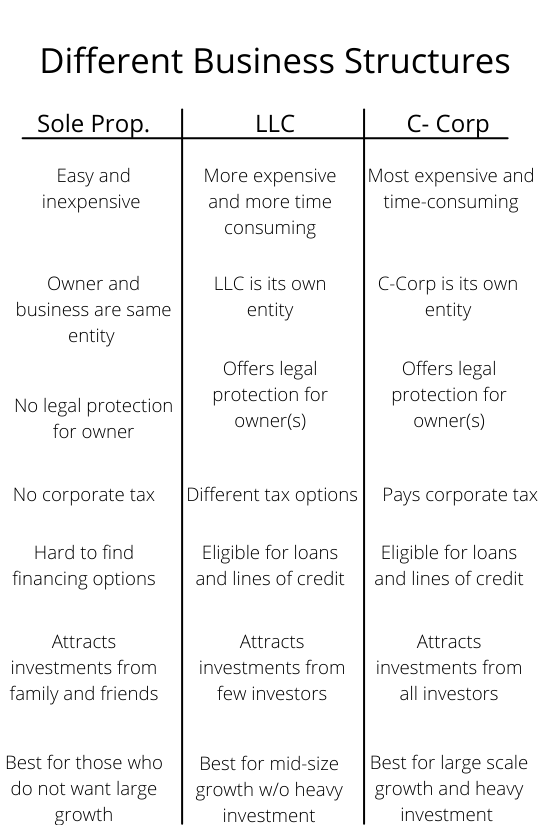

The business structure you choose is important because it determines your business's growth and revenue generation potential. While it is possible to change your business structure, starting with the right one will save you time and money. Here's a breakdown of three main business structures, the pros and cons of each, and which one is best for your long-term goals.

Sole Proprietor

The sole proprietorship is the default business structure. According to the SBA, a sole proprietor is an "unincorporated business owned and run by one individual." They are very easy to establish because you do not need to form an entity – you just start working.

As a sole prop, there is no separation between you and your business – you assume all profits and losses of the business. As a sole proprietor, you can create a trade name for your business and work under that business name.

Pros

- Easy and inexpensive. The most desirable aspect of sole proprietorships is the ease of it. You and your business are considered the same entity in the eyes of the law and the IRS. No formation, no organization, and no lengthy and expensive paperwork are required.

- Simple taxes. Sole Proprietors do not file corporate taxes. All that is required is a Schedule C and Schedule SE attached to your personal income tax return.

- No ongoing requirements. Unlike LLCs and Corporations, Sole Proprietors do not need to meet other obligations to stay in good standing.

Cons

- No legal protection. This is likely the biggest drawback to being a sole proprietor – it affords no legal protection to you at all. If your business is sued for any reason and you are found liable, all of your personal assets (bank accounts, cars, house, etc.) can be at risk.

- Very difficult to raise capital. Aside from some SBA loans, sole proprietors can find it very difficult to ascertain loans or credit from banks and other lenders. Attracting investors is practically impossible as well.

Limited Liability Company (LLC)

The Limited Liability Company (LLC) has become very popular due to its flexibility. LLCs require more work than a sole proprietor but less than a C-Corporation. To officially form an LLC, all owners (called members) must file Articles of Organization – or the equivalent of – with their state's Secretary of State office.

Pros

- Provides legal protection. An LLC is its own entity. The 'Limited Liability' means that the business owners are personally shielded from liability should the business be sued. There are exceptions if owners do not operate the LLC appropriately.

- Tax options. As an LLC, you have a choice on how the business will be taxed – you can choose to be taxed as a sole proprietor or a C-corporation.

- Few requirements. There are some formalities to follow but much fewer than a C-Corporation.

- More funding options. As an LLC, you can procure bank loans, lines of credit, and even the occasional investment from angel investors.

Cons

- Time consuming and more expensive. Compared to a sole proprietor, forming an LLC takes more time due to the multi-step process. Filing fees vary state-by-state but will be more expensive than beginning as a sole proprietor.

- Limited life span. Depending on the state, LLCs may have to dissolve and re-form when members die or leave the LLC.

- Not preferred by investors. While an LLC can get loans, lines of credit, and may attract some willing investors, most investors and venture capitalists will pass on an LLC.

C Corporation

C corporations (C-corps) are the most expensive and difficult businesses to operate, but they also have the greatest profit potential. Corporations (like LLCs) are distinct entities and completely separate from their owners. Unlike other business structures, C-cops have the ability to sell stock and dramatically increase profit margins.

Pros

- Best to raise capital. C-corps are the best business structure for raising capital. Shareholders (owners) can sell stock to attract investments from venture capitalists and other investors. For businesses looking to "go public" or sell sometime in the future, C-corps are the way to go.

- Tax deductions. There are more tax deductions available to C-corps than other business structures.

- Legal protection. Corporations, like LLCs, are completely separate entities in the eyes of the IRS and the law. Unless operated inappropriately, corporations protect the personal assets of the shareholders (owners) from legal liability in the event of a lawsuit.

Cons

- Expensive and time-consuming. Starting and maintaining C-corps are expensive and difficult. The regulations, paperwork, ongoing responsibilities, and legal formalities that C-corps must adhere to vastly surpass that of LLCs and sole proprietors.

- Double taxation. While C-corps have more deductions than other structures, they also face corporate tax. The income of the corporation is taxed based on its bracket, then the shareholders (owners) are taxed based on their income tax bracket. Every dollar faces two income tax deductions before it reaches the shareholder's bank account.

Each Business Structure Has Its Benefits and Downsides

Every business owner has different aspirations, and each business structure has its positive and negative aspects. Ultimately, your long-term goals will determine which business structure is best for you.

If you want to remain small and do not work in a risky industry, a sole proprietorship may be the right way to go. For those who want to hire employees or have moderate growth, LLCs may be better. LLCs offer a layer of legal protection, open the door to bank loans and financing, and may attract some individual investors.

C-corporations – while the most expensive and difficult to operate – offer the most opportunity for growth and expansion.

Get Funding Help for Your Business

Do you need help getting funding for your business? We can help you with SBA loans, grants, or other business financing options. Get ongoing personalized help from our team. Join Skip Premium today and get 1-1 support for your business.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.