The Small Business Administration (SBA) has released the latest data on Paycheck Protection Program (PPP) loan distribution. There are a few important takeaways that are important for your business - including which states are getting the most funding and how much funding is left. Let's dive in.

The PPP Rules Have Changed: Easier Forgiveness

First off, if you missed it, the PPP Flexibility Act was signed into law on Friday. This extends the period you have to spend your PPP loan, extends the time period you have to bring back employees, and loosens rehiring requirements. This is all good news for businesses hoping for forgiveness of these loans.

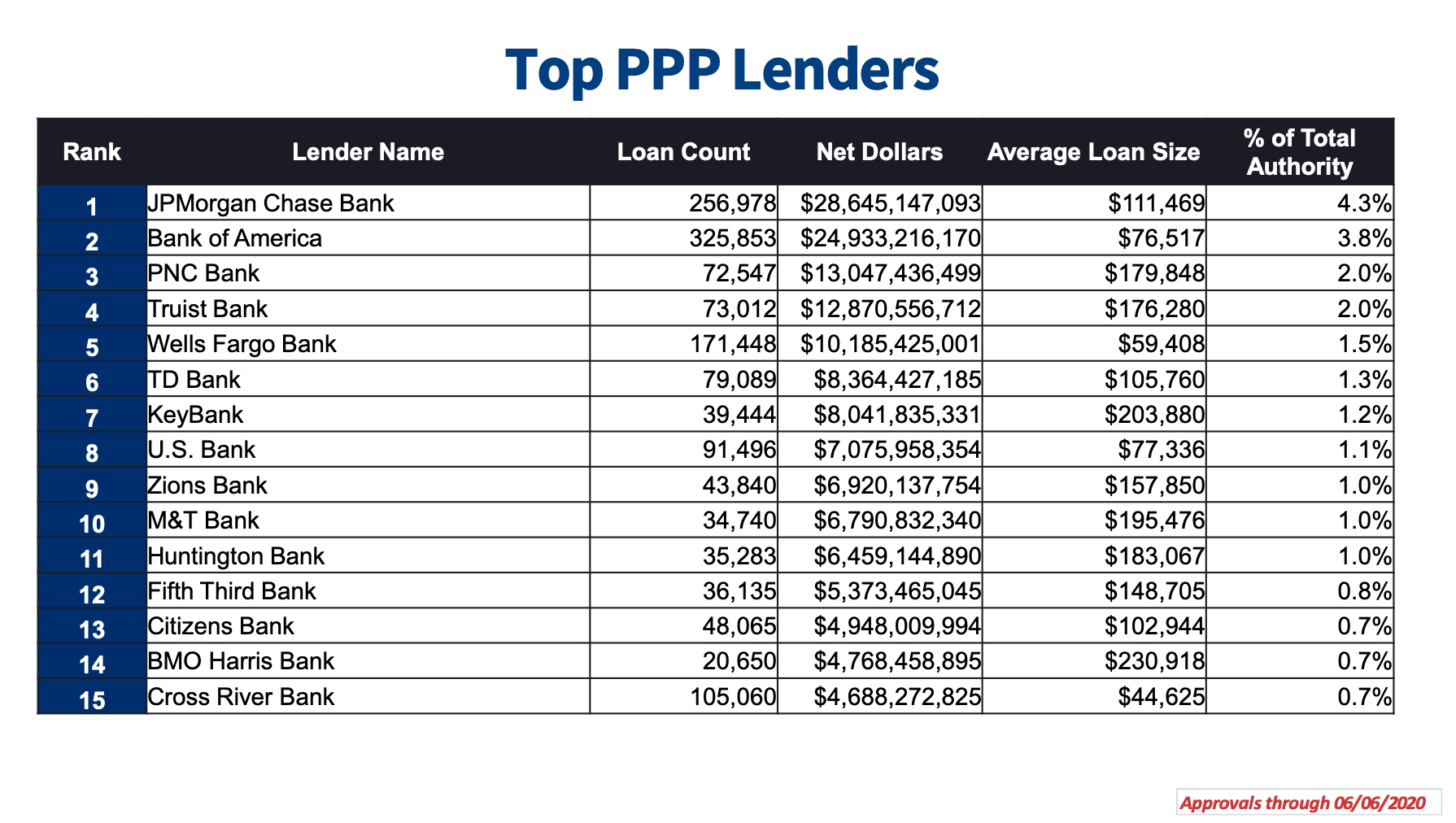

Several Banks are Doing a Majority of the Loans

Despite over 3,500 banks and lenders being eligible to distribute PPP loans across the country, 15 banks account for 1/4th of all PPP loans. In the era of big banks, this isn't too surprising, but it's more than we expected. Here is the chart from the Treasury's report that was released yesterday.

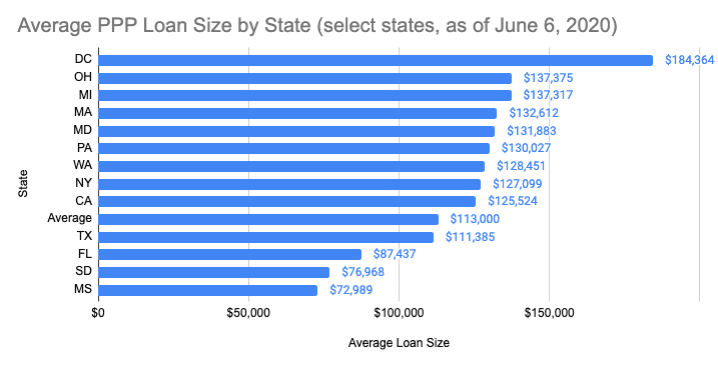

The Average Loan Amount is $113,000; The Average in DC is $184,000

4.5 million loans have been distributed across all states and territories. Of all of those loans issued, the average loan amount is $113,000. Most surprisingly, Washington DC has the highest average, of more than $184,000. The next highest average is almost $50,000 less - Ohio with an average of $137,000. Our chart of selected state-by-state averages shows how striking this difference is:

In addition, we also plotted all states and territories and the difference between DC and the rest is even more striking. Do you have any ideas on why this difference exists? If so, let us know or leave a comment on our YouTube video about this here.

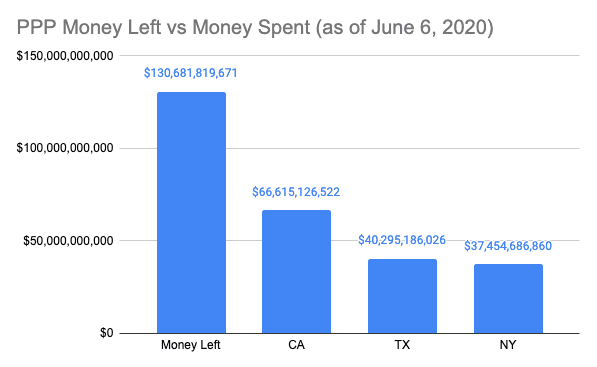

$511 Billion in Loans Has Been Issued, $130 Billion is Still Available

This is the most striking of all: Half a trillion dollars has been distributed to nearly 5 million businesses AND there is still $130 billion left in funding.

That $130 billion left is:

- More than the total amount that has been distributed to California and Texas combined ($106 billion)

- More than the amount of PPP loans issued to 33 states

- Based on the current loan average, is equivalent to funding of another 1.5 million small businesses

Our main point is that it's not too late to consider applying for a PPP loan. Especially now that forgiveness rules have been relaxed. If you're interested, here is a partner link to one of the lenders that has issued almost 1% of all total PPP loans.

Have any questions about the PPP loans? Follow us YouTube, Facebook, or Instagram, and ask us!