If you’re currently running your business as a sole proprietor and you’re looking for commercial funding, you might face difficulties. Transitioning to a Limited Liability Company (LLC) business entity – or creating a new LLC entity – expands your funding opportunities and limits your personal liability.

In this article, we’ll explain what exactly an LLC is and walk you through the ten most common steps to create one within the United States.

📌 Pro tip: We'll be adding specific state-by-state pages detailing the LLC formation requirements for all 50 states. We'll link them to this page in the next several weeks. Be sure to bookmark this page and visit again soon.

In This Article:

- What is an LLC?

- Step 1. Select and Verify Your Business Name

- Step 2. Determine Membership vs. Manager Management

- Step 3. Select a Registered Agent

- Step 4. File Articles of Organization

- Step 5. Apply for an EIN

- Step 6. Obtain a Physical Address

- Step 7. Create an Operating Agreement

- Step 8. Keep Your LLC Active

- Step 9. Abide by Tax and Regulatory Obligations

What is an LLC?

Many small business owners begin as sole proprietors, but as their businesses grow and employees are hired, they may need an entity that can change with them – enter the LLC.

One of the most popular forms of business structures for small businesses, LLCs offer ease, simplicity, and more benefits than other types of entities — namely liability protection, ownership control, and tax deductions.

If you're a self-employed sole proprietor, small business owner, or part of a partnership, forming an LLC is the logical next step for your business. If you're looking to start a business for the first time, an LLC is a great option.

Here’s how to do it.

1. Select and Verify Your Business Name

If your business exists as a sole proprietorship or partnership, you probably won’t need to change your name too much; however, you're required to append it with either a “LLC,” “L.L.C.” or “Limited Liability Company" designator.

Your business name must be unique and not confusingly similar to another entity’s name. Search for your business name through your Secretary of State’s online business name database. If it's available, you can generally reserve it for up to 60 days.

Complete a "Name Reservation Request Form" and mail or hand-deliver to your Secretary of State – if unable to do so online.

When selecting a name for your business, most states prohibit the use of certain words in its name, including but not limited to the following:

- Inc or Incorporated

- Bank

- Trust

- Trustee

- Insurer

- Insurance Company

Be sure to check the name limitations with your Secretary of State.

2. Determine a Membership or Manager Management Model

A majority of multi-member LLCs opt for their members to manage the LLC (Membership Management). However, an LLC has the option to appoint a manager, or managerial organization (Manager Management), who acts similarly to a board of directors.

Managers vote and make decisions on key issues impacting the business — like whether to pursue business loans, real estate purchases, or changes to long-term strategic planning.

3. Select a Registered Agent

All LLCs must have a registered agent, also known as the agent for service of process in the state of California. This individual or organization agrees to accept legal documents on behalf of the LLC should it be sued.

An LLC can not be its own registered agent, however, a member, manager, or officer of the LLC, or an attorney, can serve as a registered agent/agent for service of Process.

You may choose to be your own registered agent, but be aware that registered agents' information is public record – meaning your home address (because you can't use the business address) will be public record.

📌 Pro tip: Registered agents must be available during regular business hours. If you self-appoint, you must be available every business day of the year – or risk missing a legal service.

4. File Articles of Organization with Your Secretary of State

Next, file your “Articles of Organization” with your Secretary of State. This form provides information about your business, including:

- Business name

- Business address

- Business purpose

- Member(s)

- Registered Agent - the legal representative who receives legal correspondence for your business

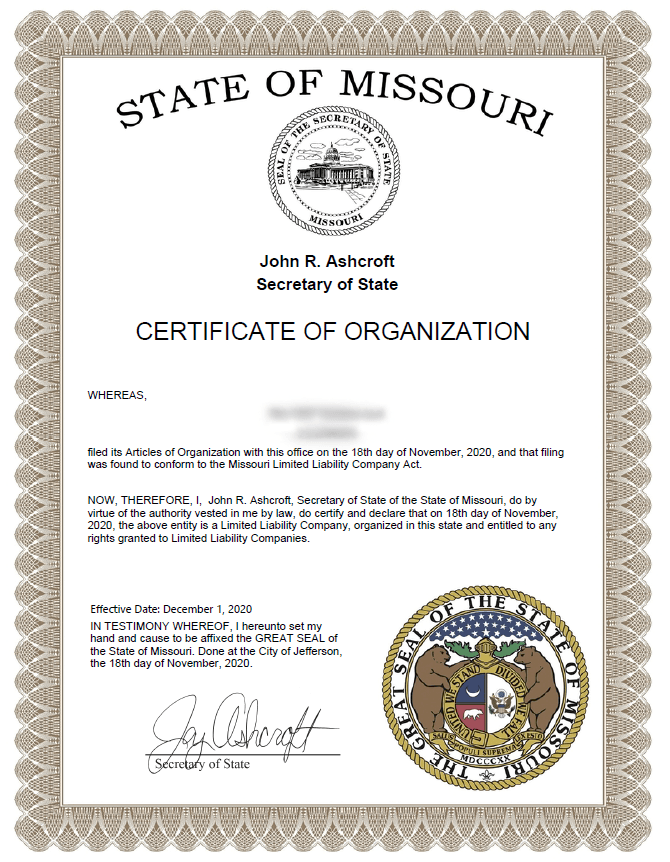

Once you file your Articles of Organization, you may receive a certificate from your Secretary of State's office.

5. Apply for an EIN

An Employer Identification Number (EIN), also referred to as a Federal Tax Identification Number (FTIN), is assigned to each business and acts like a Social Security Number (SSN) for your business. Do you need an EIN for your LLC? The short answer is — maybe. If your LLC has more than one owner – a multi-member LLC — then the answer is yes.

If you are the only member of your LLC — a single-member LLC — you have a choice. You can use your SSN or obtain an EIN. However, if you intend to hire employees you'll need an EIN. Applying online for your EIN is the fastest and easiest way to get one. If you have an existing EIN, you will need a new one to reflect your new LLC status.

6. Obtain a Physical Address

You’ll need a physical address in the state where you register your LLC. This cannot be a P.O. Box. You’ll also need a physical address to open a business banking account.

For online businesses, digital nomads, or sole proprietors who become LLCs, service providers like Earth Class Mail offer “virtual” addresses and mail forwarding conveniences that allow businesses to operate locally, and globally.

You can also check with the UPS store closest to you as some allow use of their physical address for mail services.

7. Create an Operating Agreement

Although not required by many states, it’s highly advisable to craft an LLC Operating Agreement (OA) for your business. The OA shows a clear division of responsibilities between owners, if there are more than one, and provides an outline of tasks and responsibilities that align with the objectives of your business.

8. Keep Your LLC Active — Annual and Biennial Reporting

Most states require LLCs to continue submitting their business entity filings on an ongoing basis – some annually and some biennially. This report assists the Secretary of State in keeping current on all registered LLCs within the state.

California requires LLCs to submit initial reports within 90 days of registration. This initial report contains information similar to the biennial reports filed thereafter. Your LLC’s biennial Statement of Information will include:

- Business name and file number registered with the Secretary of State

- Designated Registered Agent/Agent for Service of Process

- Physical street address

- Mailing address, if different from above

- Name and complete business/residential address of manager(s) and CEO, if any. If none, the names and addresses of member(s)

- A valid email address to receive communications from the Secretary of State electronically

- A description of the LLC’s business activity

While many states require an “annual report” there are some who only require these filings every two years, including:

- Alaska

- California

- Iowa

- Indiana

- Nebraska

- New York

- Washington DC

9. Abide by Tax and Regulatory Obligations

You’ll need to comply with any regulatory or tax requirements including obtaining tax identification and business licenses or permits, including the following:

- Business license. You may need to apply for a business license based on what you do and where you're located. Check with your Secretary of State or local entity to determine what type of business license you may need to conduct business.

- Sales and employment taxes. If your business sells goods and collects taxes, or if you employ people, you'll need to register your business with the State Board of Equalization (BOE), online or in-person at a local BOE office.

- Business insurance. Nearly every business is required to have some form of business insurance. Your county or city business office should be able to inform you on what business insurance you are required to have, but there are other types of insurance you may need. Check out our ultimate guide to selecting business insurance.

Get Help With Your LLC

Do you need help starting your LLC or getting funding for your business? We can help you with LLC formation, SBA loans, grants, or other business financing options. Get ongoing personalized help from our team. Join Skip Premium today and get 1-1 support for your business.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.