You may decide to incorporate your small business for a number of reasons — limited liability protection and fundraising capabilities are just a few. However, there are downsides to incorporating, namely, shareholder's exposure to double taxation. One way to avoid this is to file IRS Form 2553 to become an S-corporation.

In this article, we explain what IRS Form 2553 is about, who is eligible to file, and how to complete the form. We also briefly explain what an S-corp is, so you can decide if this is right for your business or not.

What is IRS Form 2553?

IRS Form 2553 is used by C corporations or limited liability companies (LLCs) who choose to be taxed as an S corporation. By doing so, companies may be able to save money on taxes because S corporations are not liable for corporate tax.

To effect this change, companies must file IRS Form 2553, but not every company is eligible (more on that in a moment).

What is an S Corporation?

C corporation shareholders are subject to double taxation. First, the company itself pays corporate taxes (the current tax rate is 21%). Then, the shareholders pay taxes from the income and/or dividends they receive from the corporation.

S corporations are considered pass-through entities. This means that instead of the business paying corporate tax, the income of the business is passed through directly to the shareholders and is recorded on their personal income tax.

There are some instances where S corporations will still owe tax, but for the most part, the income tax is passed on to the shareholders. Additionally, S-corps are taxed differently at the state level, so it may or may not save you money on taxes.

Sole proprietorships and general partnerships are considered pass-through entities by default. LLCs have the option of being taxed as a corporation or a pass-through entity.

Who is Eligible to File IRS Form 2553?

C corporations can file Form 2553. LLCs can as well, but there is no incentive as LLCs are pass-through entities by default. Unless you want your LLC to be taxed as a corporation, you would not need to file IRS Form 2553.

According to the IRS, a corporation or other entity may file Form 2553 if they meet all of the following requirements:

- It is a domestic entity

- It has no more than 100 shareholders (individuals and their spouses and estates can be considered one shareholder for this – and related family members can be considered one shareholder)

- The shareholders are individuals, estates, exempt organizations (non-profits), and certain trusts

- All shareholders are U.S. citizens or residents

- The company only has one class of stock

- The company is not a bank, thrift institution, insurance company, or domestic international sales corporation (DISC) – for the most part

- The entity adopts a tax year that ends on December 31st or another eligible tax year

- All Shareholders consent to be taxed as an S-corp

When is the IRS Form 2553 Filing Deadline?

If you (and all of the shareholders) choose to be taxed as an S-corp by filing Form 2553, it must be done by one of the following dates:

- Two months and 15 days after the beginning of the tax year – for same year filing

- During the year prior to when you want the change to occur. For example, if you want the change to take effect in 2023, you have all of 2022 to file – if your tax year ends on December 31st.

Procedure for Late Filing

If you miss the aforementioned deadlines, your filing will go into effect the following year. However, the IRS may accept your late filing if all of the following are true:

- Your company intended to file Form 2553

- There is “reasonable cause” for missing the deadline and the company acted quickly to rectify the cause for the delay

- The company acted like an S-corporation (taxable income passed to shareholders) for the year requesting S-corp taxation status and provide statements from shareholders attesting to it

If your company meets these requirements, you must write “FILED PURSUANT TO REV. PROC. 2013-30” on the top of Form 2553.

If you are filing IRS Form 2553 with Form 1120-S (S-corporation tax form) then you must also write “INCLUDES LATE ELECTION(S) FILED PURSUANT TO REV. PROC. 2013-30” on top of Form 1120-S.

How Do You Complete IRS Form 2553?

IRS Form 2553 is a four-page document and it may take some time to complete – mostly because every shareholder must sign it and describe their ownership percentage. The following are step-by-step instructions for filling out IRS Form 2553.

Part I: Election Information

Part one of the form requires information about the corporation and the tax year that the election should take place. The first several sections ask for the entity name, address, Employer Identification Number (EIN), date of incorporation, and the state of incorporation.

Select the appropriate box in section D if you changed your name or address after filing for an EIN.

Box E is where you will indicate when the election is to begin (January 1 or the first day of your tax year). Box F is where you indicate your tax year either as a traditional calendar year or another accounting period. If you have more than 100 signatures but not more than 100 shareholders then select the box in section G.

Write the main contact officer for the corporation in section H. Section I is where you would write your explanation for why the submission of Form 2553 is late. If you are filing on time, you can disregard this section. Then, sign and date at the bottom.

On page two, finish this section by having every shareholder write down their name, address, social security number, stock ownership information, their tax year-end date, and be sure they all sign it. Make as many copies of page two as you need.

Part II: Selection of Fiscal Tax Year

The fiscal year for a majority of companies is the calendar year – January 1st through December 31st. A fiscal year – or tax year – is a 12-month period used for tax purposes and financial reporting.

If your fiscal year is the calendar year – January 1st through December 31st – then you can skip Part II. If it is not (and you selected box 2 or 4 in section F of Part I) then you will need to complete Part II. Here are the other types of fiscal years that you can select in Part II:

- Natural business year. This means that you elect to have a tax year based on your business revenue. For example, some businesses may elect to have a fiscal year from April 1st through March 31st because winter is a very slow season. The IRS must approve this.

- Ownership business year. This means that a majority of shareholders in the company prefer the fiscal year to be different than the calendar year. Again, the IRS must approve.

- Business purpose. There may be another business reason that you want your fiscal year to be different from the calendar year.

- Section 444 election. Under section 444 of the tax code, businesses can choose their fiscal year if they make periodic tax payments throughout the year.

Part III: Qualified Subchapter S Trust Election

Part III is not going to pertain to most business owners. If you have a Qualified Subchapter S Trust (QSST) that wants to have stock in your S-corp, it will need to fill this section out. If you don’t have one – or don’t know what it is – then you can disregard this part.

Part IV: Late Corporate Classification Election

This part only applies to you if you are filing your application after the deadline (which is two months and 15 days after the beginning of the tax year). You need to explain the reason for the late filing either in an attachment or in Part I.

Where Do You Submit IRS Form 2553?

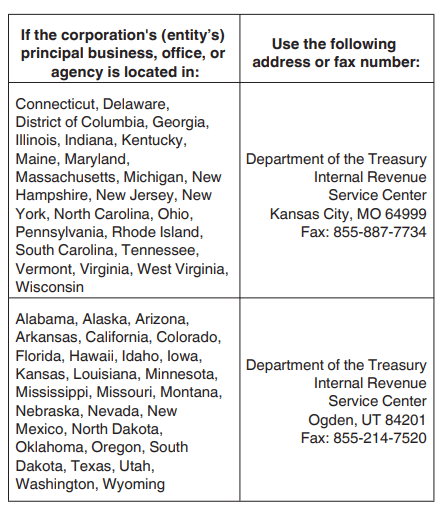

Unlike many IRS forms, Form 2553 cannot be filed online. You can either mail in the original signed form or fax the form to the IRS. Use the graph below to determine which IRS location to send your form to.

Need Help With IRS Form 2553?

Do you need help with this form or getting funding for your business – with SBA loans, grants, or other business financing options? Get ongoing personalized help from our team. Join Skip Premium today and get 1-1 support for your business.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.