Updated Monday April 5, 2021

If you're waiting for EIDL grants, there is some good news, finally. We have a new poll running that shows continued progress in Targeted EIDL Grant approvals. This follows progress last week and the week before

The new SBA leader, Isabel Guzman, has been on the job around 2 weeks and Targeted EIDL grants are being approved at a faster rate, EIDL loan limits are changing, and there's talk of changing who qualifies for Targeted EIDL grants. Here's the latest.

Current Targeted EIDL Grant Progress

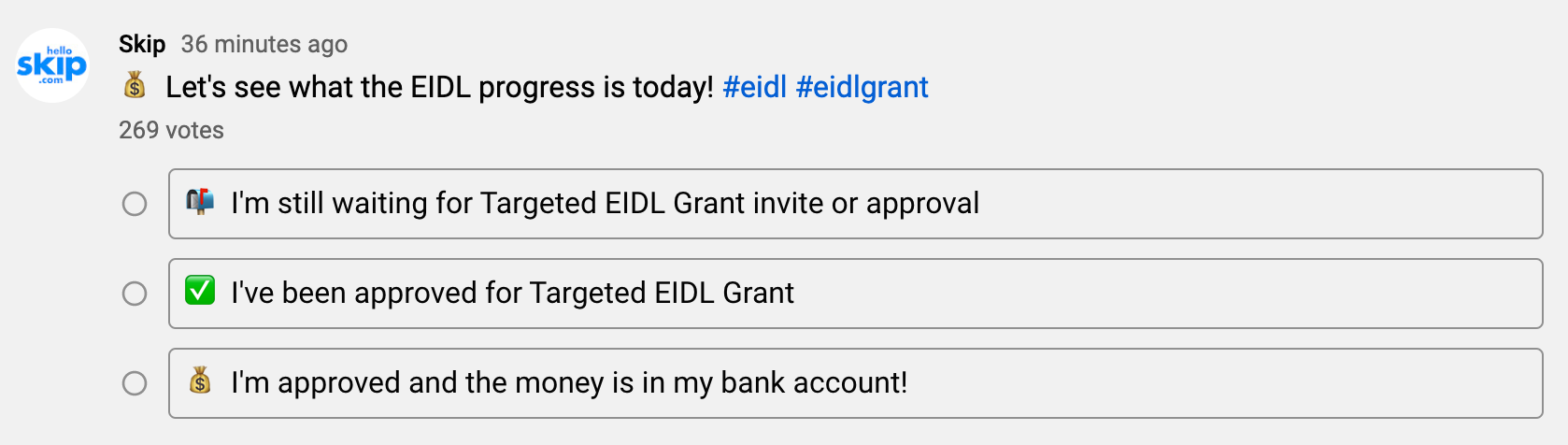

Our current poll is showing around 15% of people have been approved.

Report your status on the poll.

Targeted EIDL Grants Are Progressing

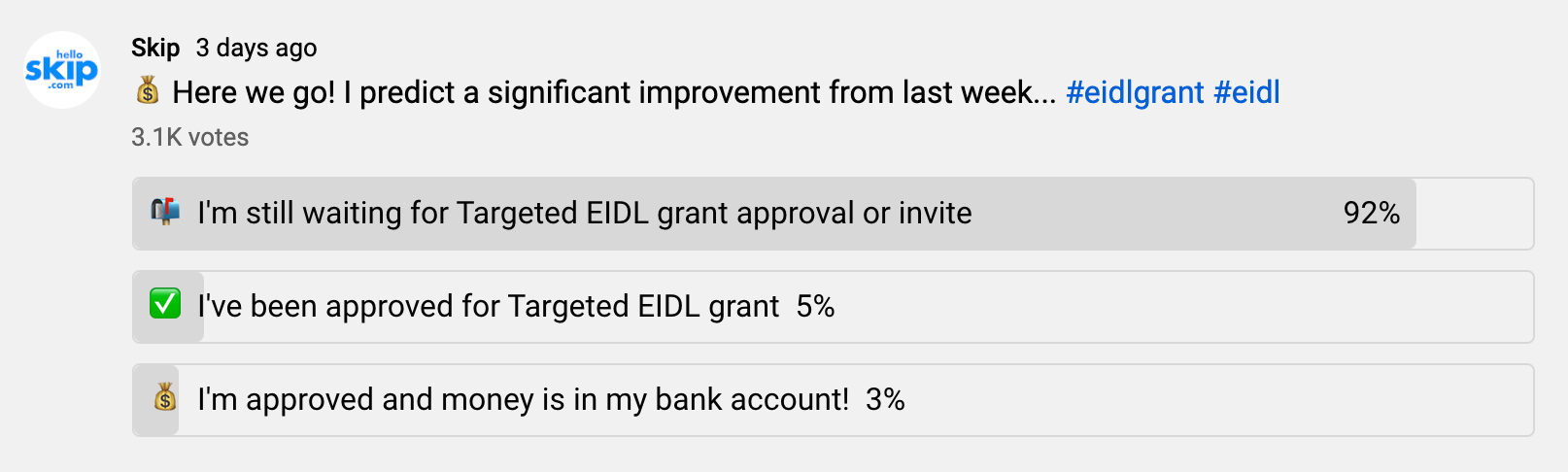

As of our latest poll from 3 days ago (below), 8% of you — nearly 1 out of 10 — have been approved for Targeted EIDL grants. In fact, 3% of your report seeing the additional funding in your bank accounts.

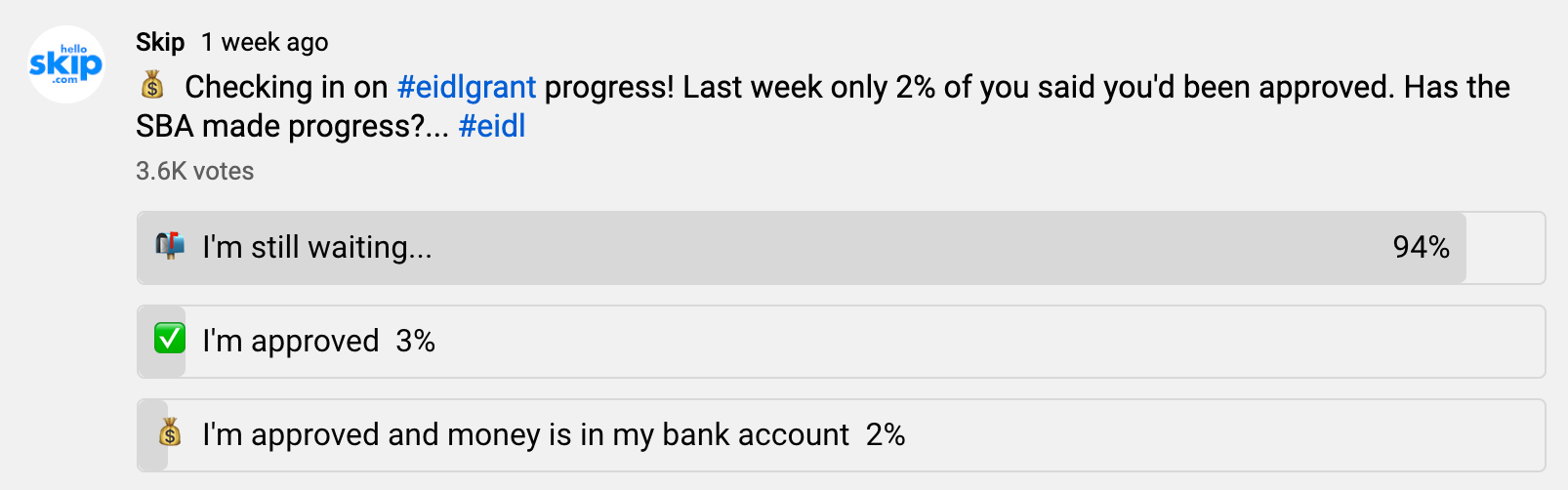

Yes, this is still incredibly low and the progress by most standards can be considered glacial. (It's been over 3 months since this extra EIDL Advance funding was approved!). But compare this to the progress last week: only 5% approved.

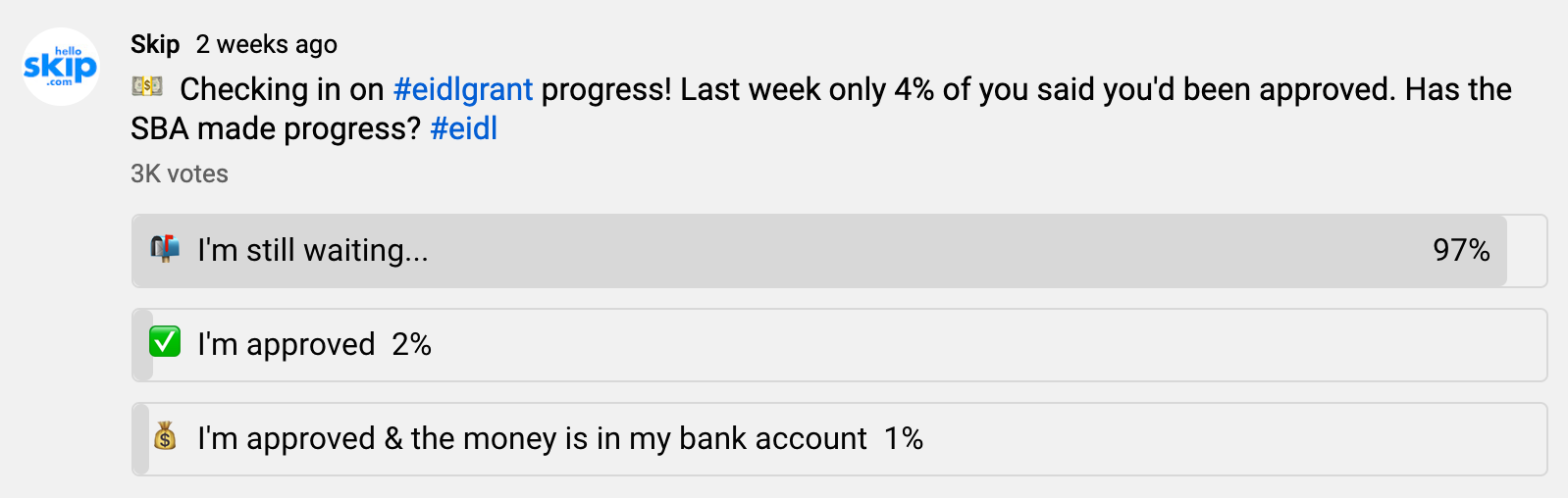

Or even the week before that: only 3% had been approved.

At this pace we'd get to 50% sometime this summer. But based on what we've seen and heard from the SBA, the progress is speeding up under Guzman.

In fact, last week our contact at the SBA said approvals will "increase rapidly" this week and next week. So — we'll poll again next week to see the latest.

For the millions of you still waiting — both for an invite or an approval — you're not alone and there's still progress being made. We'll talk about the positives here in a minute, but first the EIDL loan news recap.

EIDL Loan Limits Increased to $500,000

In case you missed the news last week, Guzman also increased the EIDL loan limit from $150,000 to $500,000. This change will go live next week, and the SBA will begin contacting folks who may be eligible for higher loan amounts soon.

As of now, there's no action for you to take here, just stay tuned, if you think you might be eligible for a higher EIDL loan. The SBA will be in touch (famous last words).

In addition, the PPP is officially extended 2 more months, so you have until May 31st to apply for First Draws or Second Draw forgivable loans.

Discussion on Changing EIDL Grant Eligibility

Perhaps the largest source of frustration among small business owners now is the low-income provision that's part of the new EIDL grants legislation — the so-called "Targeted EIDL Grants"

This excludes many of you — many of you who are in fact low-income or need the EIDL grants but are not located in neighborhood that "qualifies" based on census income data.

Legislators are aware of this, and there is discussion about how to change this, either a new bill (S.4227 is still being discussed) or amendments.

Guzman may see this as unfair (we haven't heard about this specifically) but even if she did want to change the eligibility requirements, she'd have restrictions, since the legislation included the language around who would qualify based on their business address.

As always, we're keeping an eye on the discussions and progress and we'll keep you posted. You can always follow us on social media too, for more updates: Facebook, Instagram, Linkedin, Twitter.

📌 Pro-tip: Find out about new grants and funding opportunities with 15 days free of Skip Plus. Join nearly 50,000 others getting early access to grants and other funding opportunities. See New Grant Opportunities

"I can't recommend Skip Plus enough. It is so wonderful to have the confidence that the Skip team is researching for me and they'll alert me if I need to take action on grant opportunities. -Stephanie J, Los Angeles, CA

"Thank you Skip for keeping me informed on grants and loans. It seems like you're adding new features every single week. Big help for my shop in Atlanta — thank you again." -Danielle K, Atlanta, GA