Major changes to the EIDL program are now live. As of September 8, 2021, EIDL borrowers can now request more funding up to $2 million. The EIDL rules, including eligibility and eligible uses of funds have also changed. This post will breakdown the SBA EIDL portal changes and the forms you'll need to complete to borrow more than $500,000.

📌 Note: According to our sources, the SBA plans to officially announce this on Thursday September 9 in a joint press release with the White House. We'll be adding more details, including more step-by-step guides as soon as possible.

EIDL Loan Increase Up to $2 Million Goes Live

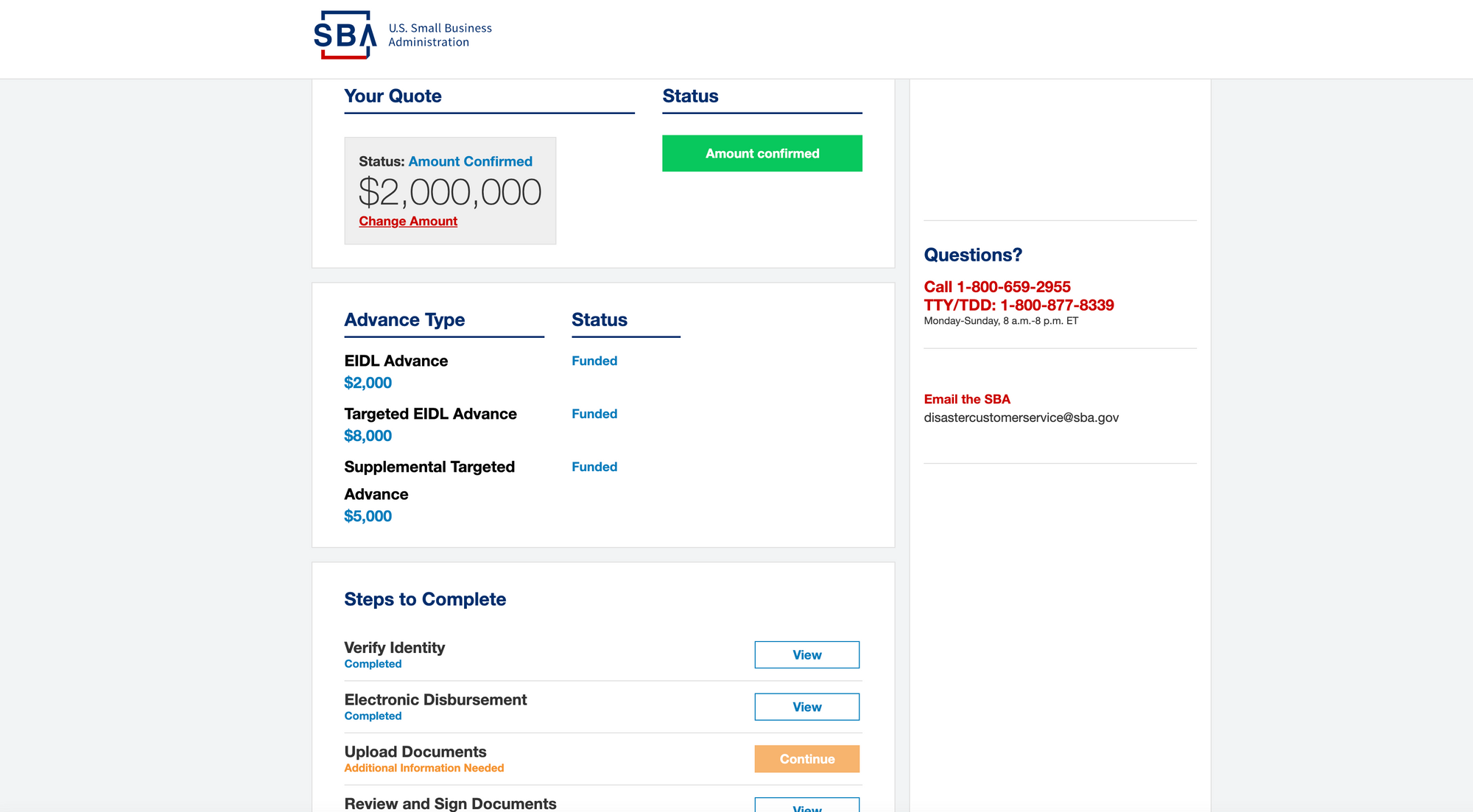

On your SBA portal, depending on your EIDL funding situation and 2019 revenue, you now may be able to request more funds, from $500,000 to $2,000,000.

The above video goes over the steps in detail. In short, you may see a new "Request More Funds" blue button on your portal. Eventually you will get to a slider to select additional funding and get to a screen that looks like the picture below.

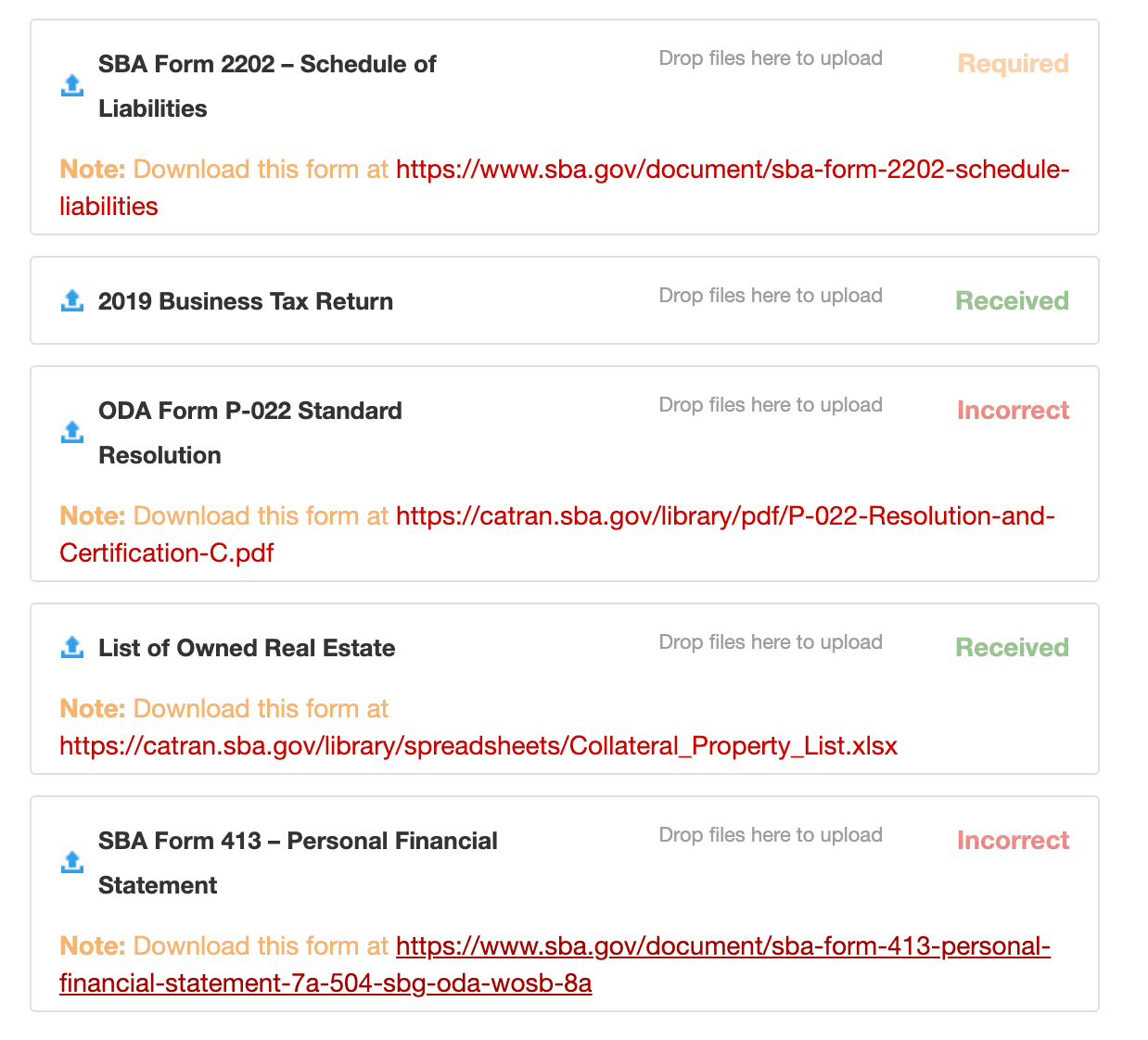

Additional EIDL Documents Required for EIDL Loan Increase Above $500,000

There are 5 new forms required to "Upload" before you can submit your EIDL loan increase request to the SBA. We've linked to the documents below and explained some of them below.

These include: Schedule of Liabilities, Personal Financial Statement, ODA P-022, 2019 Business Tax Return, and List of Owned Real Estate.

SBA form 2202 Schedule of Liabilities lists all of the liabilities for your business, so make sure this is accurate so this doesn't cause any delays. The second form you need to upload is your 2019 Business Tax Return, which you likely already have.

The ODA Form P-022 is finally live, and it's a short two page document that owners or authorized signers of the business need to sign and specify the increase amount.

The List of Owned Real Estate lists out any property you own, the market value, any existing lien, and other information about your property. This likely won't be a requirement, but you will still need to provide collateral equal to the loan amount.

The fifth and last document to upload is SBA Form 413- Personal Financial Statement. It's a longer six-page form that asks for your personal assets, liabilities, and financial information so it will require more of your time to complete.

More on the EIDL 2.0 Rule Changes

Here's our review of the 20-page new EIDL loan rules, and Ryder discusses it in the below video as well.