The SBA has yet to announce EIDL 2.0, a long-anticipated increase to the current $500,000 cap for the EIDL program. The anticipated loan increase of up to $2 million was expected to be announced on August 16, 2021. Before requesting an additional loan increase through EIDL 2.0, it's a good idea to check your current loan balance and expected monthly payments. Here's how to do it.

Check Your EIDL Balance Before Requesting An Increase

If you want to check the balance on your EIDL (or PPP loan), you need to go to the Capital Access Financial System. You cannot access the information through your EIDL portal. You will need to create an account to access the database. Once you do, it will bring you to your home screen. Clicking on "borrower" on the top left brings you to a list of SBA loans you are associated with.

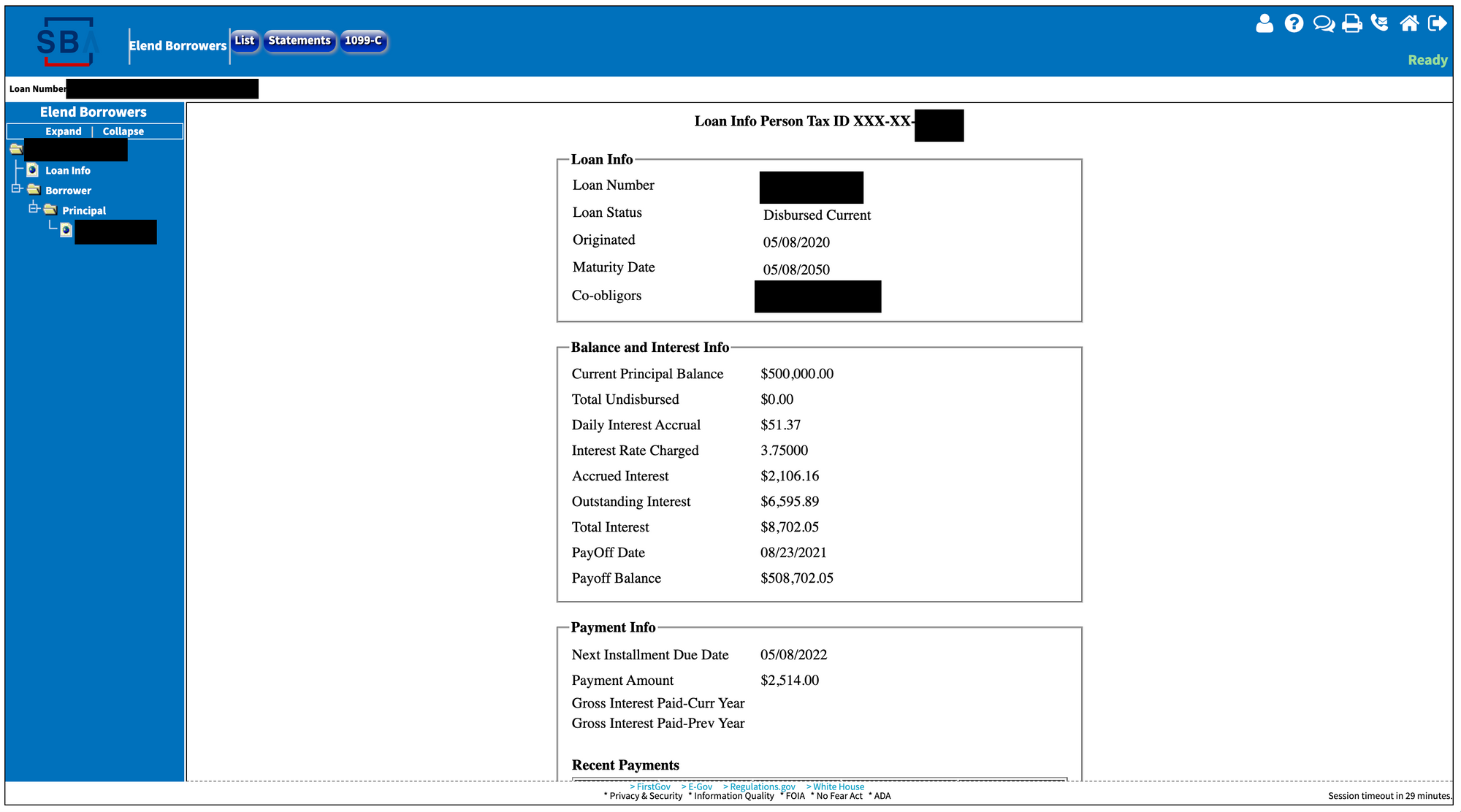

Clicking on the EIDL loan will bring up the information specific for your EIDL loan. It contains your loan number, loan status, origination date, maturity date, principal balance, and much more. The third box indicates when the next payment date (installment date) is and how much the payment is going to be.

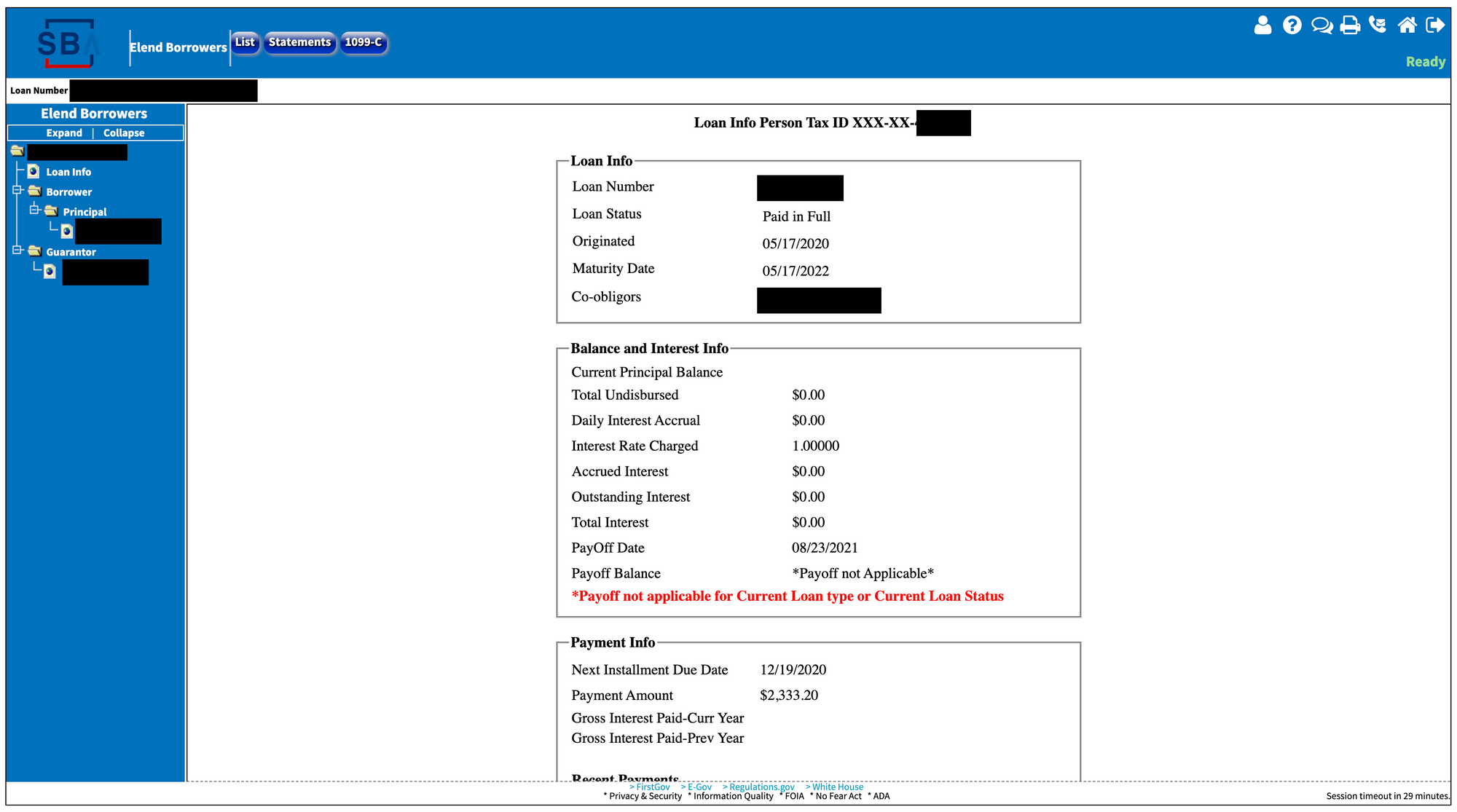

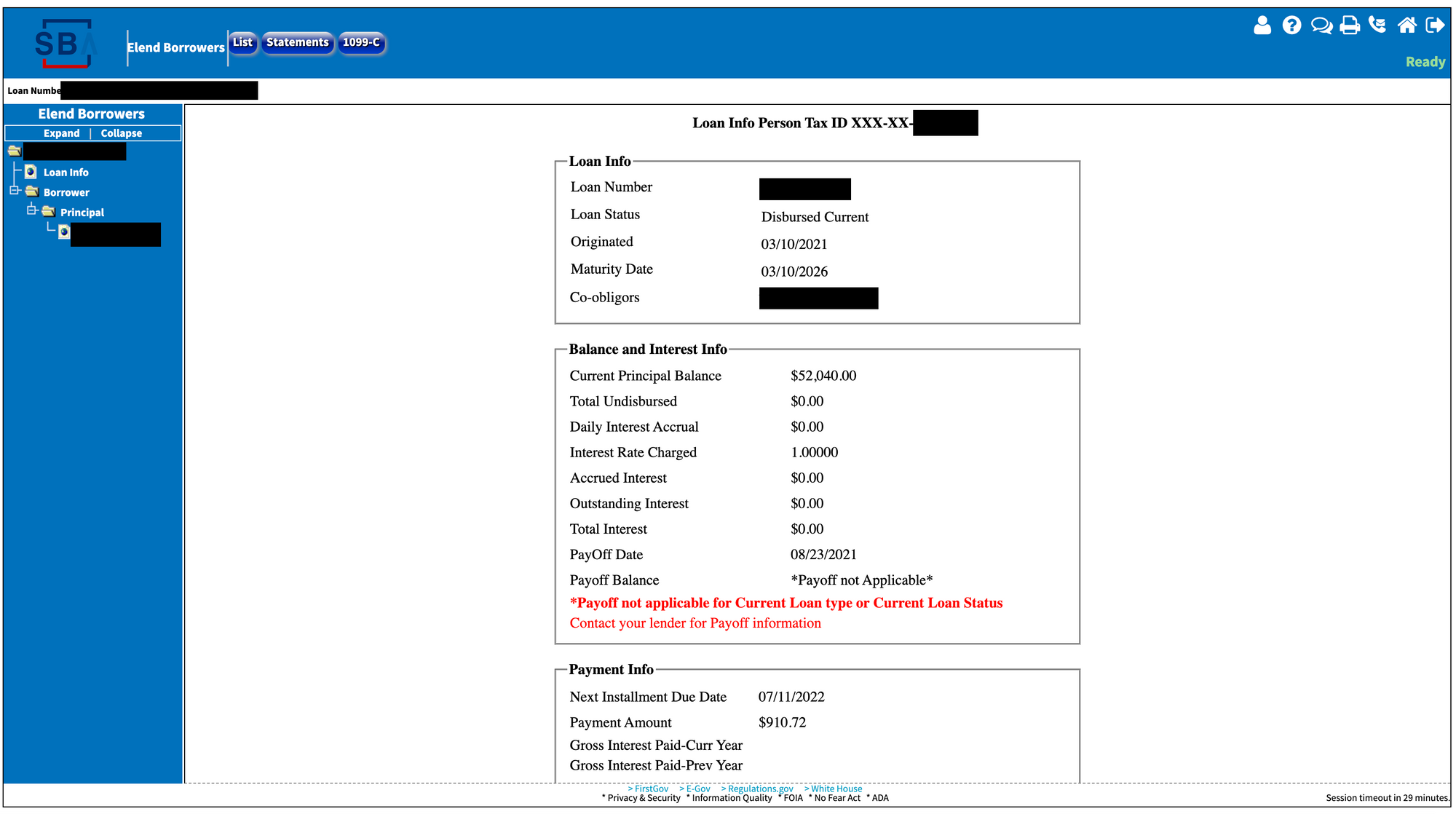

Each loan that you have through the SBA will have this information. If you have a PPP loan, you can check to see whether the loan has been forgiven or not. You will know if your PPP loan is forgiven in two ways.

First, the loan should say "Paid in Full" on your loan list screen. Second, when you click on your PPP loan, it should say "Payoff not applicable for Current Loan type or Current Loan status."

If your loan has not been forgiven, it will say "dispersed current" as well as "Contact your lender for Payoff information."

📌 Pro-tip: Log into your account at least once every 30 days, otherwise it will suspend your account, and you will need to call in to re-activate your account, and the phone waits can be long.

Here's How You Can Make A Payment On Your EIDL Loan

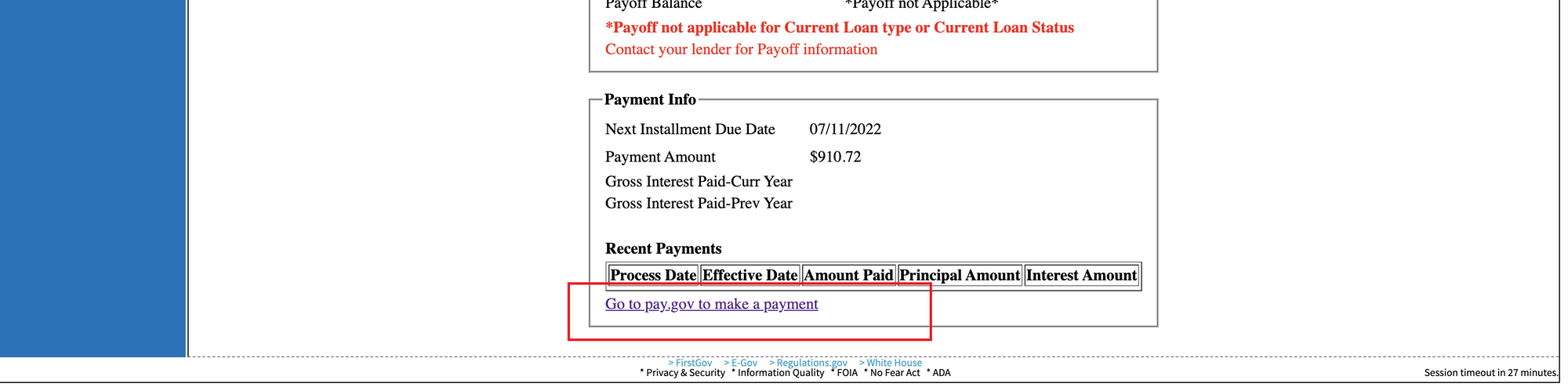

The Capital Access Financial System website only displays the information regarding your SBA loans. To make a payment on your loan, you will need to go to the official pay.gov website. A link to this website will be at the bottom of your loan profile page.

Once you are at pay.gov, click on "Make a SBA 1201 Borrower Payment," which should be right in the middle of the page. This is to be used to make payments on your EIDL loan or other non-Covid disaster loans.

In Other News: The U.S. Economy Growth Slowed In August But Housing Market Remains Stable

In the video above, we also talk important economic and unemployment news. Service providers and factories across America reported slower growth in August than anticipated. Labor shortages, weakening demand, and consistent interruptions in shipping networks are holding businesses back, the IHS Markit survey indicated.

The Delta variant has also been complicating matters as it continues to spread across America. Corporations such as Apple, Amazon, Facebook, and others have suspended or postponed their return-to-office date. Some have pushed it back into 2022 as a result of Delta.

Meanwhile, the housing market continues to do well. Sales from June to July rose by 2% and increased by 1.5% compared to July 2020. Lawrence Yun, National Association of Realtors' Chief Economist, stated “It is still a very swift, fast-moving market, but there is some indication that the market is less intensely heated now than before."

A cooling trend in the housing market would be welcomed by many homeowners who have been unable to keep up with rising house prices.

Ending Unemployment Benefits Is Not Prompting People To Seek Out Work

26 states have ended the expanded unemployment benefits that began last year. Many argued that cutting the federal unemployment extension of $300 per week (initially $600 per week) would encourage people to return to the workforce. That does appear to be the case.

The Labor Department released data on Friday indicating that there was no significant difference in job growth between states that cut the extended unemployment benefits and states that did not. These programs are set to expire in September, unless Congress extends them once more.

Conclusion: Check You EIDL Balance Before Requesting An Increase

The SBA should be confirming details regarding EIDL 2.0, which would increase the cap from $500K to $2 million. This increase only affect businesses who qualify for additional funding beyond $500K. You can calculate your potential EIDL loan amount on the Skip web dashboard or go to EIDL2.com to check.

📌 Want more funding opportunities? Try Skip Plus free for 2 weeks and never miss out on another major funding opportunity.