Updated on May 19, 2020

It is estimated that around 4 million small businesses and sole proprietors applied for Economic Injury and Disaster Loan (EIDL) Advance grants, as part of the Small Business Administration's (SBA) COVID-19 emergency response. Here is the data on just how SBA EIDL progress and SBA EIDL Advance status, based on our self-reporting. If you haven't received anything, you're far from alone. The silver lining is that progress is still being made, slow and steady.

About the EIDL Self-Reporting Progress Tracker

Our EIDL self-reporting progress tracker is free on our Skip website and allows EIDL applicants to enter their application number, see relative progress (based on other self-reporting) and also report if they've received their EIDL Advance (and for how much). Our self-reporting progress tracker also collects comments from users on their experience with the SBA EIDL loan process. Our EIDL progress tracker is not associated with any government entity and is based solely on self-reporting and is for informational purposes only.

Our Skip team built this tracker - along with many other COVID-19 resources including an unemployment tracker and job listings - to help as many people as possible through this global pandemic. We're a mission-driven company helping individuals and small businesses get government-related information, services, and help. Our methodology for this report is at the bottom of this post.

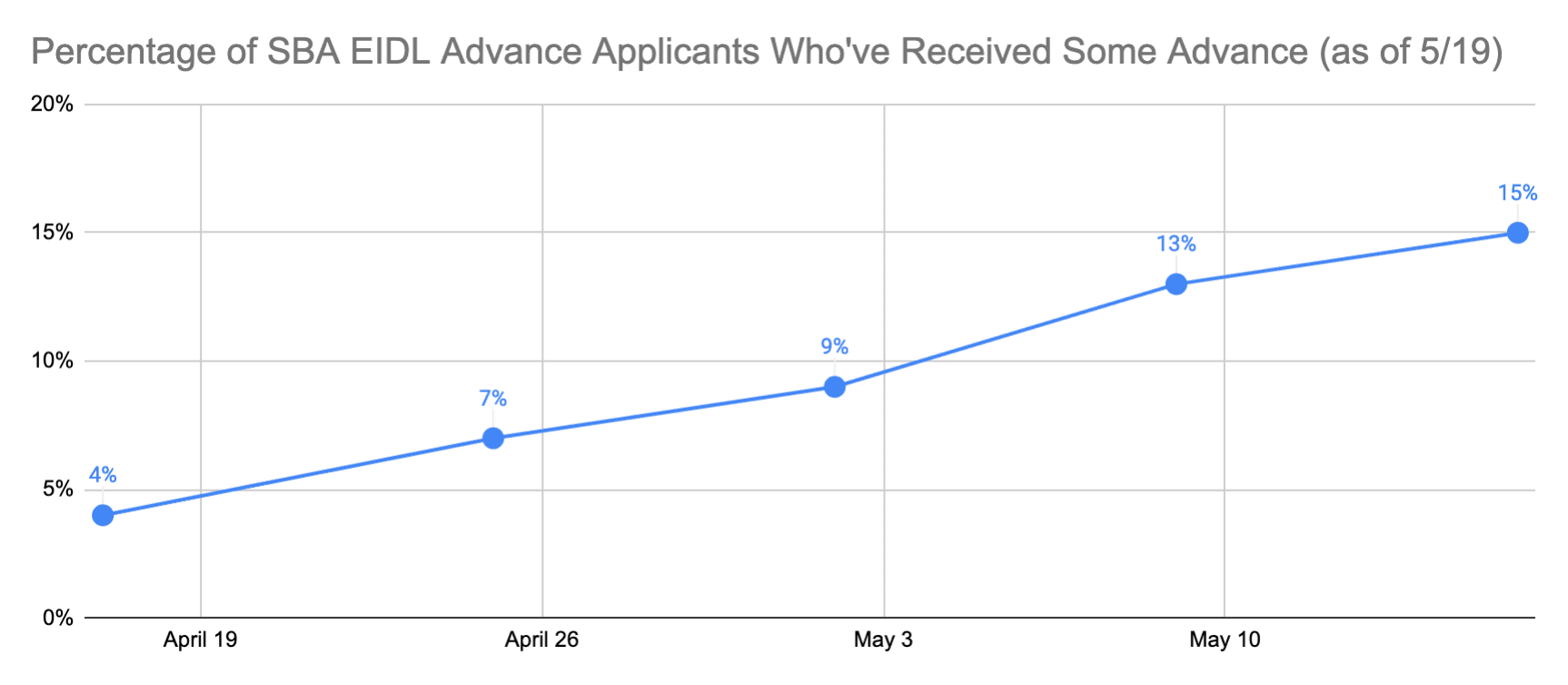

15% of Applicants Have Received Their Advance, an Increase of 8% Over the Last 3 Weeks

People have been self-reporting their SBA EIDL Advance information for over 6 weeks on Skip. As of May 19, 15% have reported that they have received their Advance. This shows a slow and steady increase, although slow progress is still being made.

By comparison, agricultural businesses, who started applying last week, are getting faster approvals, based on our latest data.

This positive EIDL Advance trend is encouraging and we expect it to continue to increase in the coming weeks. Congress is debating another $90 billion in funding for the SBA EIDL program, but this still has obstacles in the Senate.

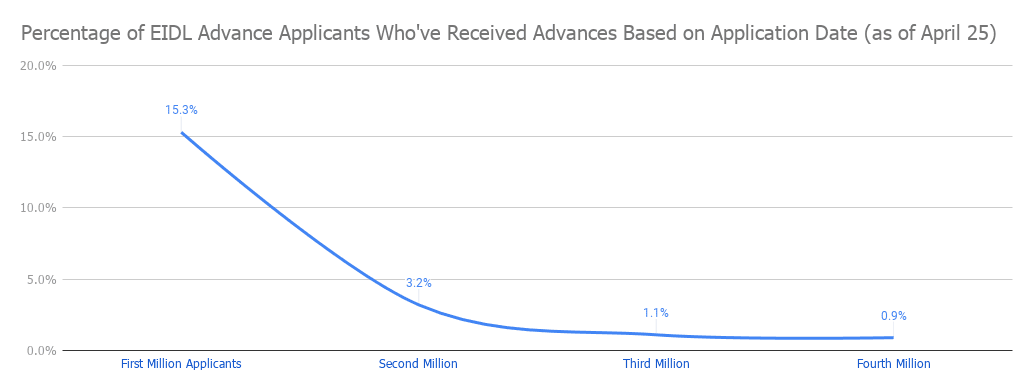

You're More Likely To Have Received Your EIDL Grant If You Applied Early.

Most people are aware that like all of the government programs happening now, timing is of the essence. There is limited funding, and most programs are processed on a first-come, first-served basis. Based on our data this holds true for the SBA EIDL Advance Grants.

20% of the first 250,000 small businesses and individuals to apply have received some funding, based on our self-reporting. Compare that to people who applied on the second week of applications. By then, around 3 million applications had already been submitted and only 1% of those applicants have had any funding.

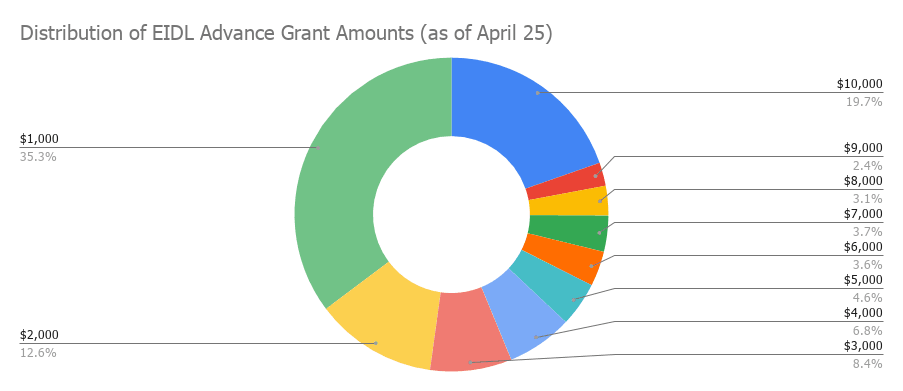

35% of Everyone Who Has Received EIDL Advance Grants Only Received $1,000

When we looked at the 7.2% of EIDL applicants who have received their EIDL Advances, 35% only received $1,000 while 20% received the full $10,000. Most applicants who applied were under the impression that they would receive the full $10,000 Advance grant no matter what.

Our takeaway from this self-reported data is that 80% of people have gotten amounts different than what they had expected. In addition, the average of everyone who has received an SBA EIDL Advance is $3,678. Over half of all applicants received $3,000 or less.

How We Calculated This EIDL Loan Progress Data

As part of our self-reporting EIDL progress tool, users input their EIDL loan applications number and verify their email address. 99.7% of users appeared to have valid application numbers. As of last count, we are tracking just under 30,000 EIDL applications. We excluded any reports that were not valid. We examined differences across various timelines, application types, and applications numbers. If you have any feedback or want to know more about this data, you can email us at hello@helloskip.com.

If you're interested in self-reporting it is a big help to the community. Thank you in advance for supporting our mission. You can link to our EIDL loan tracker or are unemployment tracker.

*This is for illustrational purposes only. We understand that there is selection bias due to the fact that people who have not received their loans are more likely to enroll and check. Self-reporting once received is not guaranteed, although we follow up with people regularly to check on their status.