This week we surveyed small businesses and asked them to rate their experience with the SBA as well as offer positive and/or negative feedback. We received over 1,200 responses. The survey also asked businesses to indicate if they received any PPP or Covid EIDL funds and if they are currently waiting for additional funding. Here are the results of the survey, which we will also share with the SBA.

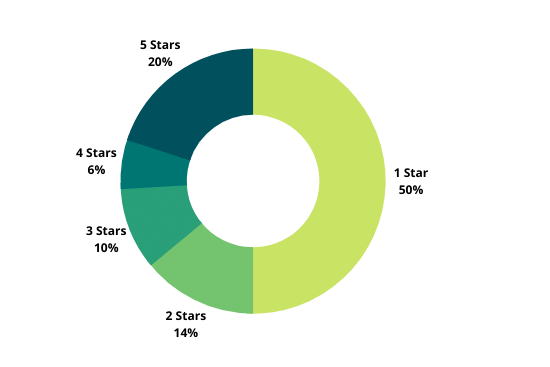

Small Businesses Give the SBA 2 out of 5 Stars

Over 1,200 businesses rated their experience with the Small Business Administration (SBA) throughout the pandemic. The average rating was just 2 out of five stars. 50% of businesses gave the SBA one star, 14% gave it two stars, 10% gave it three stars, 6% gave it four stars, and 20% gave it five out of five stars.

There is a correlation between small businesses that received either PPP or EIDL funding and their view of the SBA. For businesses that rated the SBA with five stars, 79% received funding of some kind, either through the PPP or the EIDL programs. Of those that gave the SBA one star, 48% did not receive any EIDL funding, 43% did not receive PPP funding, and 27% did not receive any funding at all.

Furthermore, there is a correlation between those that used Skip when applying for PPP or EIDL funding and those that did not. Of the businesses that gave the SBA five stars, 41% used Skip or found Skip's information and guidance helpful. Of the businesses that rated the SBA one star, 63% stated that they did not use Skip or did not find Skip's information helpful.

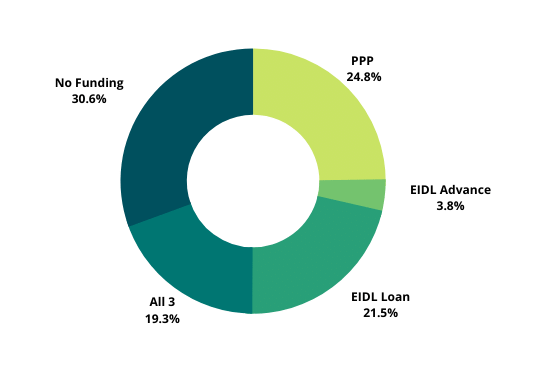

30% Of Small Businesses Have Received No Funding To Date

30% of businesses reported that they have received no funding so far. 25% have received funding from the PPP and 25% have received EIDL funding. Only 19% have received funding from all three programs (PPP, EIDL Advance, and EIDL loan). The SBA reported in August that the EIDL backlog had been cleared. It recently announced that the current wait for loans below $500K is two to three weeks, but many are still waiting.

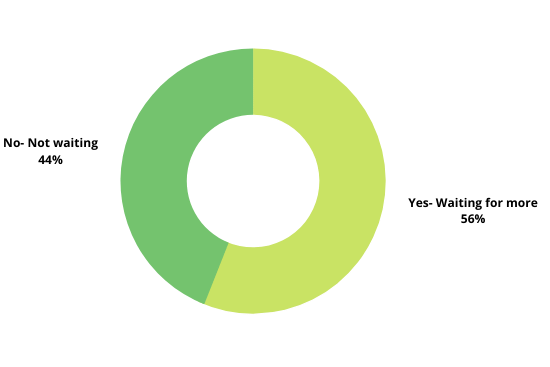

56% Of Small Businesses Are Still Waiting On Additional EIDL Funding

While 30% of businesses have received no funding, 56% are still waiting for additional funding. It is important to note that you can request an increase to your EIDL loan multiple times until you reach the EIDL amount that you qualify for. If you need more money for your business, you can check how much you qualify for with our cash flow calculator.

Recently, the SBA released updated timelines for the EIDL program. The deadline to apply for the EIDL loan and Targeted Advance is still December 31, 2021. If you believe you qualify for the Supplemental Advance, you need to apply by December 10, 2021.

Reconsiderations, appeals, and increase requests will still be processed after December 31st, as long as the SBA receives them within the timeframes– 30 days from the date of decline for appeals, six months for reconsiderations, and two years from the date of origination for increases.

The Most Common Positive and Negative Feedback

For those that had a positive experience with the SBA, their comments reflected their positive experience with their SBA agent or the customer service center. Many businesses commented on the personable nature and willingness to help that the SBA agent or customer service representative displayed during the process. Several others stated that their application was approved quickly. One business owner reflected on the experience by saying:

"Generally the customer service agents have been friendly and eager to help to the best of their ability."

For those that did not have a positive experience with the SBA, aside from not receiving the funding they sought, their comments concerned the poor communication they received from the SBA. Several businesses highlighted their frustration with the lack of communication or lack of consistent information they received from the SBA. One business owner reflected on the experience by saying:

"[The SBA] should provide more clear information on completing applications and other needed paperwork. Confusion with the 4506-T caused a lot of issues..."

We will be posting the full list of comments and data in the near future. We will also be sending this information directly to the SBA.

Get Personalized EIDL And Other Funding Help

If you have questions about your EIDL situation and you'd like to speak with someone on our team, you can book one of our limited 1-1 VIP funding spots. We will provide you with personalized guidance, walk you through the process, review your documentation, and help you find other funding opportunities for your business.