Many entrepreneurs and small business startups find themselves using their own money or personal credit to fund their businesses, while those already in business – looking to grow – might be in search of a business loan.

In this article, we’ll detail the difference between a personal loan and a business loan, their pros and cons, what you should use each type for, and tips on finding the right business loan for you. Lastly, we’ve made it easy to calculate how much you can borrow using Skip’s new loan calculator.

What’s the Difference Between a Personal Loan and a Business Loan?

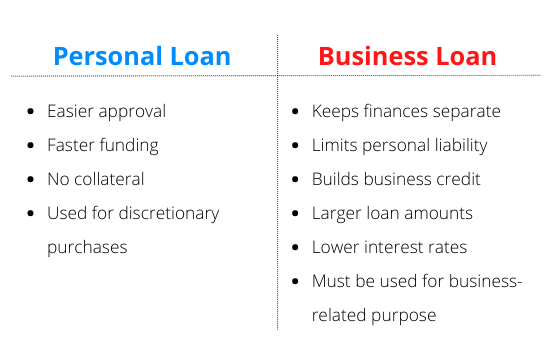

Personal loans and small business loans are similar, but there are some notable differences.

Personal Loans. A personal loan is guaranteed by your personal credit history, making them easier to obtain for people with good credit. A personal loan can be used for discretionary purposes, like remodeling your home or consolidating debt.

These are two good reasons to pursue a personal loan. What’s not recommended? Financing a vacation or purchasing a flat-screen TV. These types of expenditures are better made with personal savings or a 0% interest rate credit card.

A business loan may be harder to obtain for those new to business. This relative ease of access to capital makes a personal loan attractive for startups that might not otherwise qualify for a business loan based on their lack of business credit history.

Business Loans. A business loan comes with more restrictions and a higher degree of eligibility than a personal loan. For example, a business seeking funding could use their business loan for any of the following reasons:

- Your business is ready to expand

- You’re building credit for the future

- You need to purchase equipment or pay for additional inventory

- You’re presented with a business opportunity that outweighs the debt

- You need to hire talent — at competitive wages

A business loan should only be used to grow or sustain your business. Ideally, this purchase will generate enough revenue to offset the interest costs associated with borrowing the money. Using a business loan to pay off or consolidate debt is another good use for your business loan.

Are You Eligible for A Business Loan?

Generally, the requirements for obtaining a business loan are similar to those of a personal loan. A lender will want to know your personal or business credit score, how long you've been in business, and what your revenues are.

Here are some other requirements a lender might need to determine if you qualify for a business loan:

- Purpose of the loan

- Annual revenue or monthly sales receipts

- Personal and business bank statements, tax returns, credit reports, and financial statements

- Cash flow analysis

- Business plan with financial projections

- Proof of collateral (depending on the loan amount)

Business Loan Qualifications for New Businesses. If you're just starting a new business, lenders will look at your personal credit score when evaluating you for a business loan.

For start-ups less than a year old, online lenders like BlueVine can provide you with a full suite of business bank account services. Moreover, they can find ways to fund your small business with less traditional types of loans, with customizable terms and rates based upon your personal credit score.

Business Loan Qualifications for Existing Business. For established businesses, lenders will be looking for annual revenues starting at $50K — and beyond. If you don’t have revenue on the books yet, consider looking into SBA microloans, short-term business loans, or online lenders like BlueVine.

📌 Pro tip: Sign up for Skip Premium or VIP and get help with your business plan and business funding options.

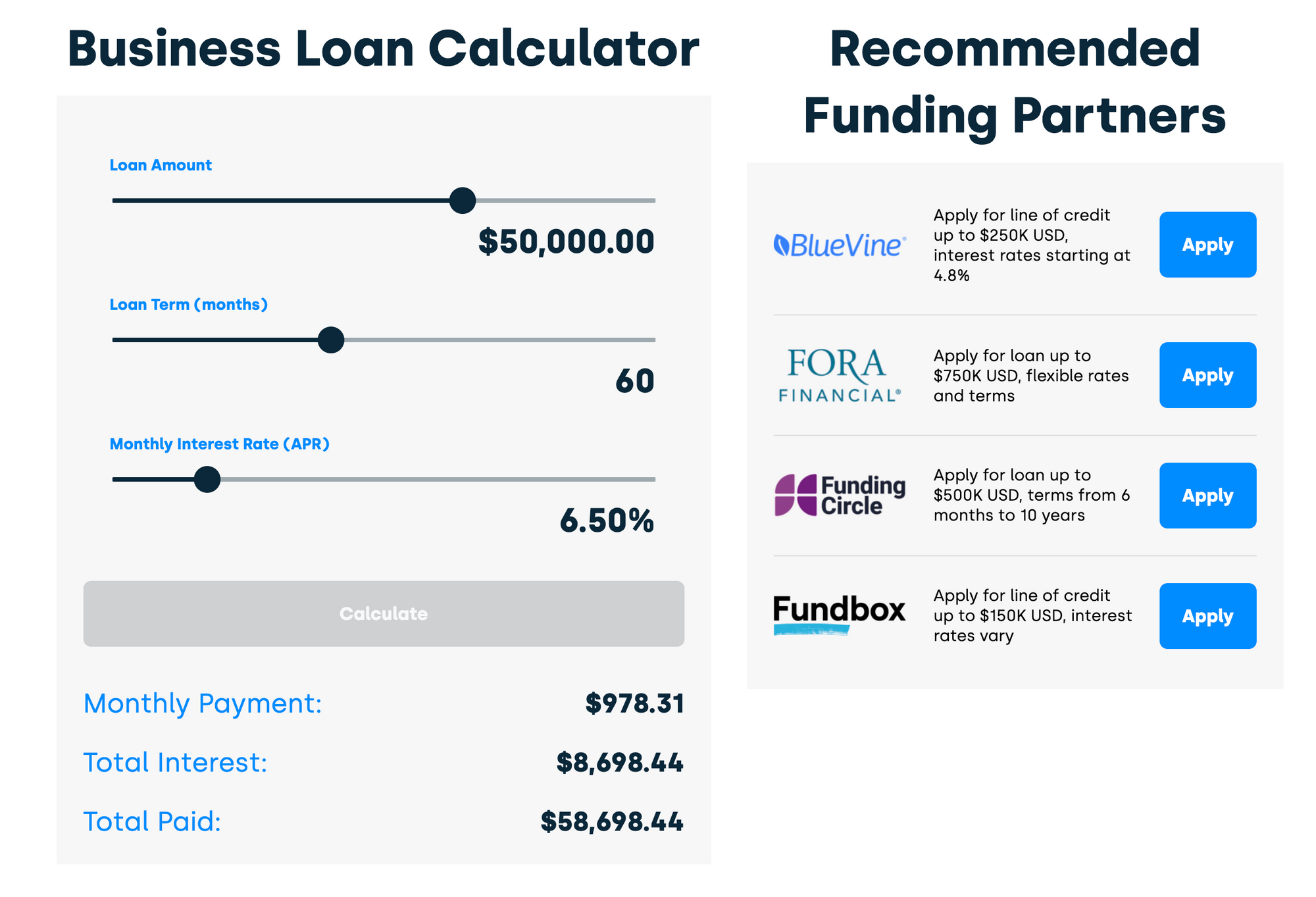

How to Calculate Your Loan Amount

Understanding how much you could, or should, borrow for your business just got a lot simpler. Using Skip’s Business Loan Calculator takes the guesswork out of determining what’s the right loan amount for your business.

Skip's loan calculator will also show you how much you’ll pay over the loan's lifetime, so you can factor these costs into your long-term projections.

What’s the Right Loan for My Business?

Once you have a realistic set of objectives and a clear understanding of your business goals, you’ll be able to base your decision on which type of small business loan and lender is right for you.

While most brick and mortar banks require a business to be engaged for at least two years, online lenders are a viable options for startups. Our partners at BlueVine offers a suite of banking services for new businesses, including business checking accounts and business lines of credit.

With a plethora of lending options and historically low-interest rates, now’s a terrific time to start a small business.

Need Help With Business Funding?

Do you need help getting funding for your business? We can help you with SBA loans, grants, or other business financing options. Get ongoing personalized help from our team. Join Skip Premium today and get 1-1 support for your business.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.