In anticipation of the SBA announcing "EIDL 2.0" on Monday August 16th, our team took a closer look at possible EIDL collateral options for new loans over $500,000. In this quick post, Ryder shares his thoughts on the forthcoming "EIDL 2.0" announcement, the 2 million EIDL loan limit, and possible alternatives to real estate as collateral to secure a loan increase over $500K.

SBA's Collateral and Personal Guarantee Requirements

For the COVID EIDL program, the SBA requires collateral for loans over $25,000 and requires personal guarantees for loans over $200,000.

In the past, the SBA has traditionally required real estate as collateral for EIDL loans over $500K. It appears this will continue to be a requirements with "EIDL 2.0" — the biggest change of which will be allowing EIDL loans up to $2 million from the current limit of $500K. An SBA loan officer has confirmed this as well.

The question is: Will the SBA accept EIDL collateral alternatives to real estate? If so, what could they be?

EIDL Collateral Alternatives to Real Estate

First, according to the SBA, they won't flat out deny a SBA loan request because a lack of available collateral. The SBA says they'll work with borrowers to try to secure whatever the business owner has available. However, in the case of $500K+ loans it's unclear how this changes requirements.

Alternative forms of collateral include cash secured loans, inventory financing for loans (like what Kickfurther does), invoice collateral, and blanket liens. These are all options that lenders use to help secure loans.

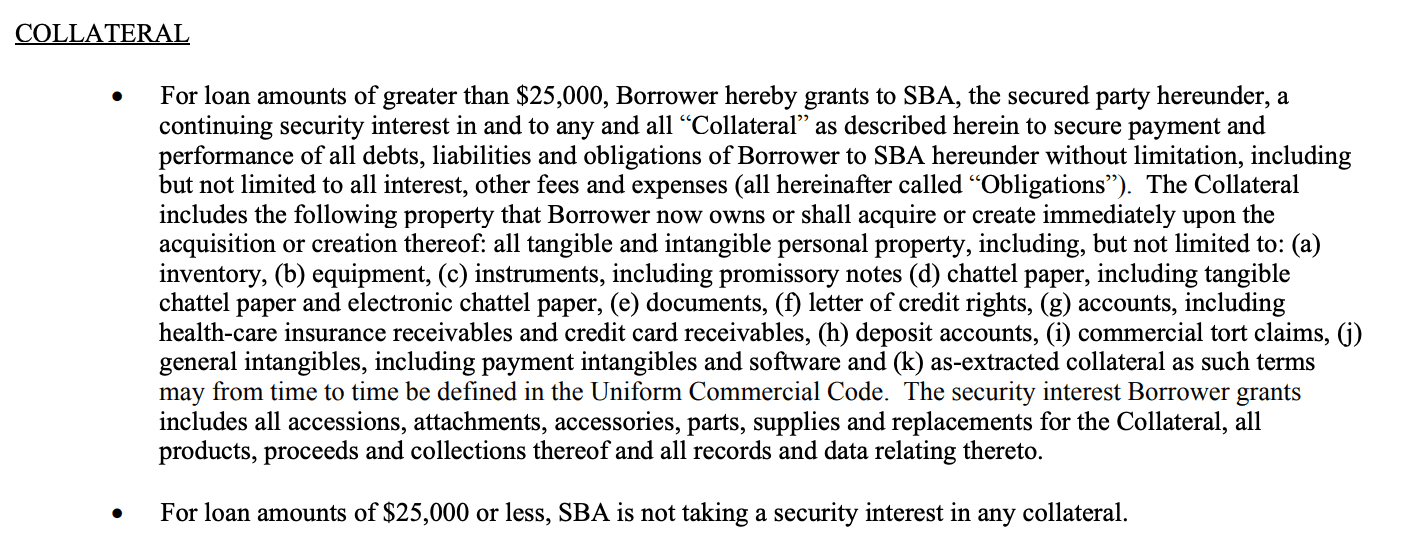

In the current EIDL loan agreements, the following is what the SBA deems as necessary collateral for loan amounts up to $500,000.

Conclusion: Collateral Requirements for EIDL 2.0 May Have Real Estate Alternatives

For the hundreds of thousands of small business owners who will be EIDL loan increases, yet again, this time up to $2 million, the question of collateral required may be on your mind. Based on past SBA practices, there may be real estate alternatives, however, the SBA has not confirmed the exact specifications of $500K+ loans. As soon as information is released we'll publish it here. Meanwhile, you can calculate your potential EIDL loan amount on the Skip web dashboard — or if you're new to Skip, go to EIDL2.com to check.

📌 Want more funding opportunities every single week? Try Skip Plus for 2 weeks for free and never miss out on another major funding opportunity.

💸 Serious about extra funding and want personalized 1-1 support? Limited spots are available here.