilitate growth. Also referred to as financial leverage, think of debt financing as a mortgage of sorts – with terms that include regular payments with interest, which must be repaid in full.

The cost of the loan is the interest charged over the repayment period.

Conversely, when a company sells stock, it is selling equity (ownership) in its business, which gives a stockholder/shareholder a claim to the company’s future earnings. Inherently speculative, if the enterprise goes bankrupt, investors lose whatever value the stock holds, and will likely not recoup their initial investment.

How Does Debt Financing Work?

For small businesses, debt financing most likely won’t involve selling bonds or notes to investors or institutional lenders. Instead, the best options for smaller enterprises are as follows:

Installment Loans. Like a mortgage, these small business loans are paid in one lump sum with a set repayment period and amount, including interest. Installment loans may be secured or unsecured and include the following:

- Government-backed loans, e.g., SBA loans

- Equipment financing loans

- Term loans

Cash Flow Loans. Sometimes called merchant cash advances (MCA), or invoice financing, these types of loans are paid out to the borrower in a lump sum to use for whatever your business might need.

They differ from other small business loans or term loans in that their repayment schedule is based upon a percentage of monthly credit card earnings. A term loan usually has capped interest rates, repayment amounts, and varying periods for repayment.

Revolving Loans or Business Lines of Credit. A small business line of credit is similar to a short-term loan. It is designed to help meet the immediate needs of a business’s day-to-day operations and provides periodic access to a set amount of cash. A line of credit is like a credit card — with better terms. You only pay interest on borrowed money.

A small business line of credit allows you to re-borrow any repaid portion, up to your credit limit and until the draw period concludes.

What is Debt to Equity Ratio?

A debt-to-equity ratio is a simple formula that takes the company’s total liabilities (what the company owes/debt) and divides them by total shareholder equity (what the company owns/assets).

Debt isn’t always bad. Investors and analysts like it when a company uses debt wisely. Moreover, lenders look at the entirety of a company’s balance sheet to determine overall creditworthiness. When financing for the growth of a company, its financial structure will include both debt and equity.

The best debt-to-equity ratio varies by industry and company. It depends on what kind of service or goods it provides, and whether it intends to go public and sell shares.

How Much Debt Can You Afford?

Ultimately, the goal of using debt and equity, and finding a balance between the two, is growth. Debt capital is a part of the process of balancing a businesses’ finances, analyzing its capital structure, and making long-term decisions on how to manage money.

As with any decision to borrow money, you’ll first need to determine how much you need and how much you can afford to comfortably repay every month. Determine this amount by evaluating your monthly cash flow and/or projections.

A general rule of thumb is to earn 1.25% more each month than your total expenses, e.g., if your business's income generates $10K per month, and your monthly expenses are $7K, you should be able to repay a loan payment of $1K. Your income is 125% times more than your expenses.

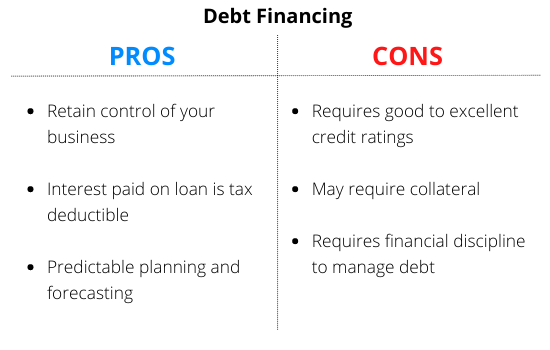

What are the Pros of Debt Financing?

Here are three reasons why debt financing can be advantageous for your small business.

- Retain control of the business. Unlike equity financing, the biggest benefit to debt financing is a business owner does not relinquish ownership or control of their business. Once the loan is repaid in full, the business relationship between the business and the lender is complete.

- Tax Advantages. Interest on your small business loan is tax-deductible.

- Predictable Planning. With principal and interest terms, you’ll know exactly how much to budget or repayment in your financial plans.

What are the Cons of Debt Financing?

Debt financing can be advantageous, but there are some downsides to consider. Here are three cons to debt financing.

- You'll Need Good Credit. If you’re just starting out in business, you’ll need Good to Excellent credit to qualify for a business loan. If your credit score precludes you from obtaining a traditional loan, consider a cosigner.

- Collateral. Most people think using their homes is the best way to secure capital. In business, it’s not. Moreover, it’s risky. Using your home as a guarantee of loan repayment could mean losing both your home and your business. Find a loan that allows you to use business assets or outstanding receivables as collateral.

- Financial Discipline. A business that’s overly reliant on debt is seen as a risky investment. Taking on debt to grow your business requires financial prudence and discipline.

What Else Should You Consider?

Finally, here are four questions to ask yourself before pursuing debt financing:

- Is it important that you retain full control of your business?

- Can you comfortably make monthly payments?

- Does your credit score allow you to pursue debt financing?

- Do you have the necessary collateral to procure a loan and are you comfortable using it?

If you answered yes to these questions, debt financing could be a good option for your business.

What’s the Right Loan Type for My Business?

Once you have a realistic set of objectives and a clear understanding of your business goals, you’ll be able to base your decision on which type of debt financing is right for you. With a plethora of lending options and historically low interest rates, now’s a terrific time to start a small business.

Funding Circle and Fora Financial are online lenders that offer a variety of options. Online lenders are often able to fund business loans quicker than local banks can, which makes them attractive options for businesses who need capital fast.

Need Help With Business Funding?

Do you need help getting funding for your business? We can help you with SBA loans, grants, or other business financing options. Get ongoing personalized help from our team. Join Skip Premium today and get 1-1 support for your business.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.