With the recent surge in defaults on Small Business Administration (SBA) Economic Injury Disaster Loans (EIDL), it's crucial for borrowers to understand what happens when they default, the implications of being sent to the Treasury department, and their available options. This post aims to provide a concise guide for those facing such challenges.

What Happens When You Default on an EIDL Loan?

Immediate Consequences

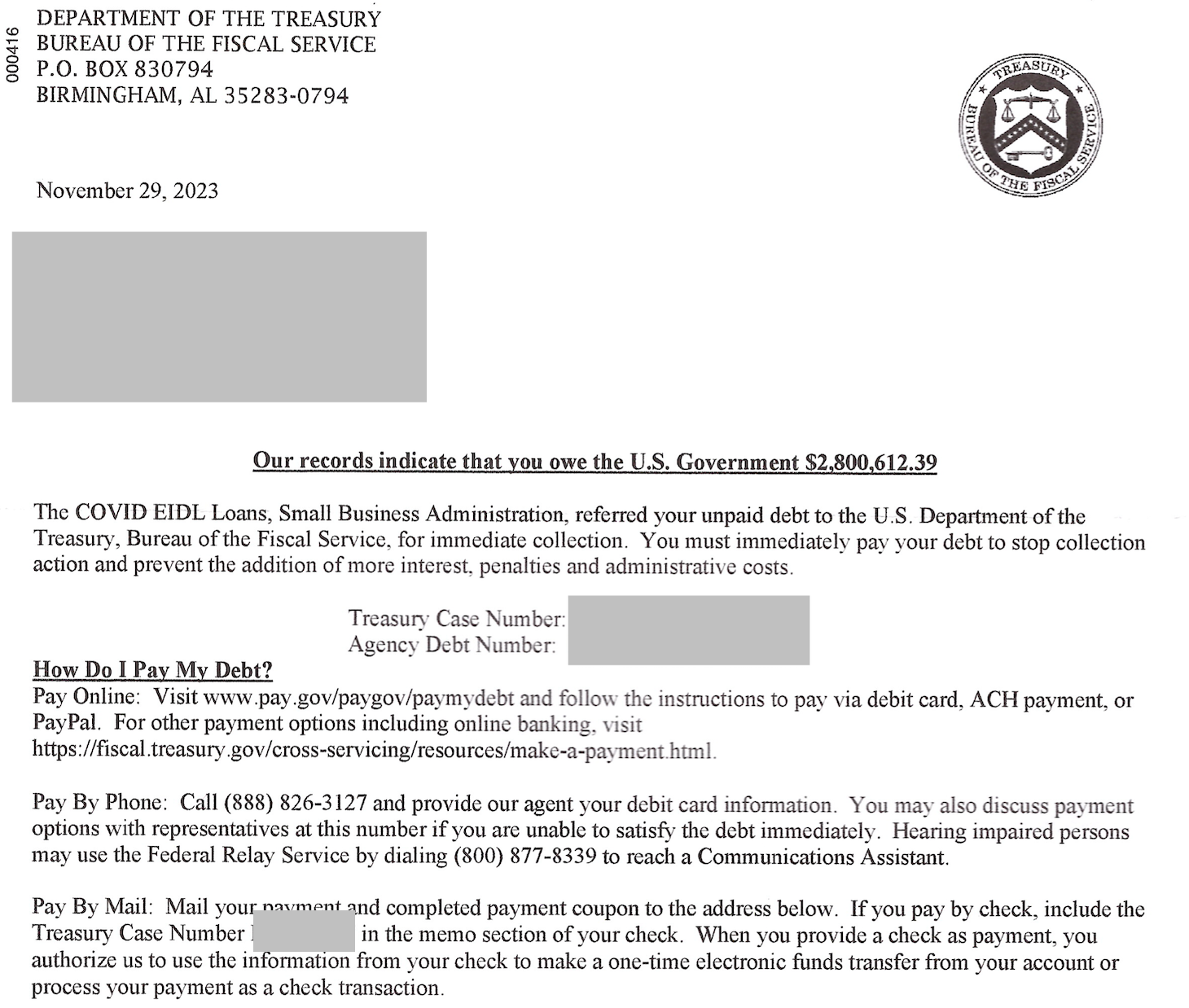

- Sent to Treasury Department: If your EIDL loan default is escalated, the debt is transferred to the Treasury Department. See below image of a letter you may then receive from the Treasury

- Increased Debt: Once with the Treasury, expect a 30% increase in your loan balance.

Long-term Repercussions

- Wage Garnishment and More: The Treasury has the authority to garnish wages, seize tax refunds, extract funds from bank accounts, and even initiate lawsuits.

- Personal Liability: For loans under $200,000, there's generally no personal guarantee required. However, if you're a sole proprietor, the lack of legal separation between you and your business could make you personally liable, regardless of the loan amount.

Your Options Post-Default

Dispute and Reversal

- Dispute Filing: You can file a dispute to have your case reconsidered and potentially sent back to the SBA. If you're interested in talking with us or getting a template you can use, book a call with Skip here.

Relief Measures

- Hardship Accommodation: Hardship Accommodation is available for up to 2 years for borrowers. Here's how it works. For continued Hardship Accommodation, some borrowers with loans under $200,000 are receiving a third 10% hardship accommodation, though this seems to be granted randomly.

Considering Bankruptcy

- Bankruptcy as an Option: For some, filing for bankruptcy might be a viable solution. This option can allow you to retain certain personal and business assets depending on your situation and how your bankruptcy is structured.

Additional Resources

- Informative Articles: For more detailed information and guidance, visit the Skip Dashboard to chat with Skip AI or get further information, including recommendations to attorneys that can help.

Conclusion

Defaulting on an SBA EIDL loan can have serious consequences, but understanding your options can significantly mitigate these impacts. Whether it’s disputing the default, negotiating accommodations, or considering bankruptcy, it’s important to stay informed and proactive. Keep an eye out for the dispute letter template and continually educate yourself through reliable sources.

Disclaimer: This blog post is for informational purposes only and should not be considered legal or financial advice. Always consult with a financial advisor or attorney for personalized guidance.