Included in the stimulus package that Congress passed this week is funding for more EIDL grants for small businesses. The bill earmarked $20 billion for EIDL grants, which are grants of up to $10,000 for small businesses, alongside the $284 billion earmarked for forgivable PPP loans. The qualification rules for EIDL grants have changed in this round from the first round of EIDL grants, also known as EIDL Advances, in the CARES act. Here’s what you need to know, and check out our YouTube video below for more info. As more information becomes available from the SBA, we will update this post.

📌 Pro-Tip: For more stimulus news, EIDL news, and small business news, download our free Skip app. We will alert you to any new actions you may need to take for grants, loans, or other small business funding.

Do You Qualify for an EIDL Grant?

In the new legislation there are two ways to get EIDL grants at the moment. This is based on our initial interpretation and is subject to final SBA rules. Once the bill is signed into law, the SBA has 15 days to finalize the rules. As things change, which they are bound to, we will let you know.

1. You Didn't Receive An Original EIDL Grant

In the new legislation these are called "EIDL Grants".

As far as we can tell so far, part of the funding for EIDL Grants is available to you — $1,000 per employee — if you did not receive a grant in the first distribution. To recap, the SBA ran out of funding so they stopped giving out grants in late summer.

It is unclear whether you will have to reapply in this situation on a new form or the existing form or if the SBA will just process the applications they've already received. Once we know, we'll let you know.

2. You Are A Qualifying Business in a Low-Income Area

In the new legislation these are called "Targeted EIDL Advances"

There is a new stipulation in the legislation that will give your small business a full $10,000 EIDL grant, regardless of number of employees, if you meet the three below qualifications. Based on our initial research, many businesses may qualify under this option, so don't dismiss it before you take a look below.

Does your Business Have 300 Employees or Less?

Businesses with 300 employees or fewer are eligible for an EIDL grant under the "Targeted EIDL Advance" option.

Has your Business Experienced a 30% Loss of Income or More?

To qualify for an advance, you need to have experienced revenue losses of 30% or greater in 2020 compared to 2019. To calculate your losses, you can choose any eight-week period in 2020 and compare it to the same period in 2019. If your revenue was 30% lower or more, you'll likely meet the revenue requirement.

Are You Located in a Low-Income Community?

The hardest calculation you’ll need to make to figure out if you are eligible for an EIDL grant under the "Targeted EIDL Advance" legislation is determining whether you are located in a low-income community according to official census data and IRS rules. Only businesses located in low-income communities are eligible for grants that don’t need to be repaid, to prioritize businesses most in need. All businesses can apply for EIDL loans, which need to be repaid but have low interest rates.

Watch the video below where we explain in detail the "low-income community" then check based on your address here.

To be considered low-income, the community where your business is located must:

- Have 20% or more people living below the poverty line based on income;

- Or, have a median family income of 80% or less of your state’s statewide median family income;

- Or, have a median family income of 80% or less of your metropolitan statistical area’s median family income.

To calculate whether your business is located in a low-income area, you can use this free income lookup from FFIEC.gov. Once you put in your address, you can see the percentage of people living in poverty in your census tract and the median family income in your area as a percentage of your statewide median family income.

If you don’t qualify by either the poverty rate or statewide median income metric, look up the metropolitan statistical area your business is located in to see its median family income, and divide your community's median income by the metropolitan area’s.

We will update you as we know more about the EIDL application process and as advances begin to be distributed. Follow along with us on the Skip blog for more info and download our app for the latest updates. Check out our video below to learn more about the EIDL eligibility process.

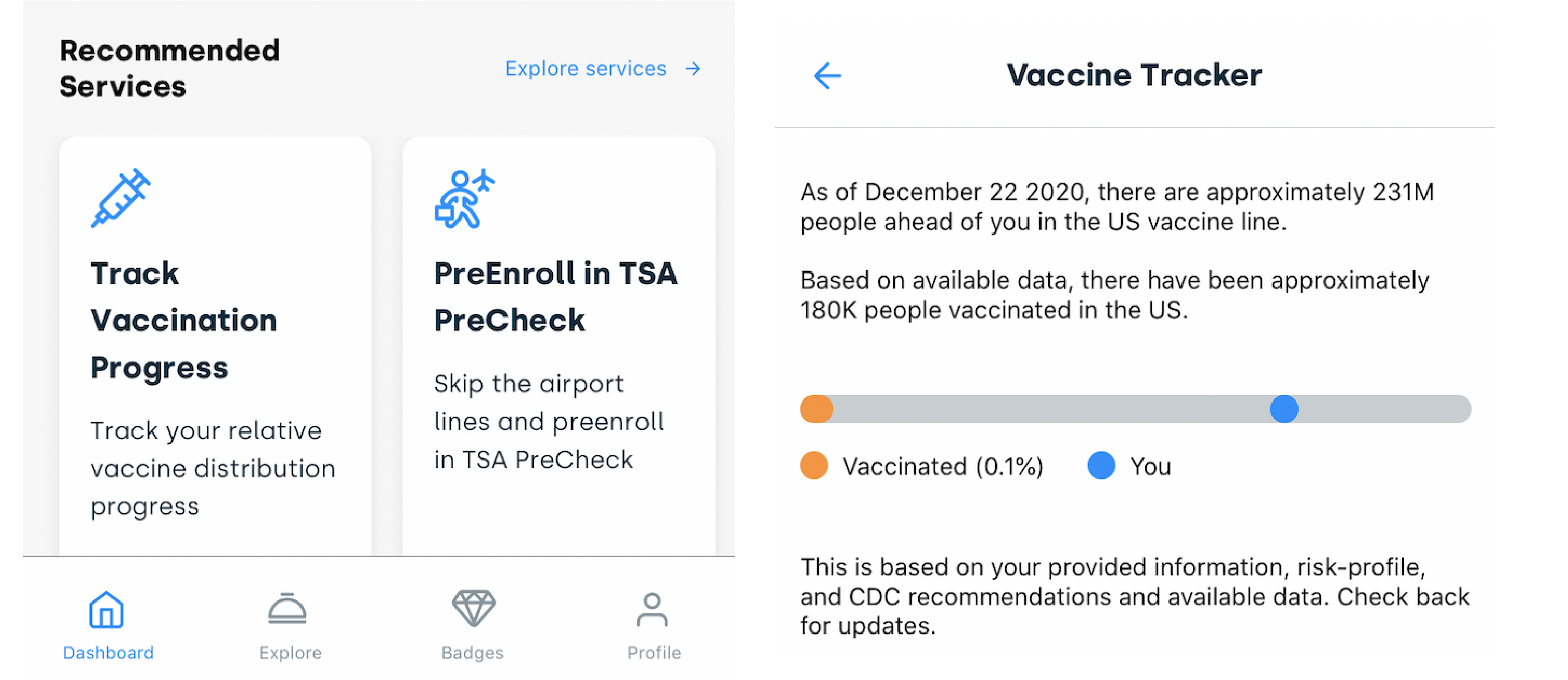

📌 Brand new from the Skip App: Track relative vaccine distribution progress.