Major changes to the EIDL program are now live. As of September 8, 2021, EIDL borrowers can now request more funding up to $2 million. The EIDL rules, including eligibility and eligible uses of funds have also changed. This post will break down the SBA EIDL portal changes and the forms you'll need to complete to borrow more than $500,000.

📌 Pro-tip: Have questions about EIDL, including reconsiderations or increases? Sign up for Skip Premium or VIP and get help with your business plan and business funding options.

EIDL Loan Increase Up to $2 Million Goes Live

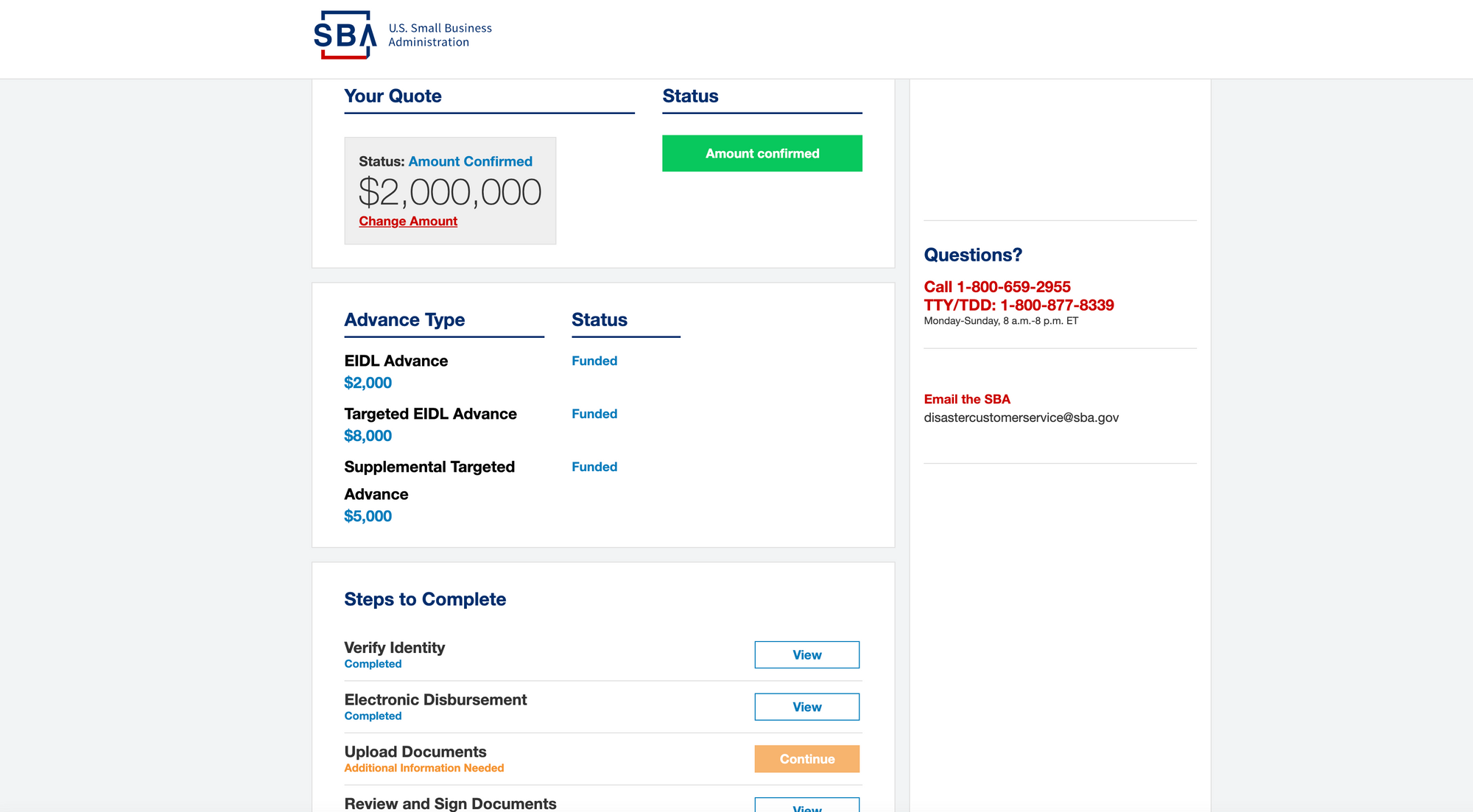

On your SBA portal, depending on your EIDL funding situation and 2019 revenue, you now may be able to request more funds, from $500,000 to $2,000,000.

The above video goes over the steps in detail. In short, you may see a new "Request More Funds" blue button on your portal. Eventually you will get to a slider to select additional funding and get to a screen that looks like the picture below.

Additional EIDL Documents Required for EIDL Loan Increase Above $500,000

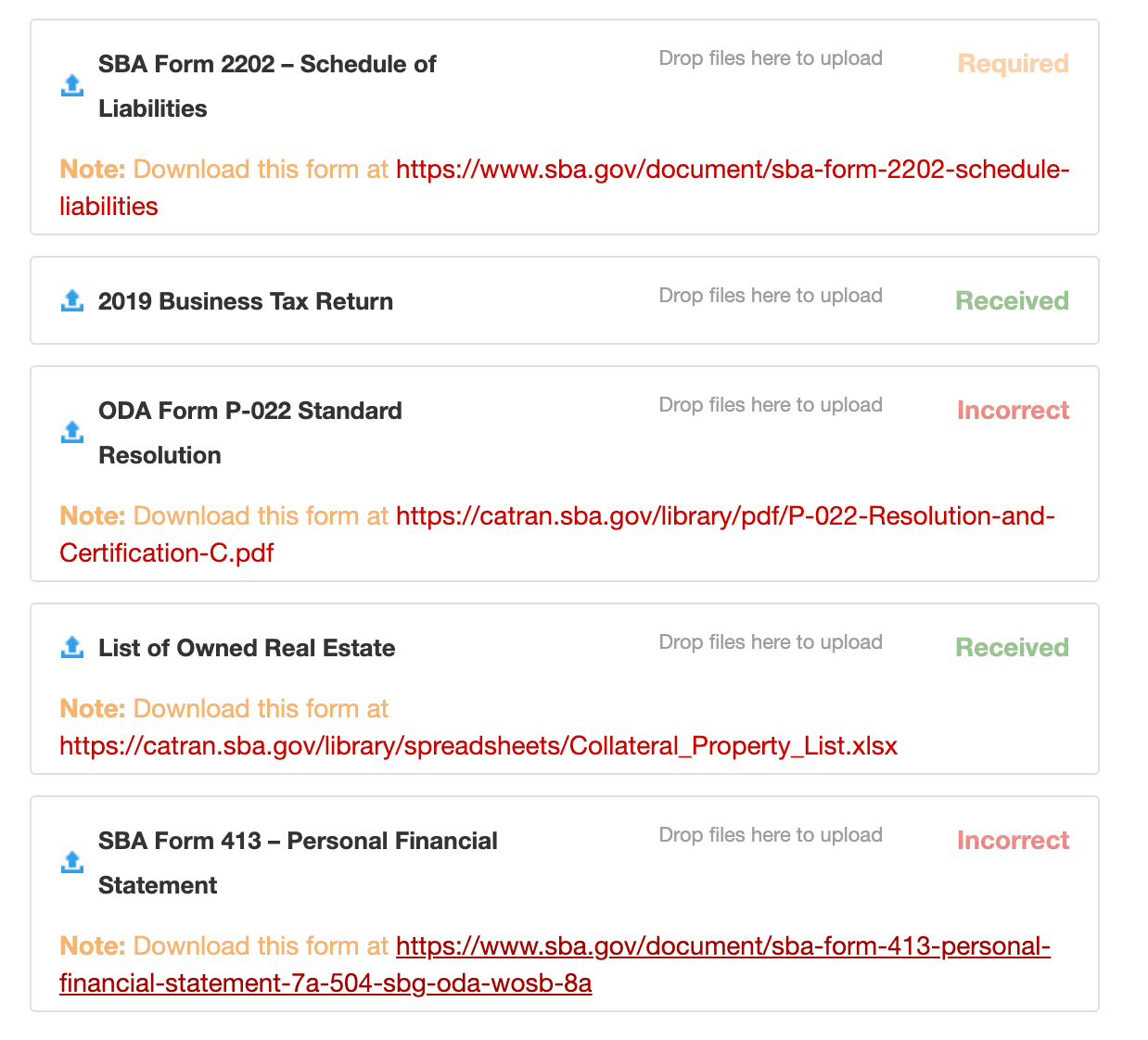

There are 5 new forms required to "Upload" before you can submit your EIDL loan increase request to the SBA. We've linked to the documents below and explained some of them below.

These include: Schedule of Liabilities, Personal Financial Statement, ODA P-022, 2019 Business Tax Return, and List of Owned Real Estate.

SBA form 2202 Schedule of Liabilities lists all of the liabilities for your business, so make sure this is accurate so this doesn't cause any delays. The second form you need to upload is your 2019 Business Tax Return, which you likely already have.

The ODA Form P-022 is finally live, and it's a short two page document that owners or authorized signers of the business need to sign and specify the increase amount.

The List of Owned Real Estate lists out any property you own, the market value, any existing lien, and other information about your property. This likely won't be a requirement, but you will still need to provide collateral equal to the loan amount.

The fifth and last document to upload is SBA Form 413- Personal Financial Statement. It's a longer six-page form that asks for your personal assets, liabilities, and financial information so it will require more of your time to complete.

Final thoughts on EIDL 2.0

In some way, shape, or form, these new EIDL loan limits and rule changes will affect your business and business funding. We highly recommend considering getting personalized help to talk through your specific situation if you're serious about appropriate funding for your business.

Get ongoing personalized help from our team. Join Skip Premium today and get 1-1 support for your business.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.