The Restaurant Revitalization Fund (RRF) is a $28.6 billion dollar stimulus program run by the SBA for businesses that serve food and drinks, which can provide up to $10 million in funds for your business. The RRF will open for applications on Monday, and in the meantime the SBA has released information about the application process, eligibility and allowable expenses you can use the funds for. Here’s everything you need to know.

Who is Eligible?

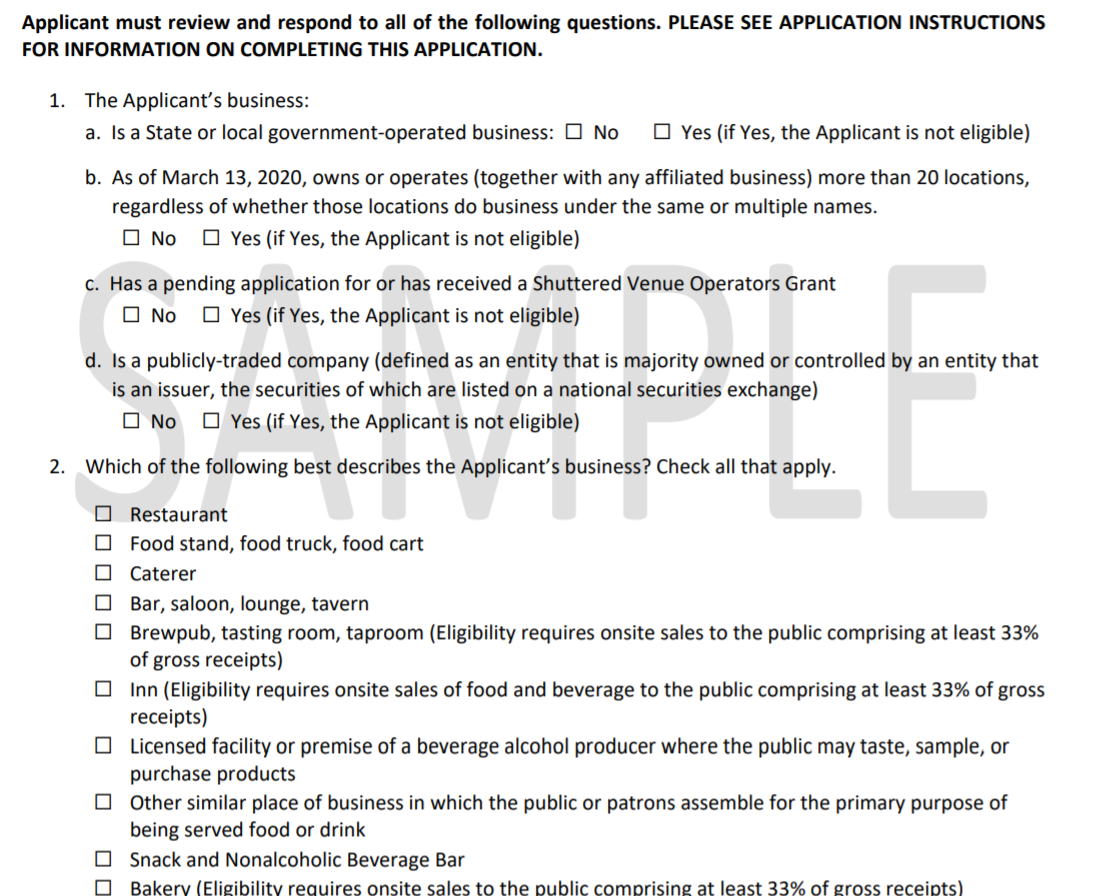

The RRF program isn’t just for restaurants. Most businesses that serve food can qualify, including bakeries, breweries, and even inns. Here are the eligible businesses:

-Restaurants

-Food stands, food trucks, food carts

-Caterers

-Bars, saloons, lounges, taverns

-Snack and nonalcoholic beverage bars

-Bakeries (as long as onsite sales to the public comprise at least 33% of gross receipts).

-Brewpubs, tasting rooms, taprooms (as long as onsite sales to the public comprise at least 33% of gross receipts).

-Breweries and/or microbreweries (as long as onsite sales to the public comprise at least 33% of gross receipts).

-Wineries and distilleries (as long as onsite sales to the public comprise at least 33% of gross receipts).

-Inns (as long as onsite sales of food and beverage to the public comprise at least 33% of gross receipts).

-Licensed facilities or premises of a beverage alcohol producer where the public may taste, sample, or purchase products

Businesses with more than 20 locations are not eligible.

How Much Money Can You Get?

The maximum funding amount per applicant for the RRF is $10 million, and the minimum is $1,000 (the limit for each location of a business is $5 million). Funding is provided for the revenue your business lost due to the pandemic, minus any PPP funding you received. Here’s the specifics of how to calculate how much funding you are eligible for, depending on when your business began:

If your business was started prior to January 1, 2019: calculate 2019 gross receipts (as reported on your Federal tax return) minus 2020 gross receipts minus PPP loan amounts. That number is how much funding you are eligible to receive.

If your business was started part way through 2019: calculate your average 2019 monthly gross receipts, multiply it by 12, and subtract 2020 gross receipts and PPP loan amounts.

The other option for businesses that started during 2019 is that you can calculate the amount you spent on eligible expenses (we will break down what expenses are eligible below) between February 15, 2020 and March 11, 2021 and subtract 2020 gross receipts, 2021 gross receipts (through March 11, 2021) and PPP loan amounts to determine how much funding you can receive.

We recommend that you do both calculations to determine which would provide you with more funding.

Eligible expenses include:

- Business payroll costs (including sick leave)

- Payments on any business mortgage obligation

- Business rent payments (note: this does not include prepayment of rent)

- Business debt service (both principal and interest; note: this does not include any prepayment of principal or interest)

- Business utility payments

- Business maintenance expenses

- Construction of outdoor seating

- Business supplies (including protective equipment and cleaning materials)

- Business food and beverage expenses (including raw materials)

- Covered supplier costs

- Business operating expenses

If your business was started in 2020 and has not yet been able to open but has had expenses, you can use the 2020 eligible expenses calculation above. If your business is a bakery, winery, distillery or brewery, you will be eligible for the program even if you haven't been able to do onsite sales, as long as your original business model included them.

What Expenses Can You Use it For?

RRF funds can be used for a variety of business expenses. The allowable expenses are the same as the eligible expenses for calculating funding, above. They are:

- Business payroll costs (including sick leave)

- Payments on any business mortgage obligation

- Business rent payments (note: this does not include prepayment of rent)

- Business debt service (both principal and interest; note: this does not include any prepayment of principal or interest)

- Business utility payments

- Business maintenance expenses

- Construction of outdoor seating

- Business supplies (including protective equipment and cleaning materials)

- Business food and beverage expenses (including raw materials)

- Covered supplier costs

- Business operating expenses

Do RRF funds have to be repaid?

The RRF is a grant program, so it doesn’t need to be repaid. Businesses must use the funds for the allowable expenses, however, and they must spend their grant before March 11, 2023. You should keep a record of how you spend your grant and be sure to use it for expenses allowed under the program.

Can the RRF Be Combined With Other SBA Programs?

The RRF program can be combined with most other SBA programs like the EIDL Loan, the Targeted EIDL grant, and the PPP. However, if you received a PPP loan, your PPP loan will be deducted from your RRF funding. If you receive an SVO grant, you won’t be eligible for the RRF.

When Will it Open for Applications?

The RRF will be open for applications beginning Monday, May 3rd at noon EDT. Applicants can pre-register for the application portal starting this Friday, April 30th, at 9 AM EDT.

Applicants will be able to apply through an online portal, via phone or via an SBA-recognized Restaurant Partner, a technology company that manages sales processes for restaurants. The application portal is currently open to a select few businesses on a pilot basis, but applications submitted during the pilot period won’t be selected for funding until the portal is open. They will just serve to help the SBA manage any technical issues with the online portal (technical issues led the SBA to shut down the application portal for the SVO program in less than a day, which the agency wants to avoid with the RRF).

Here is a list of the companies that are approved Restaurant Partners:

1) Square

2) Toast

3) Clover

4) NCR

If you already use one of the above POS software platforms for your business, you will be able to apply through them using sales and financial information already collected for you by the company.

During the first 21 days of the RRF application period, women-, veteran-, and minority-owned businesses will get priority for funding. Anyone can apply in the first 21 days, however.

What is the Application Like?

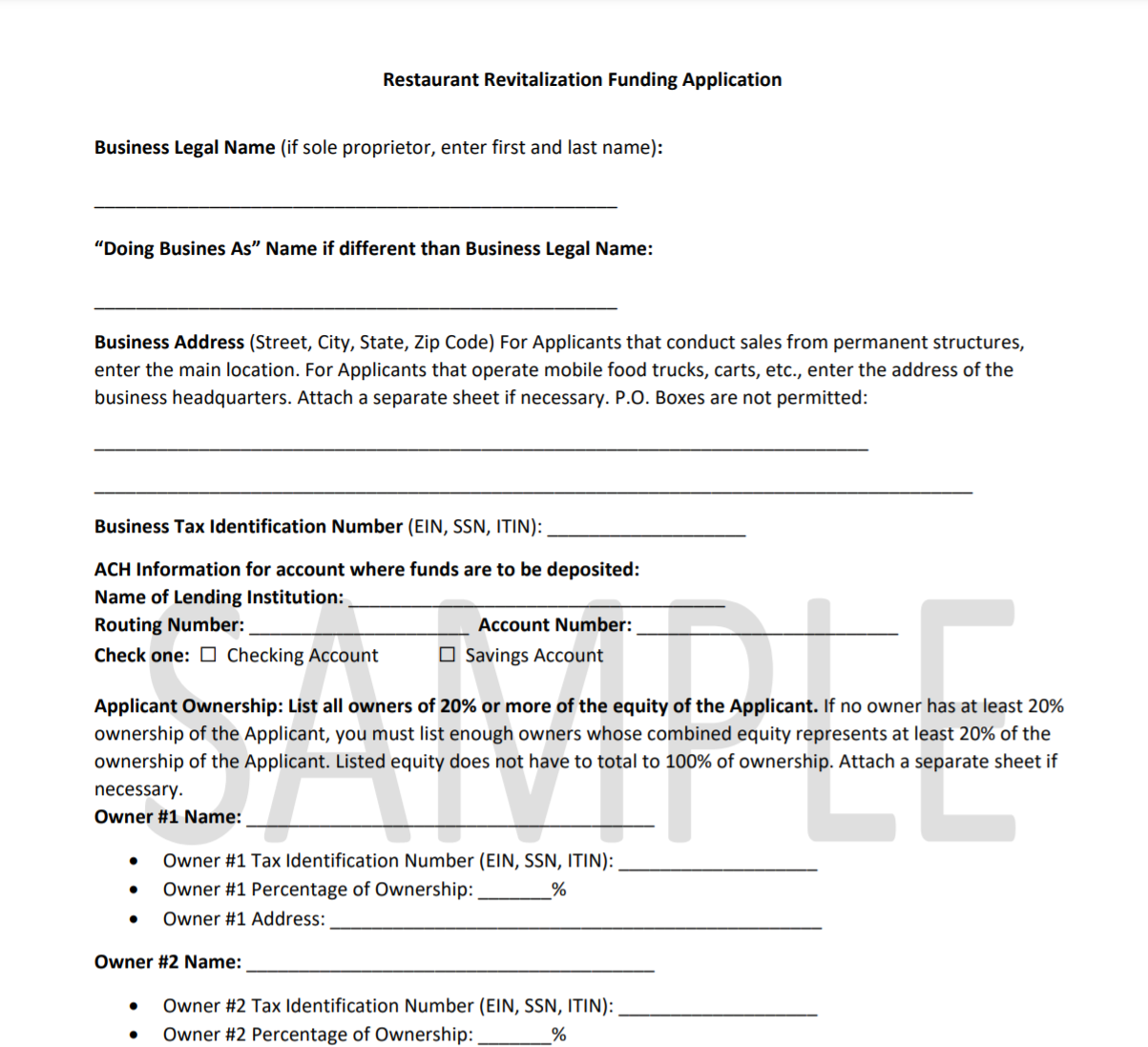

Although the RRF hasn’t opened for applications yet, the SBA has provided a sample application to the public which breaks down what will be needed to apply. The full application is twelve pages long, but we have included some screenshots below to show you what the form looks like.

You will need to provide information about your business like owners’ contact information, what type of business it is, and your tax structure (LLC, S-Corp, etc), and your funding calculations on the application. Check out the screenshots below to see what the form is like, or view the full sample application on the SBA website.

If you want to get a head start on your application, you can fill out the form now so you’ll be ready to submit it when the portal opens. In addition to the application form, you will need to provide some other financial documentation to the SBA, including bank statements, tax returns, and profit and loss statements to prove your gross receipts.

If your business is a bakery, inn, brewery, distillery or winery, you’ll also need to prove that at least 33% of your gross receipts come from onsite sales, which you can do with online forms from the Tax and Trade Bureau. If your business opened in 2020 you can show proof that your business model originally included onsite sales, even if you weren't able to offer them.

Conclusion: The RRF Will Provide Important Support for Restaurants

Restaurants and food and beverage businesses have faced a particularly challenging recovery from the pandemic, since so many precautions have to be taken to make dining out safe.

The RRF will keep these businesses from shutting down, once the program is open for applications. In the meantime, there are many other funding programs available for small business owners. There are a few options below:

📌 The SBA is now accepting requests for increased EIDL loans of up to $500,000. We released a brand new tracker yesterday for you to see how much you could receive and see progress around the U.S.

📌 We have dozens of grants and loans available in our curated database for Grants Premium users. Join nearly 100,000 others getting early access to grants and other funding opportunities.