In 2022, the SBA provided over $25 billion dollars to small businesses in the form of SBA 7(a) loans with the average loan size being over $500K. As 2023 kicks off, early data shows that this year will be an even bigger year for SBA 7(a) funding and SBA 7(a) approvals. In fact, we predict this will be the most popular financing option of 2023.

In this post we go into why this year will be such a big year for the SBA 7(a) program, what you need to know if you're considering this funding, and how you can apply. Also, in the video below, Ryder gives a 2023 update to the SBA 7(a) program.

Why Will SBA 7(a) Loans Be So Popular in 2023?

The SBA has been the leading funding source for small businesses in the US for decades. The agency was founded in 1953 and has provided funding to millions of businesses since then.

However, it wasn't until the 2020 Cares Act was passed with trillions of dollars in pandemic relief that the SBA became mainstream. Today without a doubt, every business in the US has heard about the SBA.

During the pandemic, the SBA faciliated distribution of trillions of dollars. (Here's who received EIDL funding and PPP funding)

- Over $800 billion in PPP forgivable loans

- Over $400 billion in EIDL loans

- Over $40 billion in EIDL grants, up to $15,000

These programs have entered, yet millions of small business owners and entrepreneurs are still in need of funding.

Enter the next best program: SBA's most popular lending program, SBA 7(a).

What's the Data Backing Up the Popularity of the SBA 7(a) Program?

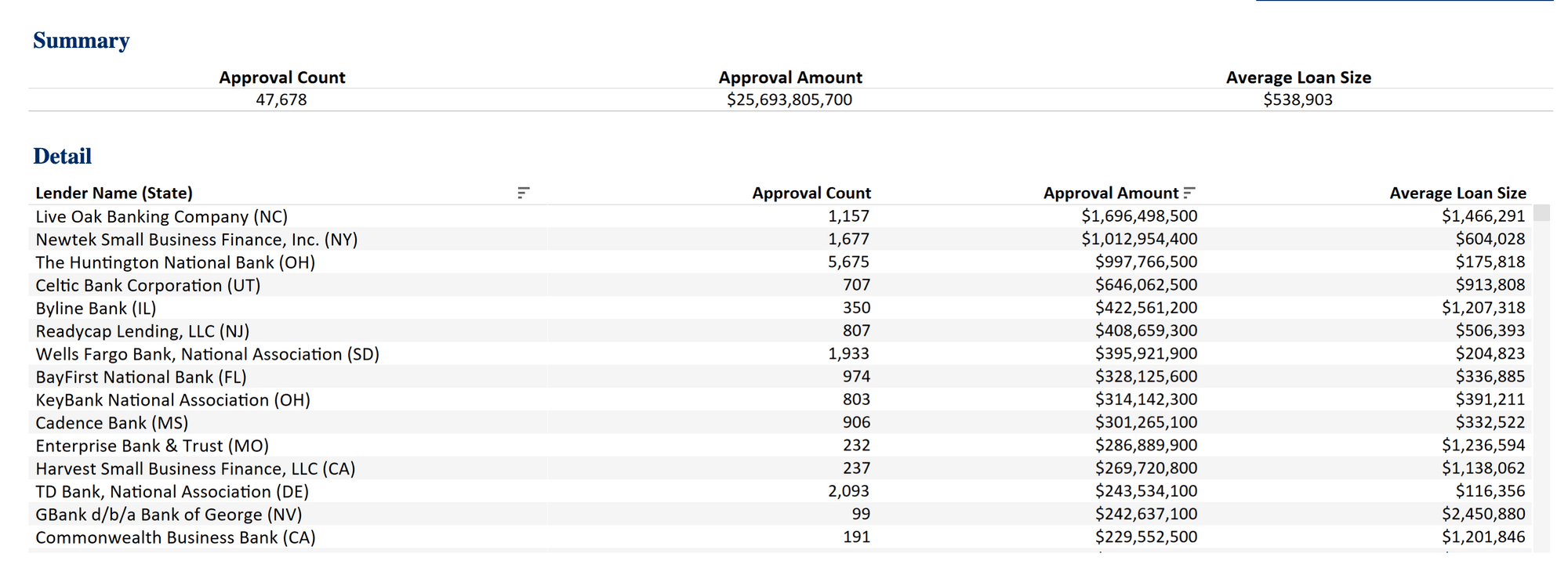

In fiscal year 2022, the SBA approved over $25B in SBA 7(a) loans for over 47,000 business owners. That's approximately 130 business getting approved every single day.

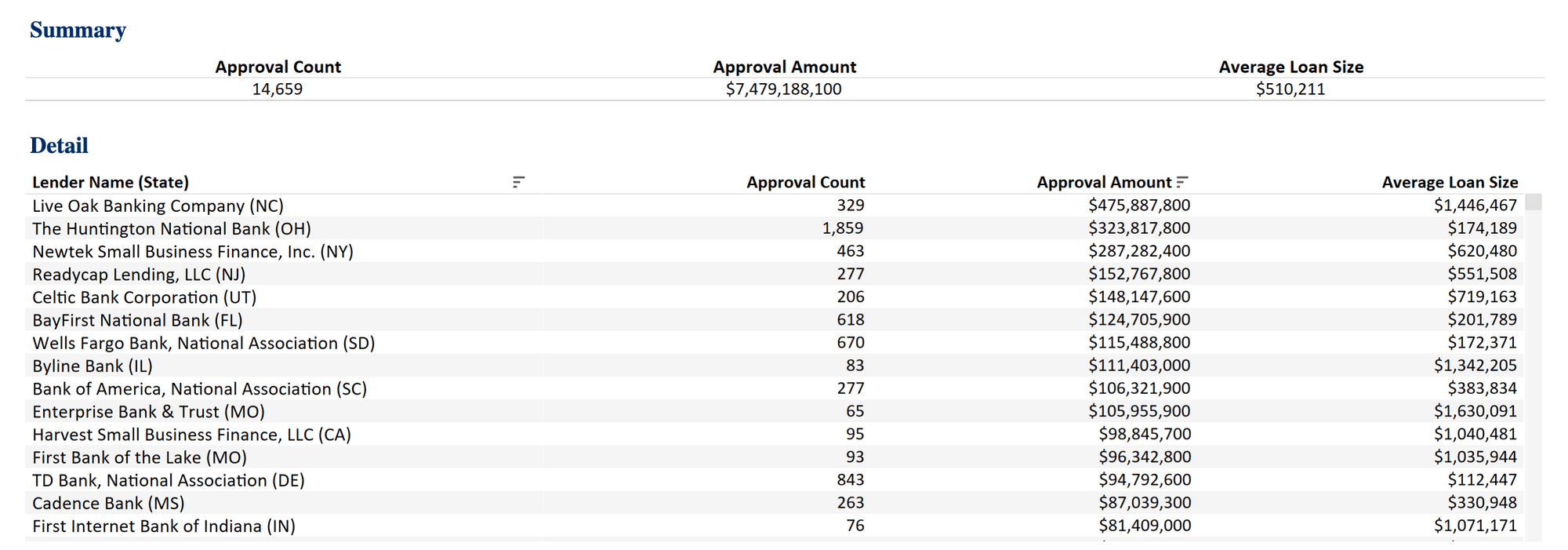

In fiscal year 2023 (started Q4 2022 for SBA), the SBA has already over $7B in SBA 7(a) loans to over 14,000 businesses. At this pace, the SBA will approve around $28B this year, a $3B increase from last year.

The SBA 7(a) loan program is a series of loans that are given out by lenders in partnership with the SBA. Lenders are incentivized to accept 7(a) loans because the SBA guarantees up to 90% of repayment if the loan defaults. These loans usually have better interest rates that private loans, and favorable repayment terms. It's no wonder why they have become among the most popular loans for small businesses.

What is the SBA 7(a) Program?

These are working capital long-term loans. Here's our guide with everything you need to know about applying for SBA 7(a) loans.

Why Should You Consider Applying for SBA 7(a) in 2023?

This program is a typically lower-interest and longer-term loan option compared with private lenders. The SBA has express programs as well if you need funding quickly.

You can use SBA 7(a) funding for:

- Short and long-term working capital

- Refinance current business debt

- Purchase furniture, fixtures, and supplies

If you're curious about applying for an SBA 7(a) loan and want to learn about the best ways to apply, what documentation you need (it's extensive but we can help), book a time to talk with our memberships team here.