America is witnessing the largest number of people becoming entrepreneurs and small business owners in over a decade. Deciding how to structure yours should be a top consideration. If you are new to small business, it’s important to understand how an LLC, a Corporation, and a Partnership differ, so you can structure your business to fit your needs and future goals.

In this article, we explain what LLCs, Corporations, and Partnerships are and discuss the pros and cons of each.

What is a Limited Liability Company (LLC)?

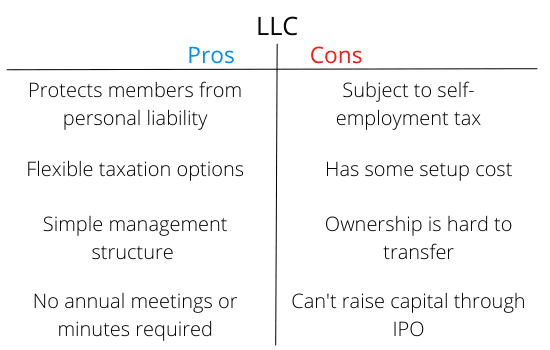

A Limited Liability Company (LLC) tells you in its name—your “liability is limited.” It’s a hybrid legal entity that combines the simplicity of a Sole Proprietorship with the liability protections and tax benefits afforded Corporations. One of the most compelling reasons to form an LLC is to protect the owners, known as members, from personal liability, including debt from the business.

Members form an LLC through an Operating Agreement, which outlines ownership percentages, responsibilities, and profit distribution for each member. LLCs allow for an unlimited number of members. They also have less formalized reporting and management requirements than Corporations.

Besides liability protection, an LLC also offers flexible tax advantages, like pass-through taxation. The company's income and expenses are passed to the members and accounted for on their personal tax returns. LLC members pay taxes only on their profits. LLCs can also choose to be taxed as Corporations or S-Corporations.

Is an LLC Right for My Business?

If you are looking for liability protection and flexible taxation options, an LLC might be a good fit for your business. Aside from some setup costs, self-employment taxes, and compliance requirements, there are very few downsides to forming an LLC.

What is a Corporation?

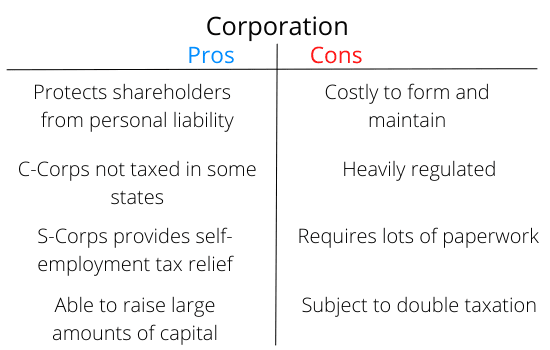

A corporation, also a legal entity, generally consists of a group of shareholders (or stockholders) who remain separate from the business for taxation and liability purposes. There are several types of corporations, the most common being C corporations (C-corps) and S Corporations (S-corps).

Stockholders share ownership in the company through their holdings but are generally not involved in its daily operations. In the U.S., corporations are regulated by the Securities and Exchange Commission (SEC). Like an LLC, a corporation offers limited liability protection against shareholders’ personal assets.

How do they differ from LLCs? For starters, a corporation can issue stock to raise capital. When this occurs for the first time, it's called an Initial Public Offering (IPO). Corporations that reach IPO (also called "going public") can raise large sums of money in exchange for equity in the company.

Additionally, while laws vary from state to state, most require corporations to file Articles of Incorporation, hold annual meetings, meet annual reporting requirements, and elect a Board of Directors (BOD). The BOD is then responsible for hiring a senior management team that manages the day-to-day operations.

How are S Corps and C Corps Different?

An S-corp offers the benefit of pass-through taxation to its shareholders but caps participation at 100 and stock is limited to one class only. C-corps can also offer unlimited membership and multiple stock classifications. C-corps pay their own taxes (corporate tax). Shareholders then pay taxes on their dividends — which leads to double taxation.

Is Incorporating Right for My Business?

Setting up a corporation is an expensive undertaking. Its biggest advantage is the ability to raise capital if you plan to take your company public. It also shields shareholders from personal liability.

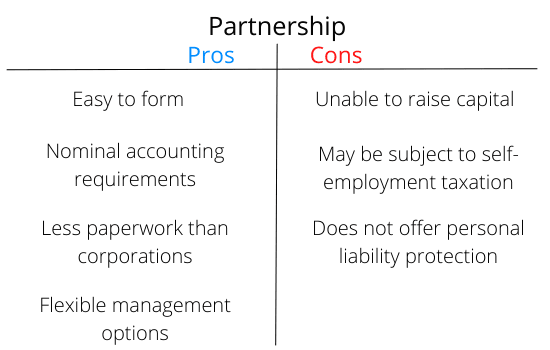

What is a Partnership?

A Partnership is a business relationship between two or more people. Each partner contributes and shares in the profit, risk, liability, and losses. There are two types of partnerships:

- General Partners (GP). GPs participate in the day-to-day operations of the business and are liable for partnership debts.

- Limited Partners (LP). LPs are typically investors who have no involvement in the day-to-day operation of the business — or liability. They simply offer financial assistance.

Compared to LLCs and corporations, partnerships are relatively easy to create. Each state varies, but generally, partnerships do not require any business filings or registrations, unless it's a Limited Liability Partnership (LLP).

Where a corporation issues stocks or shares, a partnership shares its equity, profits, and losses based on the partner’s percentage of ownership. There are no stocks or shares. At tax time, partners file a Schedule k-1 form with their personal income tax returns showing their share of profits or losses.

Is a Partnership Right for My Business?

If a hassle-free business model is your fit, a Partnership offers a simple way to go into business. Bear in mind, the biggest caveat to forming a Partnership is your exposure to liability.

What’s the Best Type of Business Entity for You?

Whether you are a sole proprietor looking to switch to an LLC or are starting a business for the first time, an LLC offers you a lot of advantages over other business structures. Ultimately, your business structure should be based on your long-term goals. Here are some final points to consider.

- LLC: If you’re looking for simplified taxation and liability protection, an LLC is most likely your best option.

- Corporation: If lowering your tax rate tops your list and you don’t mind a few mounds of red tape, a corporation lets you raise capital through IPO and other stock offerings.

- Partnerships: This is the most hassle-free type of business to start, presenting an equitable option for those willing to put skin in the game.

Get Ongoing Help For Your Business

Do you need help getting funding for your business? We can help you with SBA loans, grants, or other business financing options. Get ongoing personalized help from our team. Join Skip Premium today and get 1-1 support for your business.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.