If you are an entrepreneur or a new business owner (or not so new), you may be asking yourself, "do I need business insurance?" The answer is, yes. Whether you run an online business or have a brick-and-mortar store, you need business insurance.

There are almost as many types of insurance as there are businesses. In this guide, we’ll briefly describe eight common business insurance types–and a few less-common–so you know how to get business insurance that is right for you.

In This Article:

- General Liability

- Professional Liability

- Workers' Compensation

- Commercial Property

- Commercial Auto

- Product Liability

- Business Owner’s Policy (BOP)

- Key Person Insurance

- Other Types of Insurance to Consider

How to Get Insurance for Your Business

Having insurance safeguards against lawsuits, liability, and other types of damages. Every responsible owner should consider insuring their business. Before you purchase business insurance, here are a couple tips:

- Do your research. There are many types of coverages out there and they can be confusing to understand. It's imperative though that you get some understanding of the types of insurances so you know which apply to your business.

In our insurance guides, we did our best to synthesize the information into bite-sized portions to help you digest the abundance of information. It may be a bit tedious, but spending 30-60 minutes of research and selecting the appropriate insurance(s) will help you save money, time, and energy. - Evaluate your business. Every business is unique and will need different coverage. Consider your business industry, business assets, and potential risk when choosing insurance. It's always a good idea to speak with an insurance broker before purchasing a policy.

8 Common Types of Business Insurance

Below are eight common types of insurance for small business owners. Be sure to click the "read more" link to get additional information about each insurance type and how to get it if it applies to you.

General Liability

While General Liability Insurance is not required by law, it is definitely one of the insurance policies every business should strongly consider. General Liability Insurance protects you and your business should someone—a client, customer, vendor, etc.–sustain an injury on your business property, or from using your products and services.

Read More about General Liability Insurance

Professional Liability/Errors and Omission Insurance

Professional Liability Insurance–sometimes referred to as Errors and Omission Insurance–is a type of liability insurance geared towards businesses/entrepreneurs who make a living providing their expertise.

Think consultants, accountants, attorneys, and other professional services. This type of business insurance protects you from lawsuits that stem from mistakes, omissions (real or perceived), missed deadlines, and other claims of negligence.

Read More about Professional Liability or EO Insurance

Workers' Compensation Insurance

Nearly every business with employees is required to have Workers' Compensation Insurance. This insurance type covers claims from employees who are injured while working on the job. It is designed to cover their medical expenses, loss of wages, rehabilitation, and more, during recovery.

Read More about Workers' Compensation Insurance

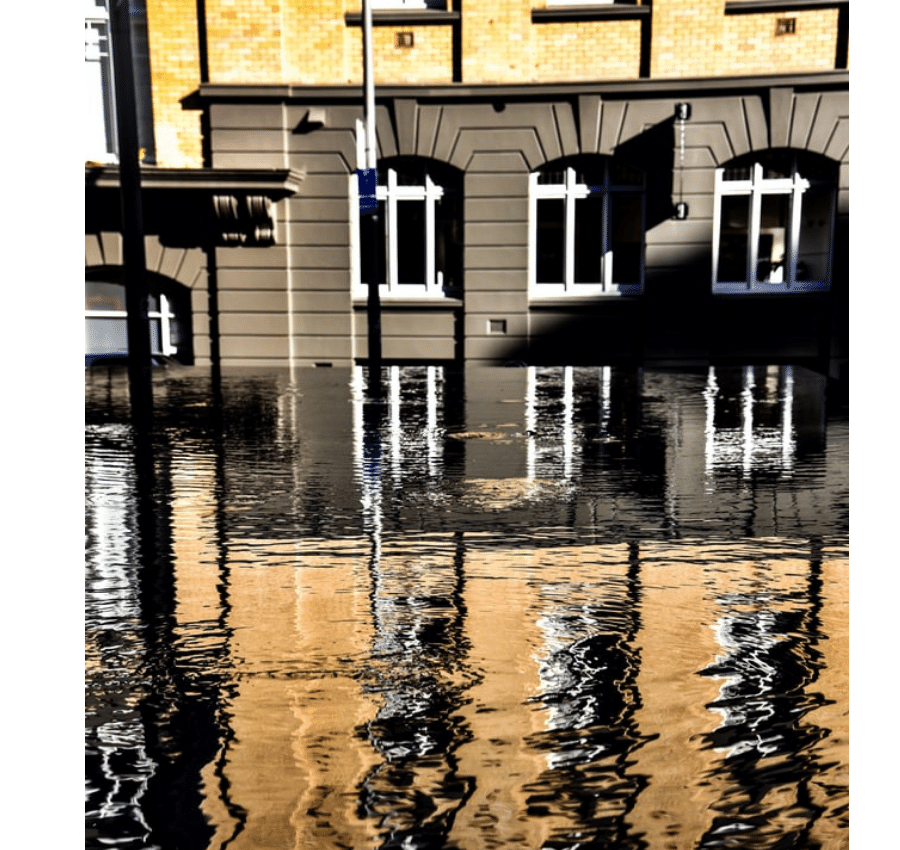

Commercial Property Insurance

Commercial Property Insurance protects a business against accidental damages, vandalism, or loss of the physical building and assets. Commercial property insurance also covers the cost to repair or replace business assets.

Businesses that own or rent a physical space, or other business-essential assets, should strongly consider commercial property insurance.

Read More about Commercial Property Insurance

Commercial Auto Insurance

Depending on the level of coverage obtained, Commercial Auto Insurance covers the repair or replacement of company vehicles damaged in accidents, while also covering bodily injury, medical expenses, and more.

Every business that uses a vehicle, or business owner that uses their personal vehicle for business purposes, should obtain commercial auto insurance.

Read More about Commercial Auto Insurance

Product Liability Insurance

Product Liability Insurance is a standalone product, but it is usually bundled with your General Liability Insurance policy. Product Liability Insurance protects your business if your product or service causes property damage, bodily injury, illness, or death. It also covers the legal expenses that may arise.

Read More about Product Liability Insurance

Business Owner’s Policy (BOP)

A Business Owner's Policy (BOP) is a hybrid of General Liability Insurance and Commercial Property Insurance. It's designed for small and medium-sized businesses as an economically bundled package instead of purchasing two separate insurance policies.

Read More about Business Owner’s Policy (BOP) Insurance

Key Person Insurance

Key Person Insurance is a policy that businesses take out for a key figure(s) in their company, such as the CEO, founding member, or top executives. Key Person Insurance is designed to help the company rebound from the death or serious disability of key individuals, who would otherwise be responsible for steering the business while minimizing the impact of their absence.

Read More about Key Person Insurance

Other Types of Insurance to Consider

The following are less common types of insurance; however, they may apply to you and your type of business.

Cyber Insurance

Cyber Insurance generally covers your business' liability when a data breach involving sensitive customer information, like SSNs, credit card numbers, driver's licenses, or health records occurs.

A Cyber Insurance policy not only helps with legal fees, but will also assist your business in notifying and restoring the personal identities of affected customers, recovering compromised data, and repairing damaged computer equipment.

Read More about Cyber Insurance

Umbrella Insurance

Should something happen in your business that exceeds your policy coverage, Umbrella Insurance extends the coverage of your existing liability policies such as General Liability, Professional Liability, etc. often at a less expensive rate. Umbrella insurance may also cover gaps in your coverage.

Read More about Umbrella Insurance

Employment Practices Liability Insurance (EPLI)

Employment Practices Liability Insurance (EPLI) assists in covering legal fees or damages related to employment-related claims against your business. Claims like wrongful termination, workplace harassment, discrimination, etc., would be covered by EPLI.

Read More about EPLI Insurance

Liquor Liability Insurance (Dram Shop Insurance)

This is for businesses that serve or sell alcohol. Liquor Liability Insurance, (also known as Dram Shop Insurance) can help cover the legal fees, settlements, and medical costs if the business is found responsible for serving a visibly intoxicated person, who then goes on to cause injury, damage, or death to others.

Read More about Liquor Liability Insurance

Inland Marine Insurance (Business Equipment)

If your business ships or transports products or equipment, Inland Marine Insurance covers these items while they are being transported by truck or train.

Additionally, Inland Marine Insurance may cover high-value items–or those excluded in a standard business owner policy. It can be purchased as standalone insurance or bundled as an add-on to your existing policy.

Read More about Inland Marine Insurance

Get Reliable Business Insurance

For ease, convenience, and great rates, we recommend Next Insurance – a reputable online broker. Get affordable quotes for almost every type of business insurance — starting at just $25 per month. Use our partner link to get a free quote.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.