When it's time to file your small business or self-employed taxes, understanding the difference between a tax deduction and a tax credit is crucial to maximizing your tax advantages in 2023. In this article, we define what tax deductions and tax credits are, explain the difference between the two, and provide several deductions and credits your small business may qualify for.

📌 This is for informational purposes and not tax advice. Consult with a CPA or account for your specific situation

What is the Difference Between Tax Deductions and Tax Credits?

Both tax deductions and tax credits can lower your tax bill — but understanding their differences is critical. There are many other tax credits and deductions besides the ones we outline below, so check with your tax professional to see which other ones you may qualify for.

- Tax Deductions: Tax deductions reduce how much of your reported income is subject to taxation. A home office is a common example of a tax deduction. If you work from home, you can deduct a portion of its expense, if not all, as a tax deduction to lower your tax bill.

- Tax Credits: Tax credits directly reduce the amount of taxes you may owe. For example, if you have a $2,500 tax credit, such as the Child Tax Credit, your taxes are reduced by $2,500. This is a common example of a credit that can help ease your tax burden.

What Tax Deductions Can I Claim for 2023?

Now that you have a basic understanding of the difference between deductions and credits, here are four major deductions you could take advantage of when filing your business taxes in 2023.

Mileage Deduction. If you use a personal vehicle for your business, you can deduct 56 cents per mile when using it for business purposes. For drive share or food delivery drivers this can be a large deduction. Be sure to keep track of the mileage just in case you are audited.

Self-Employment Tax. Self-employment tax is currently 15.3%. There is some good news though — you can deduct half of your self-employment tax on your income tax returns. For example, if you owe $3K after completing your Schedule C deductions, you can take a $1.5K deduction on your IRS Form 1040.

Office Supplies / Phone and Internet Usage. Office supplies and materials are 100% deductible. However, don’t get carried away — these items need to be used solely for business purposes.

Moreover, you cannot deduct 100% of your cell phone if you use it for personal and business purposes — you can only deduct a portion. If you want to deduct these expenses, keep track of what percentage are used for personal and business use. The IRS has not given any clear instructions on what percentage is deductible.

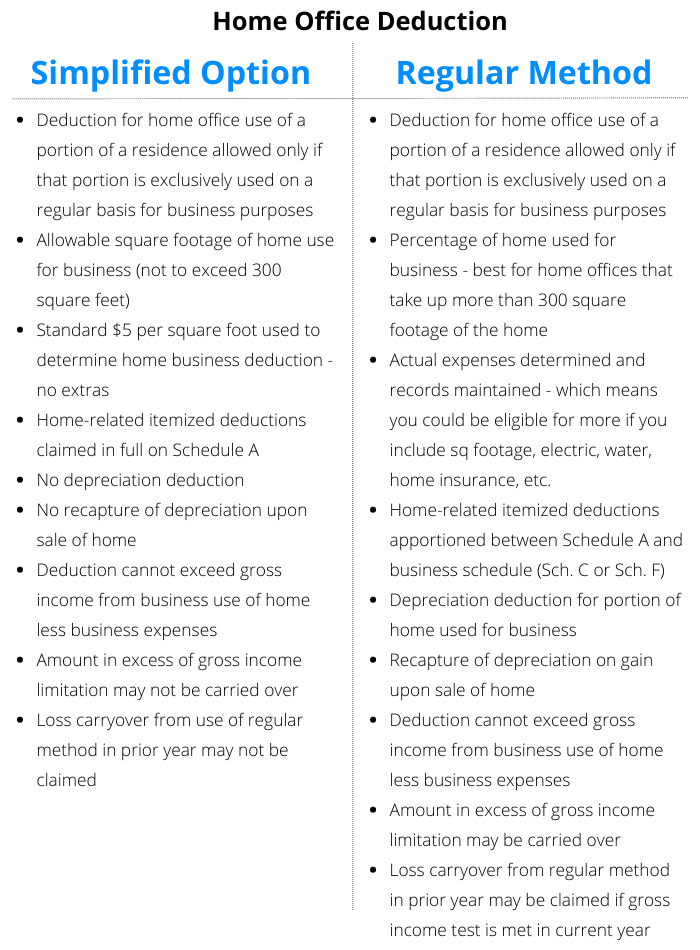

Home Office Deduction: If you perform a majority of your work at home, you are eligible for the Home Office Deduction. There are two formulas used to calculate this deduction — the Simplified Option or the Regular Method. You must choose one.

Be aware, you may not change the calculation method should you need to amend your returns for any reason. Ensure you or your tax professional understands the differences and advantages of using either of these calculations when filing your small business taxes this year.

What Tax Credits Can I Claim for 2023?

Here are three tax credits your small business could take advantage of in 2023.

Retirement Accounts. As a self-employed person or small business owner, you don't have access to a pension, so, the IRS provides a tax credit for individuals investing in a solo 401(k) or Simplified Employee Pension (SEP) for their retirement.

If your income isn’t too high and you put money into a 401(k) or SEP account, you qualify for the “Saver's Credit.” The IRS allows you to deduct up to $1K on your tax bill, and up to $2K for married couples.

The credit is calculated by the amount you contribute to your retirement, e.g. 50%, 20%, or 10% depending on your adjusted gross income (AGI). For the 2021 tax year, you are not eligible for this credit if your AGI is over $33K, or $66K for joint filers.

Covid-19-Related Sick and Family Leave Credits. If you were unable to work between January 1 and September 20, 2021, for any of these Covid-19-related reasons, you could qualify for this tax credit.

- You or someone you were caring for was subject to a federal, state, or local quarantine or isolation order.

- You or someone you were caring for was advised by a health care provider to self-quarantine.

- You were experiencing symptoms and seeking a medical diagnosis.

- You were exposed or were waiting for results of a test or diagnosis.

- You were getting a vaccination or taking someone else to get one.

- You or someone you were caring for was recovering from an injury, disability, illness, or condition related to the vaccination.

- You provided care to a son or daughter whose school or place of care was closed, or whose childcare provider was unavailable.

Eligibility for the credit depends on several factors, including the reason for missing work, the dates when you missed work, and the duration of your absence from work. Use IRS Form 7202 to calculate this tax credit.

Employee Retention Credit. If your small business has employees, this tax credit can also help alleviate some of your owed taxes. If you had to fully or partially suspend operations due to Covid-19, you could receive up to half the amount of the wages, and employee health plan costs, per worker. The maximum credit is $10K per worker. Want to check to see if you're eligible for the Employee Retention Credit — check here.

Get Your Taxes in Shape with Good Bookkeeping

Whether you're new to business or have been in business for years, now's a good time to align with a reputable bookkeeping service. We've partnered with Bench and QuickBooks to get your books and taxes in top shape.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.