Business owners and entrepreneurs can raise seed capital or working capital through crowdfunding, rather than spending hours in a bank lobby or investment firm. Crowdfunding is a way to gather financial support from customers, investors, and supporters in exchange for a reward or equity in your company.

While crowdfunding is a viable option, it may or may not be ideal for your business. In this article, we want to highlight five crowdfunding platforms and who they are best suited for.

1. StartEngine

Established in 2011, StartEngine is one of the new kids on the block. It's a platform that enables businesses to receive funding and allows people to invest in startups with as little as $100. Rather than focusing on a specific industry as other crowdfunding sites do, StartEngine accepts any business. To date, there are over 500K people using StartEngine. As a side note, Kevin O'Leary, from ABC's Shark Tank, is a strategic advisor for them.

StartEngine has helped fund over $500 million for its users. They have two different processes designed to help small businesses raise up to $5 million in funding and large businesses up to $75 million. It is equity-based crowdfunding, meaning you will be selling shares of your company in return for their investment.

StartEngine does require financial verification of the company, depending on the amount you wish to raise. There is no fee to join, but they collect 7-12% of the total capital earned in addition to a $10K withdrawal fee at the end. StartEngine may be ideal for you if you are looking to raise some serious capital.

2. Fundable

Fundable is another platform that businesses of all industries can utilize. To date, Fundable has raised over $560 million for businesses through crowdfunding. Fundable gives you the ability to offer rewards or equity in exchange for an investment into your company. Offering rewards is suggested for those seeking to raise $50K or less.

Unlike many crowdfunding sites that charge a percentage, Fundable charges a flat rate starting at $179 per month for a basic page. They also offer consulting, designing, and marketing to those who want to pay more for a customized and hands-on experience.

It doesn't matter if you raise $10 or $10 million, the monthly rate stays the same, and you keep everything you raise. Since Fundable charges a flat monthly fee, they may be an option to look into if you don't plan on running a long-term campaign.

3. Patreon

Patreon was created by YouTube musician Jack Conte as well as Sam Yam with the specific goal of helping business owners in the creative arts. Due to its subscription-based system, Patreon is the go-to platform for musicians, artists, podcasters, writers, and other creative artists. To date, Patreon has helped raise over $3.5 billion for creative professionals.

Patreon is a membership or subscription-based platform. Generally, creators have a product they offer to the public for free, such as a YouTube channel or podcast. In addition to the free content, they have a paid subscription.

Patreon connects creators of content and subscribers who want to pay for additional content. Patreon's fees range from 5% to 12% depending on the plan you choose, plus payment processing fees. If you are in the realm of the creative arts, Patreon may be a platform to investigate.

4. Indiegogo

One of the larger crowdfunding platforms on the internet is Indiegogo. It was founded in 2008 and has helped over 650K projects bring in $1 billion in funding. One of the aspects of Indiegogo that separates it from the crowd is that it has users from 223 countries and territories.

This enables businesses to reach a wider pool of potential investors — which is especially helpful for businesses that ship internationally or have an international scope.

Indiegogo states that it is the leading platform for tech products, art projects, social impact campaigns, and environmental innovation campaigns. They also provide tools, support, and partnerships to supercharge your effort. Indiegogo lets you keep anything you raise, whether you meet your goal or not. They keep 5% of your total fund amount and there are transaction fees as well.

5. Kickstarter

One of the biggest names in the crowdfunding business is Kickstarter. They host campaigns from the following industries: Theater, Technology, Publishing, Photography, Music, Journalism, Games, Food, Film & Video, Fashion, Design, Dance, Crafts, Comics, and Art. Kickstarter has helped raise over $3 billion for businesses and creative artists in these areas.

To host your crowdfunding campaign on Kickstarter, you must create a product. Kickstarter does not allow crowdfunding campaigns for charity; however, they do allow non-profits to fundraise if they are creating something. Instead of an equity-based system, Kickstarter requires campaigners to offer rewards to the investors.

It's an all-or-nothing platform, meaning that if you do not reach your fundraising target, the money is returned to the investors and you don't get any of it. They charge a flat 5% fee for successful campaigns.

Is Crowdfunding Right for Your Business?

By now, you may be asking yourself, 'Is this my best option?' The answer is, maybe. Crowdfunding is time-consuming because it requires you to market your campaign, respond to investor questions, and pay investors back either in equity or with a reward.

Consider the free time that you have and if you can take on a crowdfunding commitment. Also, most crowdfunding campaigns fall short of their goal, so it would be crucial to strategize how you would go about your campaign to maximize your efforts.

There are many benefits to crowdfunding campaigns that other financing options don't offer. Crowdfunding enables everyday people to join you in your venture in exchange for a reward or equity.

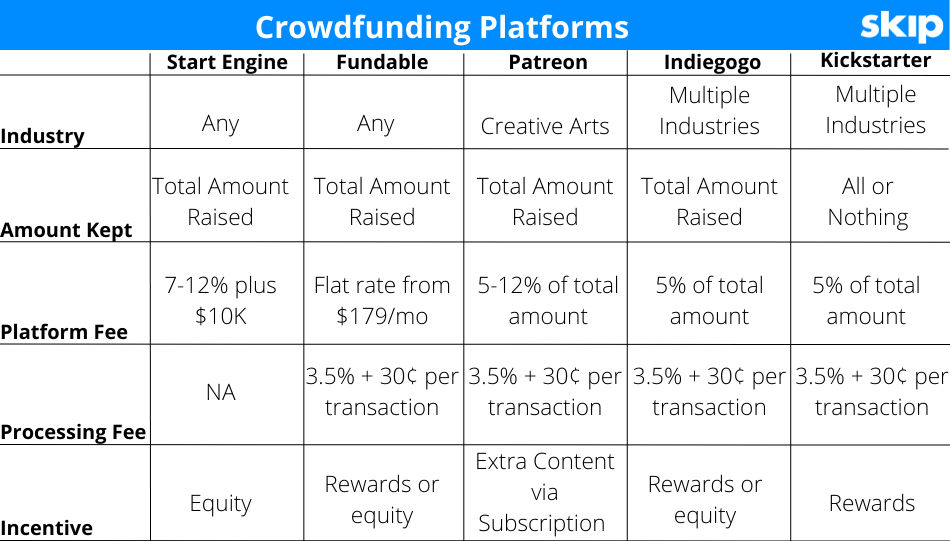

Your business may not be enticing to a venture capitalist firm, but you may be able to garner the financial support of 1,000 people on a crowdfunding platform to meet your goal. Below is a chart to help you compare the platforms we discussed in this article, should you choose to look into those options.

Get Help With Your Business

Do you need help forming or funding your business? Skip can help with your formation, crowdfunding, SBA loans, grants, or other business financing options. Get ongoing personalized help from our team. Join Skip Premium today and get 1-1 support for your business.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.