As of last week, over 400,000 PPP loans have been approved in the first 2 weeks of the 2021 PPP program. If you've applied and are still waiting — or if you've already heard back and your not approved — here's a helpful post on what you can do.

Reasons Why You Might Still Be Waiting on PPP Loan

Sheer volume is the biggest reason. Lenders have received millions of applications collectively in the first 3 weeks of the program.

While many lenders spent the time to automate processes and increase their throughput, many have not and may be doing manual review.

If your application was put in "manual review" chances are it's in a queue waiting to be looked over. Here's basically how it works:

Many lenders put in automated steps to cover most cases during the application process — automatically verifying supporting docs, having a systems of flags to pass people through internal checks, and more.

However, if you had a special circumstance, or even just a circumstance that wasn't covered in a lender's automation you may have likely been put in a manual review pile.

Reasons Why You Might Have Been Rejected for a PPP Loan

There are several reasons why you might be rejected for a PPP loan: First, you might not meet the qualifications of the program. Second, it might be due to an SBA software issue incorrectly rejecting 2nd time applicants who haven't had their first loan forgiveness.

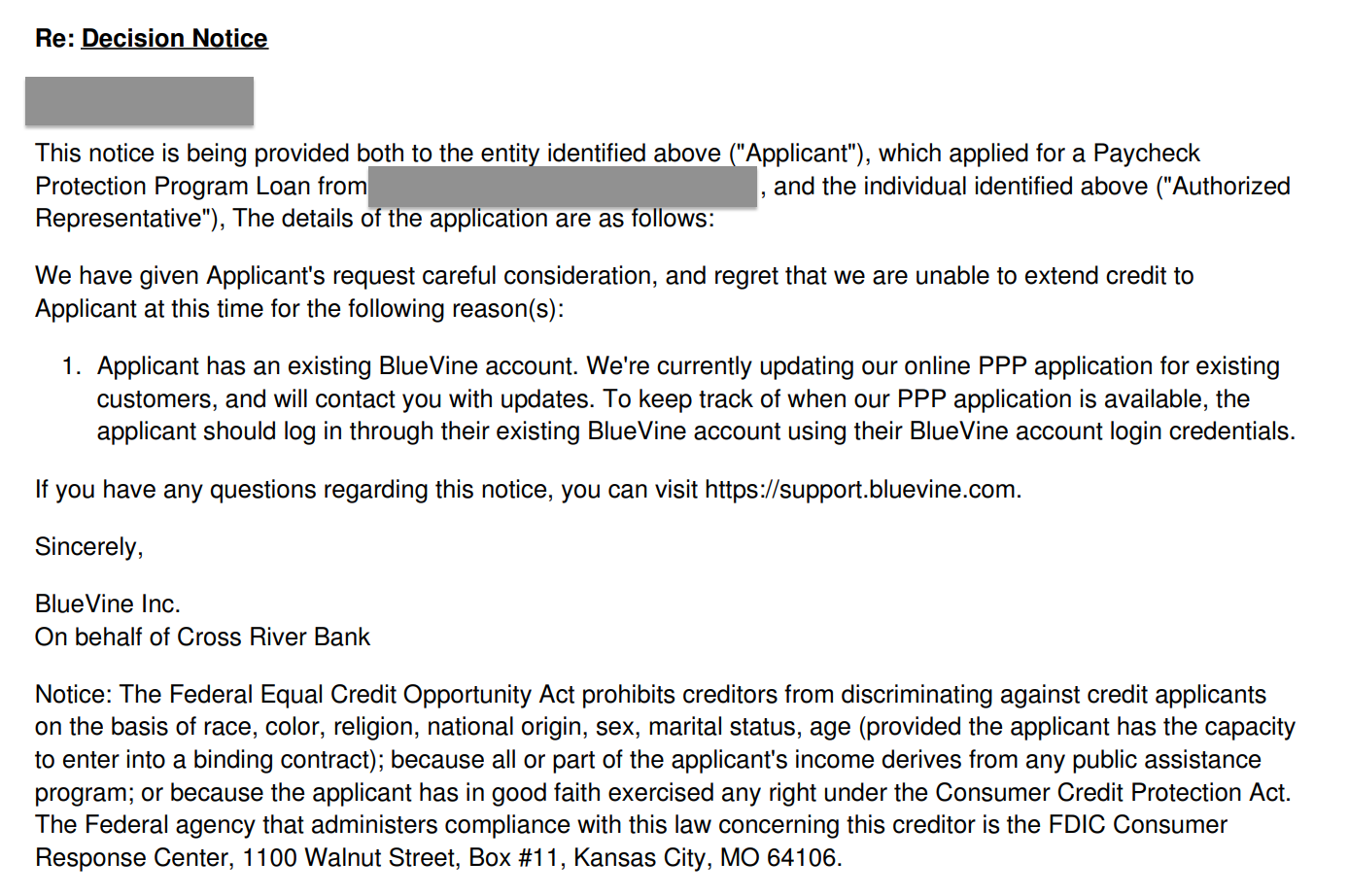

Third, it might be because of the lender you applied with had specific rules about when to apply and wasn't ready for your application (see below example letter). And fourth, it could be because your lender's internal system flagged your application (perhaps correctly or incorrectly) and send a form reply to you.

What You Can Do If You've Been Rejected for a PPP Loan

First, check the information the lender you applied with sent to you. In many cases they may share the reason why you were denied. That's a good starting point.

If you feel they made an error you can try to get in touch with them. Many lenders have protocols in place to automatically reject duplicate applications, so before you apply for the same lender again, see if you can get in touch with them.

Be forewarned, many lenders are extremely busy so it may take some time for them to get back to you.

Second, if you're sure that you qualify (re-read the rules yourself, this post is not advice - this is for illustrational purposes only), you can try other lenders as well. And example of this may be that you got a first PPP loan and nothing's changed and you meet the second PPP draw qualifications.

This approach is what many people did in the first PPP round. One example being, a big bank (take your pick) never got back to the applicant, so people applied with alternative lenders.

Here are three lenders for you to consider, if you've been denied from one or still haven't heard back: Bluevine or Funding Circle or Credibly.

Check Your Other Small Business Funding Eligibility

There is plenty of PPP funding. The first round had billions left over in PPP funding and based on last week's data, only around 10% of this rounds PPP funding has been allocated.

Once you review your qualification again and consider trying another lender or contact the lender you applied with, you can also take a look at your other options.

We put together a stimulus funding calculator. You can quickly check to see what you might be eligible for (for illustrational purposes only).

Look for Other Grant or Low-Interest Loan Opportunities

Many states and cities have localized grant and loan programs. We expect significantly more of these when the third relief package is passed. The timing for this looks like it will be middle or end of March. In this package is hundreds of billions for state and local governments.

We curate new grant and loan programs weekly for our Skip Plus members. If you'd like access to these you can get a free 15 day trial here and we'll send you access.

We'll also be doing quick recaps on opportunities both on our YouTube and Instagram pages so be sure to follow us there if you aren't already.