The Senate on Thursday voted to extend the SBA's Paycheck Protection Program (PPP) by an additional two months, allowing small businesses to continue to apply to the program through the end of May.

Senators voted 92 to 7 to pass the PPP Extension and it will now go to President Biden for his signature, who has indicated he will sign it. The vote comes a week after the House of Representatives passed the bill and is welcome news for millions of small business owners.

PPP Extension is Welcome News for Small Businesses

Since the PPP program was originally created as part of last year's CARES Act, over 8 million small businesses have received PPP loans — which are forgivable loans if the businesses use them correctly, primarily for payroll.

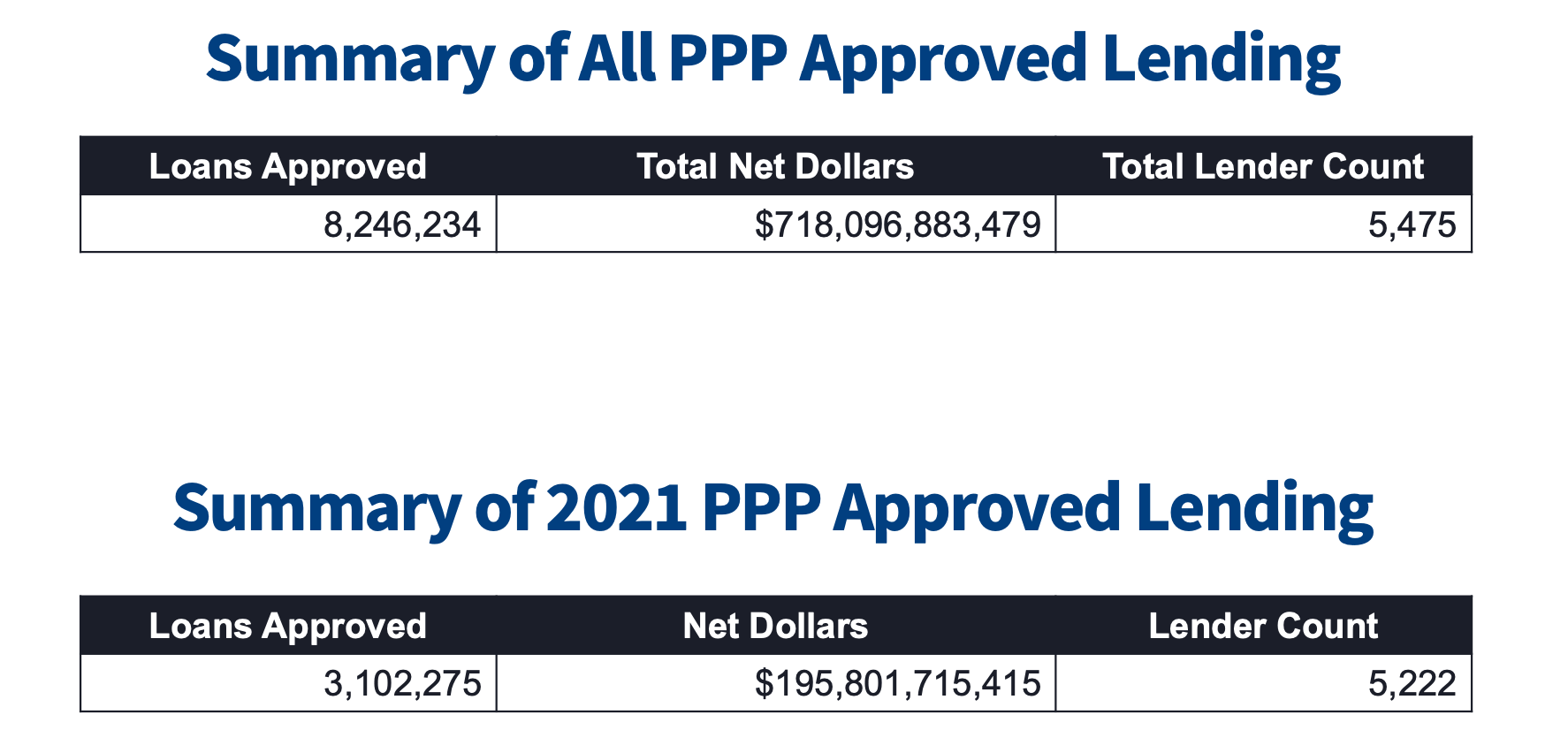

Just this year alone, since the Second PPP Draw was approved, over 3 million businesses have received PPP loans for a combined value of $195 billion. Here is a snapshot of the PPP loan numbers provided by the SBA, as of March 21, 2021.

Despite the progress, million of business owners are still waiting for their loans. A poll we conducted recently on our YouTube channel, found that 25% of small business owners are still waiting — either in the queue with a lender, or in a queue at the SBA — for their PPP loan approval.

Rule Changes to the PPP Program Made the Extension Necessary

In February, the Biden Administration released new rules to the PPP program to help the smallest of the small businesses. This included a 2 week priority period for businesses with 20 or fewer employees and changes for Schedule C filers to use a higher income amount in the PPP calculation.

The guidance for these changes didn't come out until March, making if difficult for both businesses and lenders to adapt quickly to the changes. As a result lawmakers increased their calls to extend the PPP round 2 deadline. Last year, the first PPP round was also extended as well.

Still Want to Apply for a PPP Loan

Given the PPP loan extension, there's still time to apply. We have two partner lenders that have been helping businesses of all sizes: Funding Circle and Bluevine. If you think you're eligible, take a look at their PPP applications, which take approximately 5 minutes to go through.

📌 In other news... Today, the SBA announced they will increased EIDL loan limits from $150,000 to $500,000 starting in April. Here's what you need to know.

📌 Pro-tip: Stay on top of all the grant and funding programs with Skip Plus. Get curated grant and funding opportunities twice weekly. Start a 15 day free trial here.