Since December 2020, Congress has approved over $46 billion to provide rental assistance to those financially affected by the pandemic. As of today, only 10% has been distributed, leaving renters and landlords in great need. Businesses need assistance as well to cope with the many challenges the pandemic has brought. Here are some updated data.

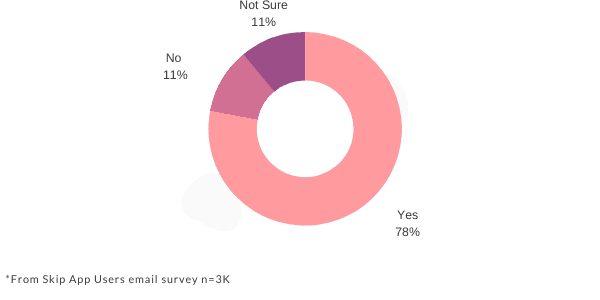

Businesses Still Need Funding

Data released yesterday shows that a majority of businesses still need assistance. 78% of businesses are looking for more funding, mostly under $100,000. Many have been waiting for months on a decision on their EIDL loan application. Others are waiting for the long-anticipated increase of the EIDL cap from $500K to $2 million, known as EIDL 2.0.

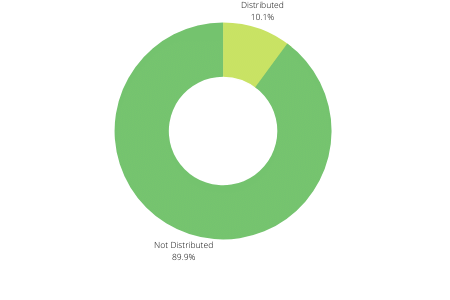

90% of Rental Assistance Pool Has Not Been Distributed

$46.6 billion was apportioned to assist tenants and landlords through the Emergency Rental Assistance (ERA) program, but new data as of Wednesday highlights key struggles for local governments and renters alike. The $46.6 billion pot is overseen by the Treasury Department. It disburses that money to landlords and renters through 450+ charitable organizations, as well as state, county, tribal, and municipal governments.

According to the Treasury Department, many state and local programs did not even begin until July 2021. As a result, only $4.7 billion of the $46.6 billion pot has gone out to help renters and landlords. In an attempt to ease the pressure, the Biden Administration extended the eviction moratorium once more until October 3, 2021.

The Biden Administration has also encouraged states to move faster in their distribution. They offered guidance to reduce documentation for renters and landlords to hasten the approval process. In addition, Wednesday, the Treasury Department eased the self-attestation requirement for tenants, quickening the initial approval.

Extended Moratorium Has Positive and Negative Consequences

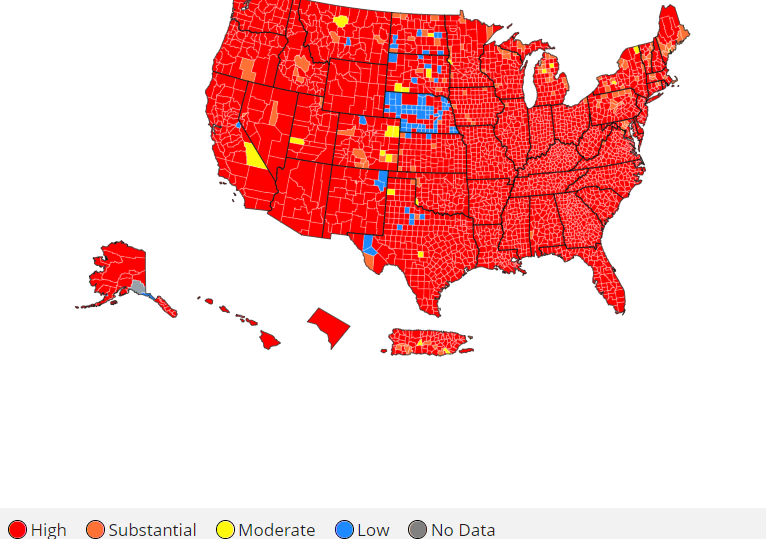

The moratorium simultaneously has positive and negative effects. The positive effect is that renters are not being evicted during a season when Delta is rapidly spreading. With millions expecting to be evicted after the moratorium expired in July, there was concern that an increase in evictions would drive an increase in Covid infections.

At the same time, the eviction ban is bad news for struggling landlords who rely on their rental income to sustain themselves. The extended moratorium only applies to areas with "substantial and high levels of community transmission" of Covid, but 96% of the country falls into that criteria. Landlords across the country cannot evict a renter for non-payment if they are given a declaration form by their renter, which threatens their financial stability.

Conclusion: Many Americans Need Help

Funding has been available for businesses, renters, and landlords, but inefficient policies at the state and federal level has stymied timely distribution. The moratorium assists tenants who are unable to pay their rent, but many landlords and businesses are still waiting for their help.

If you are a business owner and you need help with funding, join thousands of businesses that receive small business grants and loans updates, twice per week on our app, and set up your funding tracker.