Jerome Powell, Chairman of the Federal Reserve, recently stated that they plan to begin scaling back their low-interest policies as employment increases. The challenge facing them is deciding when the time is right, based on factors such as 'maximum employment.' Here we discuss how employment affects the interest rate, when the Fed may increase interest rates, and how it will affect you.

How Does Employment Affect Interest Rates?

The level of employment is a key factor in the Fed's decision to raise interest rates. The correlation between federal interest rates and employment is the reason Powell does not want to raise rates too soon, and risk increasing unemployment. That being said, Powell stated that rates will be raised when they determine the U.S. has reached 'maximum employment.'

Determining when the country hits 'maximum employment,' which is the unemployment rate relative to inflation, has proven to be difficult. In June, there were 10.1 million job openings across the country, which was the highest it has ever been since 2000 when record-keeping began.

Are People Seeking To Fill Job Openings?

While the unemployment rate is down to 5.4%, employers across the country are still finding it difficult to bring on new staff. Some have resorted to sign-on bonuses and other incentives to entice new workers. Others have outsourced their work to other countries as a result of labor shortages in the U.S.

The number of adults between 25 and 54 seeking employment is on the rise but is still below the pre-pandemic level. Julia Pollak, a labor economist from ZipRecruiter said “We have fewer people in the labor market now than we did before Covid."

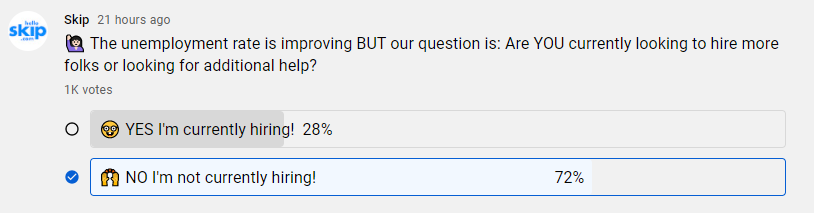

Meanwhile, other businesses do not need additional employees. We surveyed over 1,000 businesses. 72% of them said they are not hiring. Some speculate that the type of job seekers and type of job openings are not aligning in many places in the country. This could be why there is still a labor shortage overall.

When Will The Fed Raise Interest Rates?

Determining when to raise interest rates is a difficult decision that the Fed is wrestling with right now. Powell expects the U.S. to reach maximum employment by next year, but with a fluctuating labor market and the Delta variant raging through most of the county, there is no guarantee.

More money in the economy can increase demand on products, which can drive inflation--that's why choosing the right time to increase interest rates is imperative.

How Would Raising Interest Rates Affect You?

When the Fed raises the federal funds rate (the rate that banks pay to trade with Federal Reserve Banks), it directly affects the interest rates that consumers pay. It's meant to help cool down the economy, but it means the low-interest loans that businesses and home buyers enjoy will increase as well.

Simultaneously, higher interest rates can result in businesses not wanting to borrow--so fewer expansions, large purchases, and possibly hiring fewer workers.

Conclusion: Consider Borrowing Now If You Can

If you have consulted with a financial advisor or another lender, and you qualify for a loan--business or mortgage, now could be the time to borrow. This is not to be received as financial advice, but an awareness that interest rates will likely be going up in the near future. The Fed is having difficulty pinpointing when "maximum employment" will occur, but rates will increase when they make that determination.

📌 If you are a business owner and you need help with funding, join thousands of businesses that receive small business grants and loans updates, twice per week on our app, and set up your funding tracker.