Updated Friday April 16 11am PST

There has been significant progress this week from the SBA for their major relief programs and stimulus updates as well. We have new data on Targeted EIDL grant approvals, why people are getting denied for Targeted EIDL grants, and when EIDL loan increases will start being approved. In addition, we have heard back from our SBA on when the additional $5K grants will go live. Plus, there are more grant and funding opportunities available to you. Here's the latest recap covering the following:

- Stimulus Recap

- Targeted EIDL Grant Progress

- EIDL Loan Increase Progress

- SVO Grant Program Progress

- PPP Program Progress

- Targeted EIDL Grant Extra $5k

- New Grants and Funding Progress

Fourth Stimulus Payments

Yesterday was the one year anniversary of the first stimulus checks being sent. We recently covered the "Plus Up" Stimulus Payments and if you can expect to receive one. Plus Up payments are fourth stimulus checks being sent to some eligible recipients. Plus Up payments are additional funds that certain people are owed because their third stimulus checks were sent based on their 2019 taxes and their circumstances changed in 2020, meaning they should have been sent more than they received.

Targeted EIDL Grant Programs Sees Increasing Approvals and Rejections

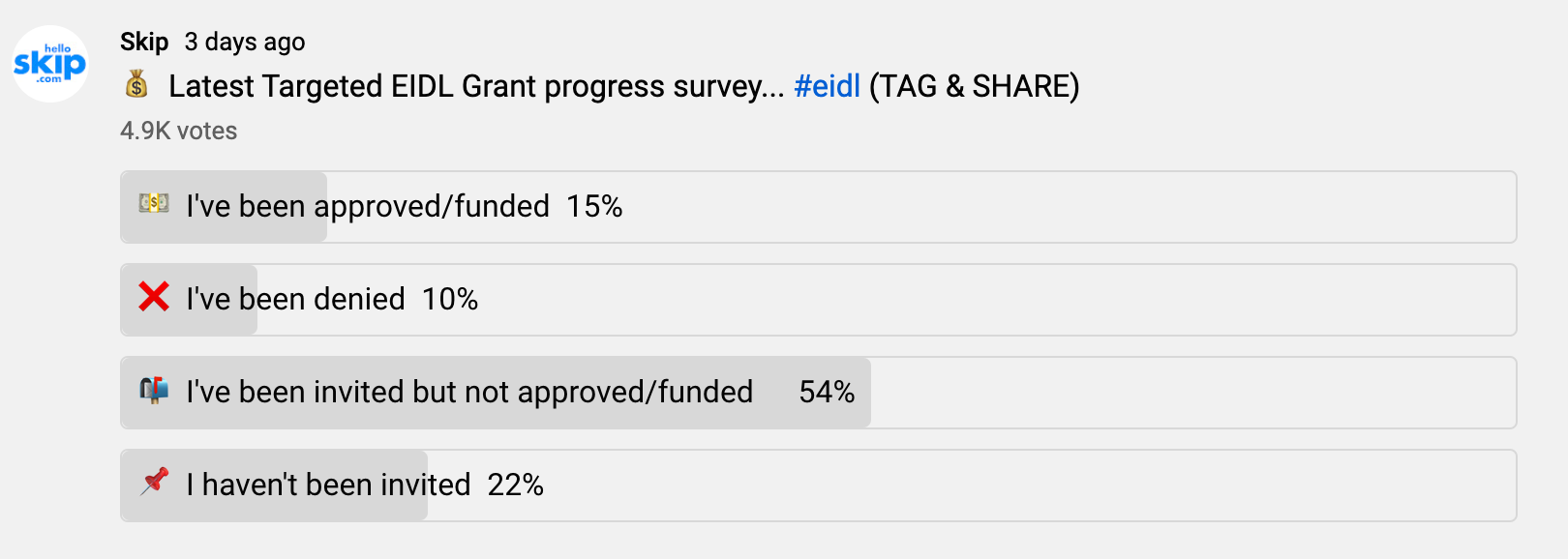

Our latest survey by nearly 5,000 folks shows that 78% of people have been invited for Targeted EIDL grants and 22% have not.

Approvals have ramped up in the last week, but so have rejections: Of everyone surveyed, 15% have been approved or funded and 10% have been rejected. Here's the survey breakdown:

When we breakout survey respondents by only those invited we get a clearer picture on how many have been approved versus denied.

Of everyone invited for Targeted EIDL Grants, 20% have been approved, 13% have been rejected, and 67% are still awaiting a decision.

In April 14th's YouTube video we break down why people are being rejected. There are two main reasons: Either the IRS hasn't processed your 2019 taxes so the SBA cannot verify your business existed prior to 2020, or the SBA cannot verify your revenue loss. However, according to comments from many of you, many of these rejection letters are in error.

If you're curious, we've pasted copies of the main types of the Targeted EIDL rejection letters in this post.

EIDL Loan Increases Are Beginning — Expect More Instructions By End of Next Week

As we reported last week, you can now express interest in getting an increased EIDL loan amount. In a somewhat convoluted process, the SBA instructed interested past EIDL loan recipients to email the SBA if they're interested in an increase with specific instructions. However, that email is just an expression of interest.

This follows the SBA's announcement three weeks ago that they'll increase the EIDL loan limits from $150,000 to $500,000. This allows businesses to receive EIDL loan funding up to 24 months of working capital. Previously, it was based on 6 months of working capital.

We've heard back from our SBA contact earlier this week who said people can expect further instructions by April 26th. This does not mean their EIDL loans will be approved or denied by then, but that there will be next steps by then.

The SVO Grant Program Remains Closed

The Shuttered Venue Operator Grant — billions of dollars allocated to venues and in-person operators approved in the December 27th legislation — opened on April 8th to applicants, only to be quickly shut down on the same day.

After tens of thousands started applying, it became clear in minutes that the portal had technical issues. Applicants couldn't upload any files, and certain questions had the incorrect logic.

The SBA shut down the SVO Grant portal while they work on fixing the issues. They have yet to announce a reopening date.

The PPP Program Is Progressing — 80% of Funding Has Been Allocated

The PPP program continue to progress and over $232 billion has been approved in this round. We continue to hear reports of lender delays and SBA delays, but overall things are improving.

If you're still waiting to apply, you now have until the end of May to apply, after the latest rule changes. However, over 80% of the funding has already been approved. If you're considering applying, it's best to do so sooner rather than later. Here are our two partner lenders: Bluevine and Funding Circle.

Additional $5,000 Targeted EIDL Grants News Is Coming Next Week

According to our SBA contact:

SBA expects to release more details about the $5,000 Supplemental Targeted Advance by the end of next week (4/23)

One note they made is that it will be a requirement to completed the Targeted EIDL Application in order to be considered for this extra $5,000. This extra $5,000 Targeted EIDL Grant was approved in the last stimulus package from March. As soon as further directions are given, we will be posting about them.

Additional Grants at the State and Local Levels

This week we have covered several new grant and funding opportunities. These include grants in a handful of states as well as grants for minority or women owned businesses. Specifically, we featured $500 grants for service businesses, as well as government grants of up to $50,000 for some business owners.

📌 Pro-tip: Join nearly 100,000 others getting early access to grants and other funding opportunities. See New Grant Opportunities

"I can't recommend Skip Plus enough. It is so wonderful to have the confidence that the Skip team is researching for me and they'll alert me if I need to take action on grant opportunities. -Stephanie J, Los Angeles, CA

"Thank you Skip for keeping me informed on grants and loans. It seems like you're adding new features every single week. Big help for my shop in Atlanta — thank you again." -Danielle K, Atlanta, GA