If you're looking for more funding options for your small business, here is an important program that is under the radar. Here is the ultimate guide to the SBA Community Advantage Loan Program, also called the CARL (Community Advantage Recovery Loans). Here is a quick guide directly from the SBA as well.

Ultimate Guide to SBA CARL Loan Program

The Community Advantage Recovery Loan Program (CARL) is a pilot program to increase SBA-guaranteed loans to small businesses in underserved areas. It gives loans up to $250,000 at an average interest typically between 7% and 9%. Only Community Advantage (CA) approved lenders are eligible to distribute the loans.

What Are the Basics of the SBA CARL Loan Program?

As mentioned above, loans are up to $250,000 through approved Community Advantage (CA) lenders, with minimum loan periods of 5 years, with some business and collateral requirements on amounts over $25,000.

When Are the Deadlines to Apply for an SBA CARL Loan?

Since this is a pilot program that has been updated to help businesses during COVID-19, as of the SBA update in August 2020, loans must be originated no later than September 27, 2020. That means you should talk to a lender soon to see if you could qualify.

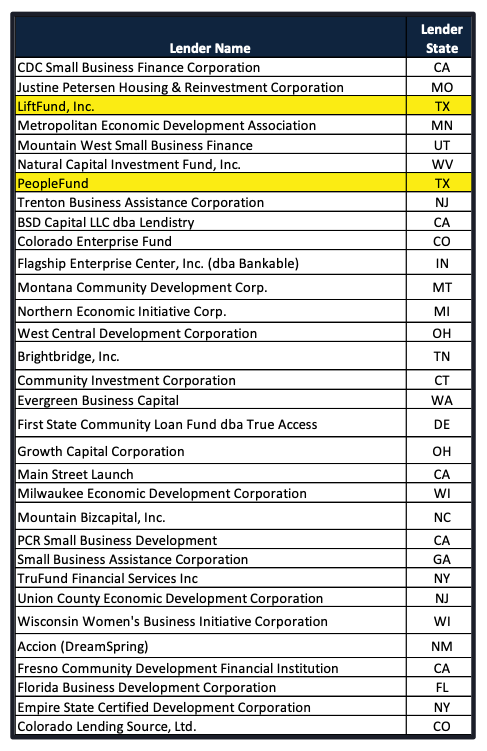

What Are the SBA CARL Approved Community Advantage (CA) Lenders?

Generally, CA lenders can be CDCs, microloan programs, or intermediary lending pilot (ILP) program intermediaries. Below is a chart from the SBA, otherwise you may want to search "Community Advantage Lender" in your state and contact them directly.

What Are Specific Community Advantage Program Requirements for Applicants?

There are some SBA imposed requirements but the specific CA lender can also decide to make stricter requirements.

For minimum credit score, SBA allows people with scores as low as 140, however CA lenders can demand higher scores. But typically this program has much more leniency.

For minimum time in business, most SBA lenders require 2 years in business, however this program requires less time and is more startup friendly. There is no minimum requirement.

For business financials, CA lenders may require solid business plans and financial projections. CA lenders are much more flexible for this program.

How to Apply for a SBA CARL Loan and Find a CA Lender?

The first step is finding a Community Advantage (CA) Lender to work with. There are over 100 approved SBA CA lenders across the US. You can take a quick look at the list above, or search for Community Advantage lenders in your state.

Then you can start to work with the lender and start to prepare information about your business which will need to be reviewed.

📌 Thanks for checking out our Skip blog. Subscribe to our YouTube channel to get immediate loan and grant updates when they become available.

Related Articles to Read

📌 Small business Grants of up to $20,000 - an EIDL Grant alternative

📌 Thinking of shutting down your business? Here's what you'd need to do

📌 Request and track your mail-in Ballot for the 2020 Election