Have you ever invested in stock only to have it go south? This can be very frustrating, but there is an advantage to selling your stock at a loss–it's called tax-loss harvesting. By using this strategy, your poor-performing stock can actually lower your tax bill. Here's everything you need to know.

What is Tax-Loss Harvesting?

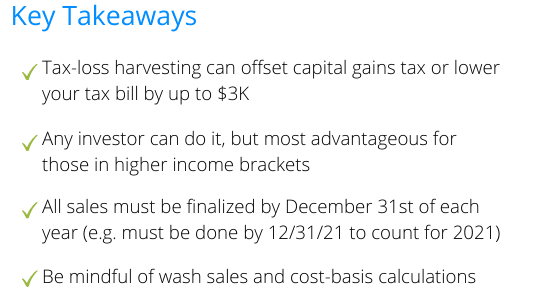

Tax-loss harvesting is the act of selling bad investments (investments that lost you money) to offset any capital gains tax. When you sell a stock, it's referred to as being "realized." Any profitable realized stock is taxed with capital gains tax.

In essence, the purpose of tax-loss harvesting is to reduce the taxes you pay on capital gains. You can deduct your losses from your gains and thereby lower your tax liability.

How Does Tax-Loss Harvesting Work?

The ultimate goal of tax-loss harvesting is to lower or eliminate capital gains tax, so here's what you need to know. When you sell a stock for a profit, you are taxed–that's capital gains tax. The amount that you are taxed is based on how long you own the stock.

- Short-term capital gains. Short-term capital gains refer to the profit you make off of stock that you held for less than one year. They are taxed according to your tax bracket, just like ordinary income. Currently, the highest tax rate is 37%.

- Long-term capital gains. Long-term capital gains refer to the profit you make off stock that you held for more than a year. Depending on your income, your long-term capital gains tax will fall between 0% and 20%.

When you sell–or harvest–your investments where you realize a loss, you can deduct that loss from your other gains and reduce your tax liability. This is tax-loss harvesting or tax-loss selling.

If you have more losses than gains in a particular year, you can offset some of your income. For those filing individual or married filing jointly, you can offset $3K in income, and $1,500 for married filing separately. You can even carry your losses to offset future income or capital gain in the coming years.

Before selling stock, it is important to weigh the benefit of reducing your tax bill against your long-term investment goals. Always consult with a tax professional before making these decisions.

Important note, stock harvesting must be completed by December 31st in order for it to count for that year. So, if you want to harvest losses for 2021, the sales transactions must be completed by December 31, 2021.

Tax-Loss Harvesting Example

Here's an example to help bring this to life.

On May 1st, Thomas buys 100 shares of XYZ stock and 100 shares of ABC stock. Both of these options were $10 a share, so Thomas spent $1K on each stock. During the year XYZ does very well, while ABC tanks.

On December 31st (the deadline to sell/harvest your stock), Thomas sells all of his XYZ stock at $30 per share–for $3K. He made a profit of $2K and will pay short-term capital gains tax.

Thomas also decides to sell his ABC stock–since it's not doing so great–at $2 per share. Thomas lost $800 on his ABC investment. Instead of paying capital gains on the $2k he made from XYZ, Thomas will only pay capital gains tax on $1,200 ($2K in gains - $800 in loss).

What are the Tax-Loss Harvesting Rules?

If you'd like to read the entire 76-page IRS Publication 550 on investment income, it has everything you'd need to know–and then some. But, there are two main rules that you should be aware of when it comes to tax-loss harvesting–wash sales rules and cost-basis calculations.

- Wash sales. If you were to sell your stock to minimize capital gains, and then purchase that same stock again–or similar stock, that would be referred to as a wash sale. A wash sale occurs when you (or your spouse) sell stock at a loss and purchase the same stock–or "substantially identical"–30 days before or after.

However, according to the IRS, "stocks or securities of one corporation are not considered substantially identical to stocks or securities of another corporation," except in some cases. In other words, you can still invest in the same industry because stocks of the same industry are not considered "substantially identical."

It's not a bad idea to purchase similar stock to keep your investment profile and asset allocation balanced. One option is to invest in a mutual fund or exchange-traded fund (EFT) that invests in that the same industry.

If the IRS does determine that your sale is a wash sale, there is no penalty or fine, but you cannot deduct those losses from your gains. Worst case scenario (absent any illegal activity) is your tax bill will be higher than anticipated. Always speak with a tax professional or investment firm to be sure. - Cost-basis calculations. To accurately calculate your capital gains and losses, you need to know the original price you paid for the stock, including brokerages fees and others–this is the cost basis. If you purchased all of the securities at the same time, this will be easier to determine. If you purchased securities at different times, it will be harder.

It's critical to know the date that you purchased the shares as well as the value of each share when purchased. This will enable you to determine how much it's grown (or shrunk) in value and whether it is subject to short-term or long-term capital gains.

Your brokerage or investment firm should be able to help you with all of this. If you're investing on your own, you will need to make these determinations and calculations yourself.

Are There Benefits To Tax-Loss Harvesting?

As you may have already determined, there are benefits to tax-loss harvesting. The main benefit is minimizing or eliminating your capital gains tax. By deducting your losses from your capital gains, you'll pay less in taxes.

You don't need to be a professional day trader or have a large portfolio to benefit from this. Anyone that dabbles in investments can do this. If you don't have impressive gains for a year, you can use your losses to offset your traditional income. Always consider your long-term goals before harvesting.

When Should You Use Tax-Loss Harvesting?

Harvesting your investment losses can be quite advantageous, but there are certain limitations to keep in mind. Primarily, harvesting your losses should only be conducted on taxable accounts.

If you lose money on securities in tax-advantaged accounts–which includes most retirements plans such as 401(k), 403(b), traditional IRA, etc.–it would not make sense to employ this strategy. Why? Because these accounts are tax-deferred, so you aren't being taxed on your gains.

Tax-loss harvesting is most advantageous for individual stocks. If you dabble with online trading yourself or have money in certain exchange-traded funds or actively managed funds, your gains will be taxed, and thus, harvesting your losses could be beneficial.

Additionally, tax-loss harvesting benefits you the most when you're in a higher income tax bracket. Higher income means higher capital gains tax. The goal of harvesting is to reduce your tax bill now–not in 30 years when you retire. If you're on the lower end of the tax bracket, this will not be as beneficial–but you can still do it.

One more reminder about the deadline, you must sell your losses by December 31st of the same tax year. So, if you have losses you want to harvest for 2021, you must sell them by December 31, 2021.

Disclaimer: This article is intended to be used for informational purposes only. Skip does not provide tax or investment advice. Always consult with a tax professional and financial advisor when making such decisions.

How Else Can Skip Help? Whether you need help navigating small business funding–like SBA loans, grants, or other financing options–or help with other government-related services–like TSA PreCheck or DMV appointments — skip the red tape.