With just two weeks left until the application window closes, there are some major changes to EIDL approval and loan amounts. But, you can still get help applying for EIDL loans here. Here's a quick look at recent data.

2/3rds of Small Businesses Are Still Waiting for EIDL Increases or Reconsiderations

This is based on self-reported Skip user information. In fact, most businesses are eligible for loan increases since businesses can use revenue data from multiple tax returns if necessary.

For example, according to SBA loan officers, if you had higher revenue in 2018 or 2017 (and 2019 was an anomaly for you), you can submit your earlier tax returns and try to get your EIDL loan amount based on those returns.

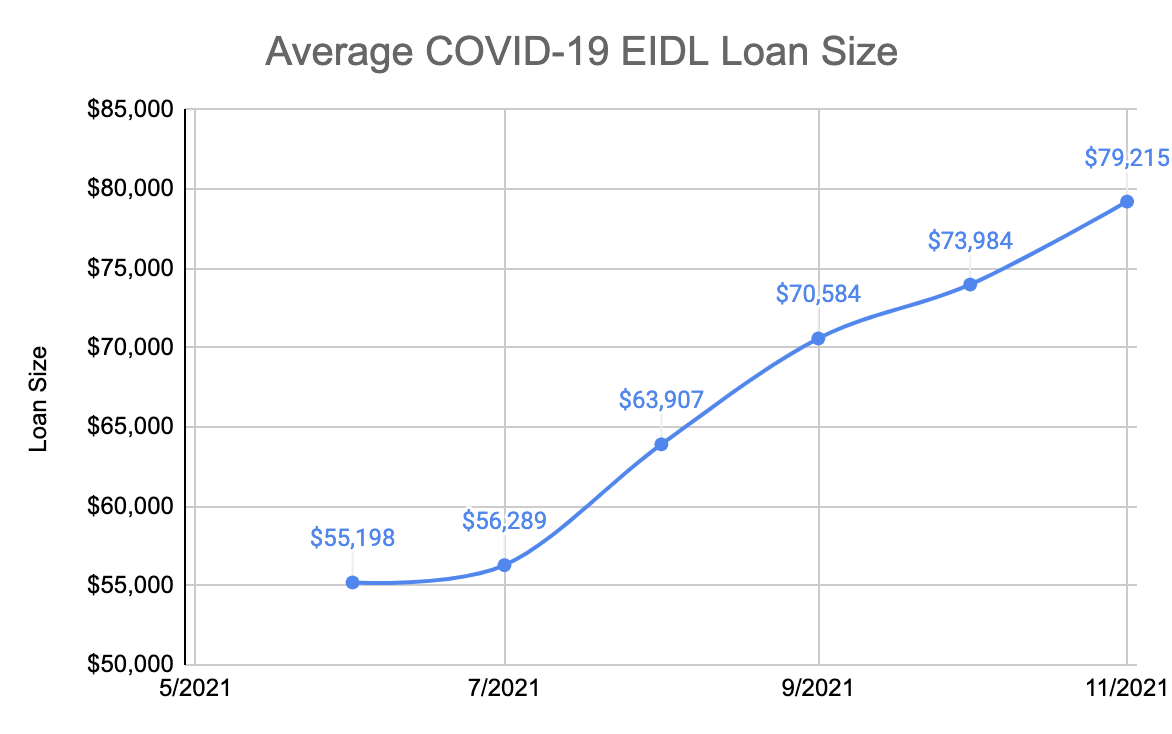

The Average EIDL Loan Size Has Increased 44% in the Past 5 months, From $55K to $79K

This is the biggest shift of all, thanks to the $2M EIDL loan limit increase the SBA implemented this summer. This has allowed tens of thousands of small businesses to get loan increases above $500K.

The calculation to determine your maximum EIDL loan amount is still 24 months of working capital, so take your 2019 revenue minus 2019 COGS and multiply by 2. As mentioned above, in some cases you can use tax revenue information from 2018 or 2017.

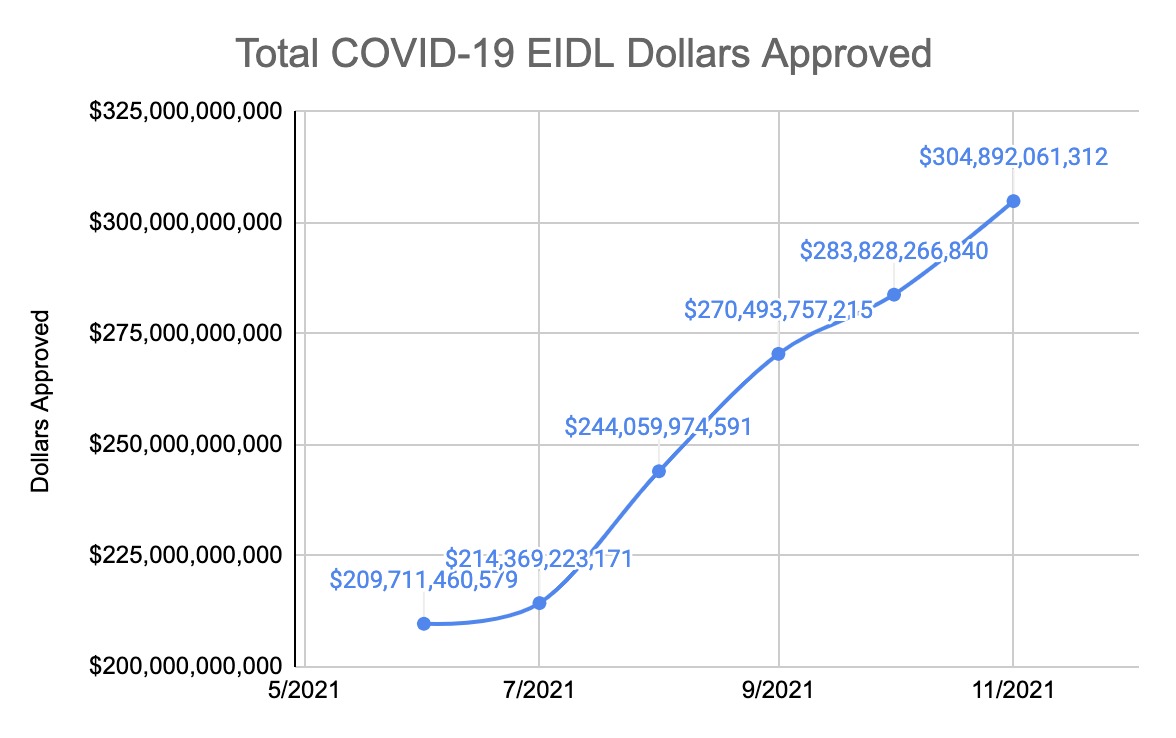

Nearly $100B in EIDL Loan Funding Has Been Approved in the Past 6 months

As the chart below shows, in June, only $209B in EIDL loans had been approved and distributed. As of November, that number jumped nearly $100B to a total of $305B in EIDL loans.

Again, the biggest shift is EIDL increases. Businesses that were previously capped at $150K, then $500K, have had the opportunity to increase their EIDL loan amounts.

Based on our self-reported information, we've helped our Premium users obtain nearly $1B in combined funding in this same time period. This represents thousands of small businesses and independent contractors.

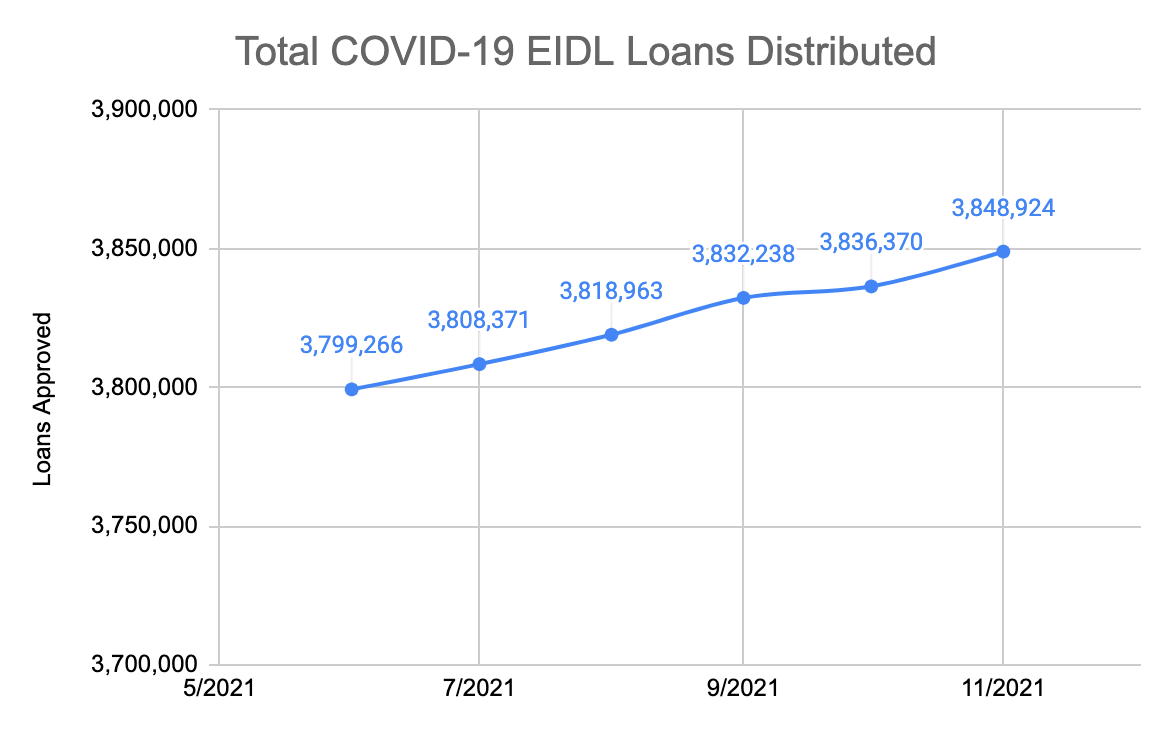

We Expect an Increase in Approvals and Average Loan Sizes in the Next 2 Weeks

The SBA has said they will accept new EIDL applications on or before December 31, 2021. They've also indicated they will try to speed up reviews before that time as well.

As you can see in the chart below, the average monthly new EIDL loan approvals has averaged around 10K per month since June. It's a small number compared to the number of EIDL loan increases, but it still means new EIDL loan recipients are getting approved and funded.

We hope this helps—and if you want Premium funding help, we have limited availability this week: Spots on Tuesday, Wednesday, and Thursday.

👋🏼 Hope you had a great weekend!

— The Skip Data Team