Although cases are slowing slightly, COVID-19 continues to spread at high rates around the U.S., threatening lives—and the recovery of the economy. This week, a survey by the National Association of Business Economics found that 80% of economists believe that there is a 1 in 4 chance of the U.S. entering a double dip recession, a rare but worrisome economic phenomenon where the economy recovers briefly and then dips again. Read on to learn about what a double dip recession means, why the virus could cause one, and what you should do to prepare yourself financially.

What is a Double Dip — W Shaped — Recession?

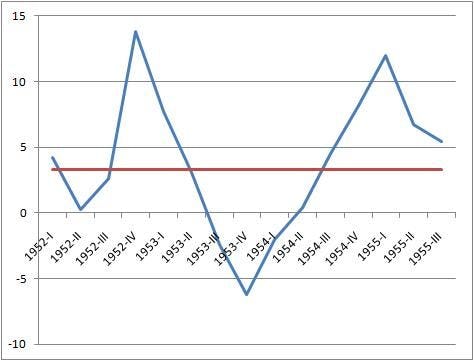

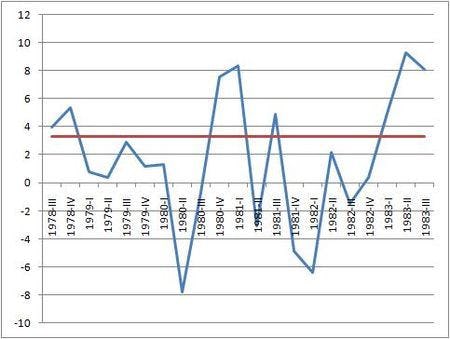

Most recessions are shaped like V’s—the economy crashes and then recovers. But occasionally, the economy recovers only slightly and then crashes again. Those recessions, called “double dip recessions” are shaped like a W, and they are much harder to recover from. It takes longer for the economy to return to normal when it has crashed twice. Usually, double dip recessions are caused when government aid, like the CARES Act, helps to alleviate the economic impacts of a major event, but when the aid runs out the economy dips again.

W-shaped recessions also sometimes occur with long-term, difficult to predict events, like the spread of a virus. If COVID-19 cases spike and cities are forced back into lockdown, the result could be another dip in the economy.

Why Might Coronavirus Cause a Double Dip Recession?

The CARES Act and the stimulus checks provided to eligible Americans helped alleviate the economic pressure from the COVID-19 crisis. Although unemployment remains extremely high, U.S. jobs and the stock market are slowly returning.

But as the virus continues to spread around the U.S. and Congress struggles to come to an agreement on a second stimulus bill, the economy may dip again. Some economists are estimating a second crash could happen this fall, as schools return to session and some areas experience increased cases.

40% of the economists surveyed said that the first stimulus package was insufficient, leaving the country vulnerable to the economic impacts of the pandemic, and over half (52%) noted that the next stimulus package would need to be at least $1.5 trillion to prevent a second dip.

How Can You Prepare for A Double Dip Recession?

Hopefully, the next stimulus package will prevent the U.S. economy from entering free fall once again. But since it’s a possibility, you should do everything you can to prepare for that reality. Here are some tips to help you prep for a second crash:

- Pandemic proof your credit cards by reducing annual fees, switching to cash rewards cards and spending responsibly on your cards.

- Create a thoughtful budget that will help you figure out where you can reduce spending.

- Find one major expense that you can cut out, like a vehicle, and put the money you save into an emergency fund. Economists recommend having enough money in savings to be able to cover your expenses for 3-6 months.

- Consider using referral programs to make some extra cash without having to add a second job into your schedule.

Ideally, the U.S. will avoid a second economic crash and the economy will continue to recover slowly. But whatever happens, we are happy to help out here at Skip. Feel free to reach out to us with any questions you might have about government loans, unemployment, relief programs and other financial needs.

Related Articles to Read

📌 Check unemployment progress in your State by Skip