May 21 Update on PPP Loan Forgiveness:

You may be receiving government aid for the first time right now, whether it's your stimulus check, the PPP, PUA, or just regular unemployment.

People around the country are wondering how all these new forms of government aid will impact their 2020 taxes. We can help! Here is your guide to what is taxable,what's not, and how coronavirus will impact your deductions.

Is the stimulus check taxable?

No, your stimulus check is not considered taxable income for the purposes of the IRS. You won't be taxed on it.

Do I have to pay taxes on unemployment?

Yes, if you're receiving unemployment, you will need to pay taxes on it. The federal government collects income tax on unemployment, and some states do as well. But 15 states don't--you can find a list of them here.

Some of the expenses of your job search--like travel for interviews or resume prep--might be deductible from your taxes, so keep your receipts. And depending on your income, you may be eligible for other tax credits while on unemployment as well.

PUA benefits--the additional $600 a week on top of state unemployment that many out-of-work Americans are receiving through the CARES act--is also considered taxable income.

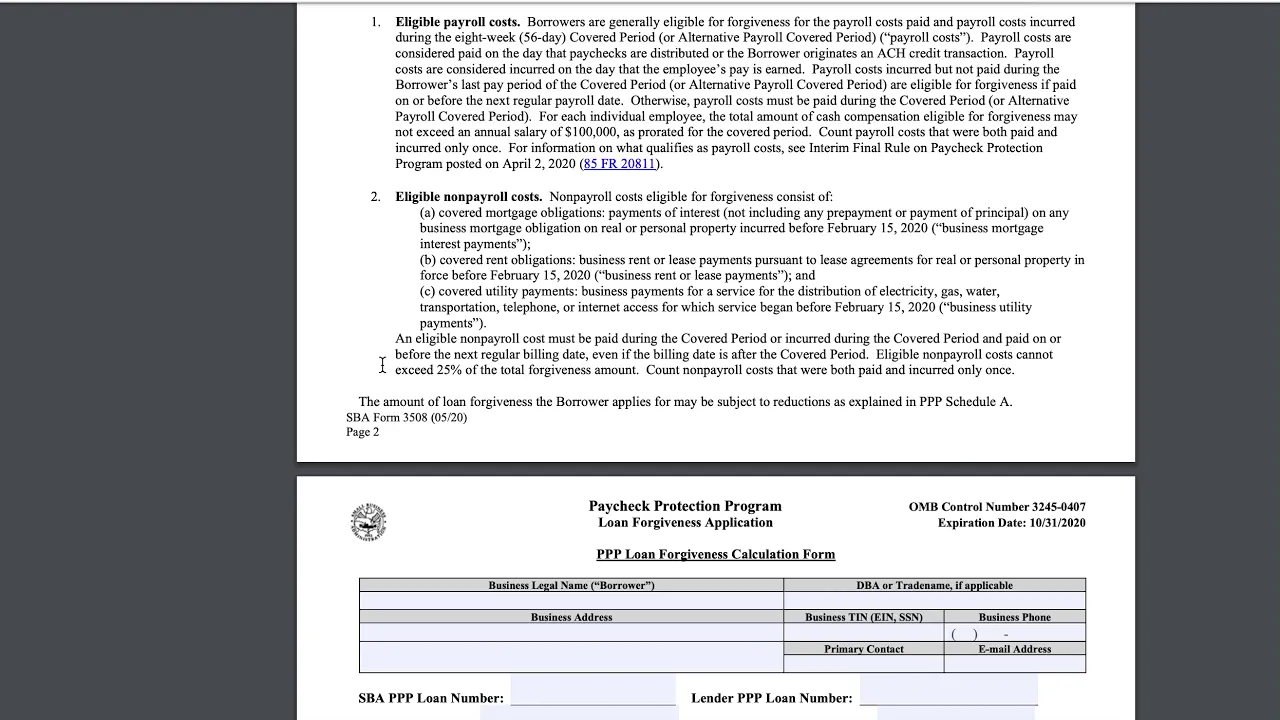

I received a PPP Loan. Is that taxable?

Nope. Your forgiven PPP loan is yours, free and clear, and you don't have to pay taxes on it. But there's a catch--many small business owners rely on tax deductions, and the current guidance from the IRS is that those expenses that you use the PPP for are not deductible. It's possible this will shift due to pressure from Congress, and we will update this page if so.

If I got a PPP Loan, Can I Also Get the Employee Retention Tax Credit?

The Employee Retention Tax Credit announced by the IRS allows business owners impacted by COVID-19 to deduct 50% of wages paid (up to $10,000) from their 2020 taxes. But unfortunately, recipients of the PPP are not eligible for this credit.