Whether you have an immediate need for working capital, or you’re just starting in business, it’s not impossible to get a small business loan with bad credit—it’s just not as easy.

In this article, we’ll explain what a personal credit score is, how it's determined, how it affects your ability to access funding, what to expect when looking for loans—and what to look out for.

We’ll also briefly explain the types of loans or lines of credit available to those with bad credit—and ways to improve yours. Lastly, we’ll point you at some reputable lenders who can help you get your credit scores in order.

What is a Credit Score?

A credit score or rating is a standardized calculation of your creditworthiness. The algorithm used to determine credit scores was invented by two mathematicians—Bill Fair and Earl Isaac—who teamed up in 1950 to create their business, Fair Isaac & Co., now known as FICO.

The FICO credit score is considered the industry standard for determining personal creditworthiness, based upon these factors, in descending order of importance:

- Payment history

- Amounts currently owed

- Length of credit

- Types of credit

- Recent credit card inquiries

What is a Credit Rating?

Credit scores and credit ratings are similar in that they both judge creditworthiness. However, a credit rating is specific to businesses and measures a business’s ability to meet its financial obligations, like payroll, vendors, rent, and others.

Many businesses just starting, e.g. in business under a year, won’t have a business credit rating. This is when lenders will look at your personal credit score to determine your eligibility.

What is a Bad Credit Score?

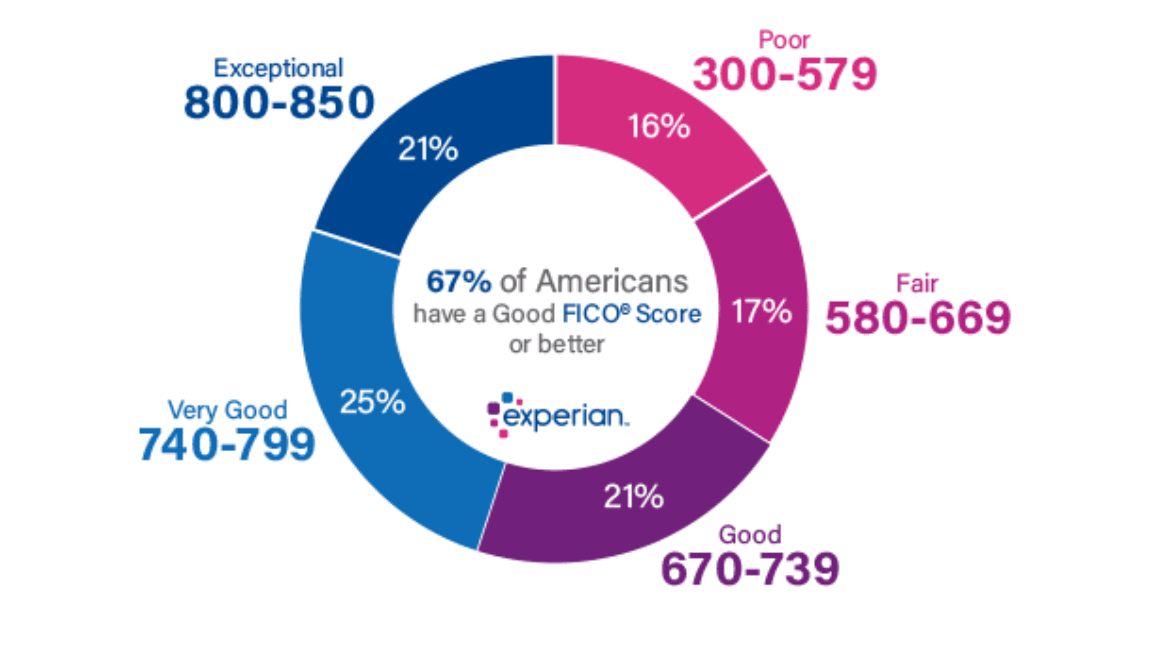

There are five categories for ranking personal credit scores, from Poor to Excellent.

If your credit falls below the 579 mark, you’re considered a poor credit risk. Meaning, banks, and other creditors may not approve your application or may require collateral, or co-signature with any funding, sometimes at exorbitant interest rates and risky terms.

Personal Credit Score Categories

- Poor: 300 and 579

- Fair: 580 - 669

- Good: 670-739

- Very Good: 749 - 799

- Excellent: 800 to 850

How are Credit Scores Calculated?

The FICO algorithm takes your payment history, e.g. payments made to any creditor in the past, as well as any missed or late payments, any defaults on loans, bankruptcies, or other debt collection issues. It accounts for how late your payments were, how often you missed them, and how many of your accounts are delinquent.

All this data is then weighed against your current debt load, e.g. what you currently owe any lenders or creditors.

Next, the length of time you’ve held credit will impact your score. If you’ve recently applied for new credit, this may reduce the overall age of credit because it averages all of your credit or lending accounts. A longer history of credit is a positive factor for your credit score.

Lenders also look at the diversity of your credit and factors in the types of credit you hold. Meaning a mixture of installment loans—home mortgages or equity, auto, and student loans, or revolving credit accounts, such as credit cards.

Lastly, hard inquiries, the type made by creditors after you apply for credit, and their frequency will sometimes adversely affect your credit score.

How Does a Bad Credit Score Affect Your Ability to Borrow?

A Poor or Fair credit score may indicate a history of poor money management, making it riskier for lenders or creditors to extend credit. If your credit score falls within these categories, you’ll be facing less attractive terms on loans than someone with a higher rating. Here’s an example of just how much your bad credit score might be costing you.

Two different tradespeople are applying for a 30-year commercial real estate loan to purchase properties for their respective cabinet-making businesses.

- Tradesperson 1 has a credit score of 760 (Excellent) and obtains a loan for $250K, with terms of 0.27% APR, and a monthly payment of $1,197.

This applicant will pay $181K in interest over the timeline of the loan

- Tradesperson 2 has a credit score of 625 (Fair). To obtain the same loan, this cabinet maker will pay an APR of 6.16%, with a monthly payment of $1,438.

Due to his Fair credit score, this cabinet maker will end up paying $268K in interest, or $86K more over the lifespan of the loan.

How Can You Improve Your Credit–and Your Chances for a Business Loan?

Don’t despair, there are still ways to obtain credit, and improve your credit score—sometimes at the same time. Here’s where to start.

Check Your Credit Score

The first thing you should do is check your credit score. Knowing your credit score is the first step in understanding the types of credit you’re eligible for. There are plenty of free credit score sites, be sure to look for both your Experian and TransUnion scores. If there are discrepancies or errors, contact the creditor to correct them.

Write a Business Plan

Never a bad idea when starting a business, a business plan provides the “road map” for a lender to evaluate your business. A well-prepared business plan with financial projections will go a long way to proving your creditworthiness—especially if you have less than enviable credit.

Do Your Research

Once you have your credit score in hand, you can begin looking for credit opportunities and loans that match your credit score borrowing capabilities.

Get a Co-Signer

If you have a trusted friend or family member with a good credit score, they may be able to cosign a loan for you. However, the downside is if your business fails, your co-signer, who is essentially guaranteeing the loan, is now responsible for its repayment.

Use Collateral

Most people think using their homes is the best way to secure capital. In business, it’s not. Moreover, it’s risky. Using your home as a guarantee of loan repayment could mean losing both your home and your business. Better to find a loan that allows you to use business assets or outstanding receivables as collateral.

What are the Best Loans for Businesses with Bad Credit?

Business Credit Cards

Using a business credit card is a fast and easy way to access capital, while improving your credit score (if payments are made on time).

Moreover, business credit cards are not difficult to obtain, but this ease of access to capital comes with a higher price in the way of interest rates and terms.

If you’re a small business in need of short-term access to credit—and you can pay your bills in timely fashion—a business credit card is a good place to begin.

Personal Debit Cards that Act Like Credit Cards

There are personal debit cards that behave like credit cards. Meaning, the debit card is still tied to a checking account, with spending limits, but every time you use it the issuer "spots" you the money, then repays themselves the next day.

A monthly calculation of all your purchases are reported to the credit bureaus as "creditworthy" purchases.

Short-term Business Loan

A term loan can be as short as 6 or 12 months. Like a mortgage, term loans operate on structured repayment periods and amounts and can provide better interest rates and borrowing terms.

Short-term Line of Credit

A small business line of credit is similar to a short-term loan. It is designed to help meet the immediate needs of a business’s day-to-day operations and increase cash flow. Moreover, you only pay interest on borrowed money. A small business line of credit allows you to re-borrow any repaid portion, up to your credit limit and until the draw period concludes.

Merchant Cash Advance (MCA) Business Loans

A merchant cash advance loan is paid in a lump sum. They differ from other small business loans in that their repayment schedule is based upon a percentage of monthly credit card earnings. Such easy access to immediate working capital makes MCAs more expensive than other types of small business loans. They may also add risk, and only offer a short-term solution for your business.

What’s the Right Loan Type for My Business?

Once you have a realistic set of objectives and a clear understanding of your business goals, you’ll be able to base your decision on which type of small business loan, and lender, is right for you. With a plethora of lending options and historically low interest rates, now’s a terrific time to fund your small business.

Funding Circle and Fora Financial are online lenders that offer a variety of options. Online lenders are often able to fund business loans quicker than traditional lenders can, which makes them attractive options for businesses that need capital fast.

Need Help With Business Funding?

Do you have other questions about your business, such as EIDL applications, SBA loans, or other business funding questions? Get ongoing personalized funding help from our team. Join Skip Premium today and get 1-1 support.