Hiring help? One of the first decisions you'll make is whether to bring on a W2 employee or a 1099 contractor. Both have advantages, and limitations, depending on your goals, budget, and how your business operates.

Here’s what you need to know to choose the right fit.

Related Posts:

What is a W2 Employee?

W2 employees are hired directly by your business. You control how and when they work, and you’re responsible for benefits, payroll taxes, and compliance with labor laws.

Pros of W2 Employees:

- Stronger commitment: often more invested in your company’s mission

- More control: you set expectations, processes, and schedules

- Easier to build a team culture: especially for in-person work

Cons of W2 Employees:

- Higher cost: includes taxes, benefits, and insurance

- More time-consuming: onboarding and training required

- More legal obligations: must follow employment laws and HR policies

What is a 1099 Contractor?

1099 contractors (or freelancers) are self-employed individuals hired to complete specific tasks or projects. They work independently, often for multiple clients, and are not subject to your business’s daily oversight.

Pros of 1099 Contractors:

- Specialized skills: great for expert tasks like design, writing, or coding

- No training needed: they’re ready to start immediately

- Cost-effective: no benefits or payroll taxes required

Cons of 1099 Contractors:

- Less stability: may not stick around long-term

- Weaker team connection: especially if remote

- Limited control: can’t dictate how or when the work is done

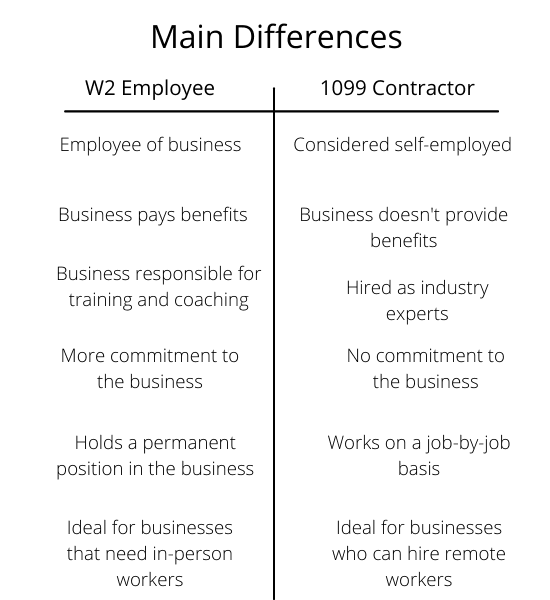

What are the Main Differences?

Both W2 employees and 1099 contractors can accomplish the task you need completed (in many cases). Here is a quick break down of the main differences.

Which One is Right for You?

Choose a W2 employee if:

- You want consistent availability and in-person support

- You’re building a long-term team culture

- The role requires set hours or physical presence

Choose a 1099 contractor if:

- The work is project-based or remote

- You want to save on benefits and overhead

- You need fast, specialized help

Tip: Misclassifying a worker can lead to penalties. Make sure the role fits the contractor definition if using a 1099.

Need Help Hiring or Growing Your Business?

Skip can help with everything from funding to building.

- Create a website using Skip's Instant Website builder

- Get a Business Plan Instantly

- Book a 1-on-1 call with a Skip expert