The Covid EIDL program, which allows businesses to borrow up to $2 million at low interest, will be ending on December 31, 2021. For businesses who were denied for the EIDL program, or who need financing beyond December 31, 2021, the SBA has two other programs to consider. Here is a comparison of the SBA 7(a) and 504 loan programs.

SBA 7(a) Program

About the 7(a) program. The 7(a) program is the SBA's most common loan type and it's financed through SBA-approved lenders. The maximum loan that businesses can qualify for is $5 million. The SBA will back 85% of loans up to $150K and 75% of loans over $150K.

Interest rate. The final interest rate for a 7(a) loan is negotiated between the borrower and an SBA-approved lender. The base rate can be the prime rate, London Interbank One Month Prime plus 3%, or the SBA Peg Rate. Lenders are then allowed to add up to 2.25% for loans up to 7-year terms and 2.75% for loan terms greater than 7 years.

Eligibility. In order to be eligible for a 7(a) loan, businesses must be a U.S. for profit small businesses (as defined by the SBA), have reasonable invested equity, have a demonstrated need for a loan, and cannot be delinquent on any other U.S. government debt.

Required Forms. When applying for an SBA 7(a) loan, you will need to submit the following forms: borrower information form, statement of personal history, personal financial statement, business financial statement for the past 6 months (including profit and loss and projected financial statements), as well as others. Visit the SBA website for a complete list.

Use of funds. Businesses can use 7(a) funds for the following purposes: long and short-term working capital, refinancing business debt (with some restrictions), purchasing a new business, expanding your current business, equipment purchasing, real estate purchase, construction of a new building, and renovation of an older building.

SBA 504 Program

About the 504 program. The 504 program is a loan program offered through Certified Development Companies (CDCs), which are SBA non-profit partners. These CDCs are certified and regulated by the SBA. The goal of the 504 loans is to promote business growth and job creation.

When businesses apply for a 504 loan, 40% of the loan will be financed through the CDC (which is backed by the SBA), 50% will be financed by another lending institution, and 10% must be covered by the borrower in cash or business equity. Additionally, for every $65,000 borrowed, the business must create one job.

Interest rate. The final interest rate for a 504 loan is negotiated between the borrower and an SBA approved lender.

Eligibility. To qualify for a 504 loan, the business must be a U.S. for-profit business with a net income below $5 million and a tangible net worth below $15 million. Businesses must also meet the definition of a small business (as defined by the SBA), be in good standing, and meet any other criteria imposed by their local CDC.

Required Forms. Every CDC will have its application process and specific paperwork. Begin by finding the CDC closest to you. You will also need SBA form 1244 and the 504 Authorization file library.

Use of funds. Businesses can use 504 funds to promote business growth and job creation. Allowable expenditures include the construction of new buildings, the purchase of existing buildings or land, and the purchase of long-term equipment and machinery. 504 funds can also be used for improving buildings, streets, parking lots, landscaping, and utilities. They cannot be used for working capital, paying off debt, or for investment.

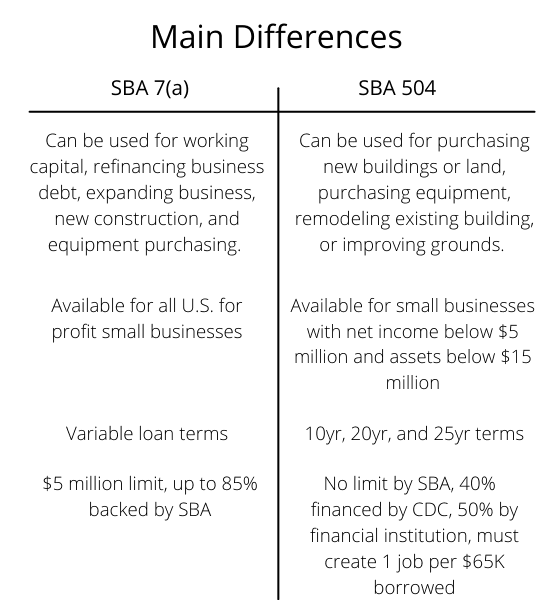

SBA 7(a) and 504 Comparison

Both 7(a) and 504 loans can be used for business purposes, but they cannot be used for the same expenses. Here is a side-by-side comparison of SBA 7(a) and 504 loans.

Assess Your Loan Options Carefully

Whether you decide to pursue a 7(a) loan or a 504 loan, it's important to understand the details of your loan before signing. You may already know which one is better for your business, but if not, here are some more pointers:

An SBA 7(a) loan may be better for your business if:

- You need working capital or want to pay off business debt.

- You don't need long loan terms.

- Your business does not need more than $5 million.

A 504 loan my be better for your business if:

- You want to remodel an existing building or upgrade business property.

- You want to purchase land, purchase a building, or build a structure.

- You will create one new job for every $65K you borrow.

Other Considerations

The SBA's 7(a) and 504 programs are viable EIDL alternatives. Both programs enable business expansion, but they have different qualifications and limitations. If you want help navigating funding options for your business (EIDL, 7(a), 504, and more), you can use this invite link to skip the 2,000+ on our waitlist to receive personalized 1-to-1 support from someone on our team.